Get the free accudata irs form 4506 t

Show details

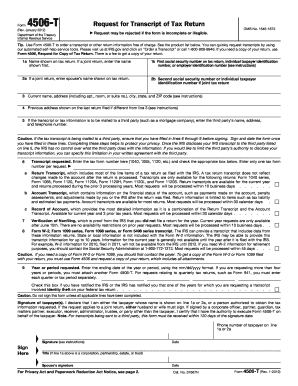

Moreover Accudata offers customer service and order accountability that the IRS frequently lacks in processing Form 4506-T requests. The 4506 can take the IRS up to 60 days to complete. The IRS Form 4506-T is used to obtain IRS Tax Transcripts. The 4506-T usually takes two business days to obtain from the IRS. Accudata specializes in 4506-T processing and does not offer 4506 services. The 4506-T usually takes two business days to obtain from the IRS. Accudata specializes in 4506-T processing...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accudata irs form 4506

Edit your accudata irs form 4506 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accudata irs form 4506 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accudata irs form 4506 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit accudata irs form 4506. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accudata irs form 4506

How to fill out accudata irs form 4506:

01

Start by providing your personal information in Section 1. This includes your name, address, social security number, and any other applicable information.

02

In Section 2, indicate the type of tax return you filed and the years you are requesting transcripts for. Specify whether you need a transcript for the tax return itself or for other related documents.

03

Fill out Section 3 if you want the transcripts to be sent to a third party. Provide their name, address, and any other required information.

04

If there are any special instructions or additional information you need to include, use Section 4 to provide those details.

05

Review your form for accuracy and make sure all the required fields are filled out. Sign and date the form at the bottom.

Who needs accudata irs form 4506:

01

Individuals who want to request a transcript of their tax return or any related documents from the Internal Revenue Service (IRS) may need to fill out accudata irs form 4506.

02

This form is commonly required by individuals who need to provide proof of income, verify their tax return information, or obtain information about their tax history.

03

Other situations where accudata irs form 4506 may be needed include applying for certain loans, mortgages, or financial assistance programs that require tax information.

04

Additionally, individuals who are facing tax-related disputes or audits might also be required to complete this form to provide the IRS with the necessary information.

Overall, anyone who needs to obtain official tax return transcripts or related documents from the IRS should consider filling out accudata irs form 4506.

Fill

form

: Try Risk Free

People Also Ask about

Can you fill out a form 4506 T online?

Although the form can be completed online, you must print and sign the form, then submit to SBA. The IRS Form 4506-T must be completed and submitted with each SBA disaster loan application, even if you are not required to file a federal income tax return.

Why is a 4506-T required?

Purpose of form. Use Form 4506-T to request tax return information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year) must file Form 4506-T to request a return transcript.

What is IRS form 4506 T used for?

Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript. Use Form 4506-T to request tax return transcripts, tax account information, W-2 information, 1099 information, verification of non-filing, and record of account. Customer File Number.

How do I submit IRS form 4506 T?

Please submit the form directly to the IRS at the address or fax number listed for your state of residence at the me your return was filed. The IRS will mail you a copy of the document you have requested. You will then submit all pages of that document to the Financial Aid & Scholarship Office for review.

What does the 4506-T show?

Use Form 4506-T to request any of the transcripts: tax return, tax account, wage and income, record of account and verification of non-filling. The transcript format better protects taxpayer data by partially masking personally identifiable information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find accudata irs form 4506?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the accudata irs form 4506 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in accudata irs form 4506?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your accudata irs form 4506 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in accudata irs form 4506 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing accudata irs form 4506 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Fill out your accudata irs form 4506 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accudata Irs Form 4506 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.