Get the free apa itu irs institute revan service

Show details

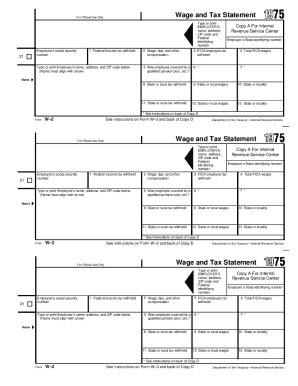

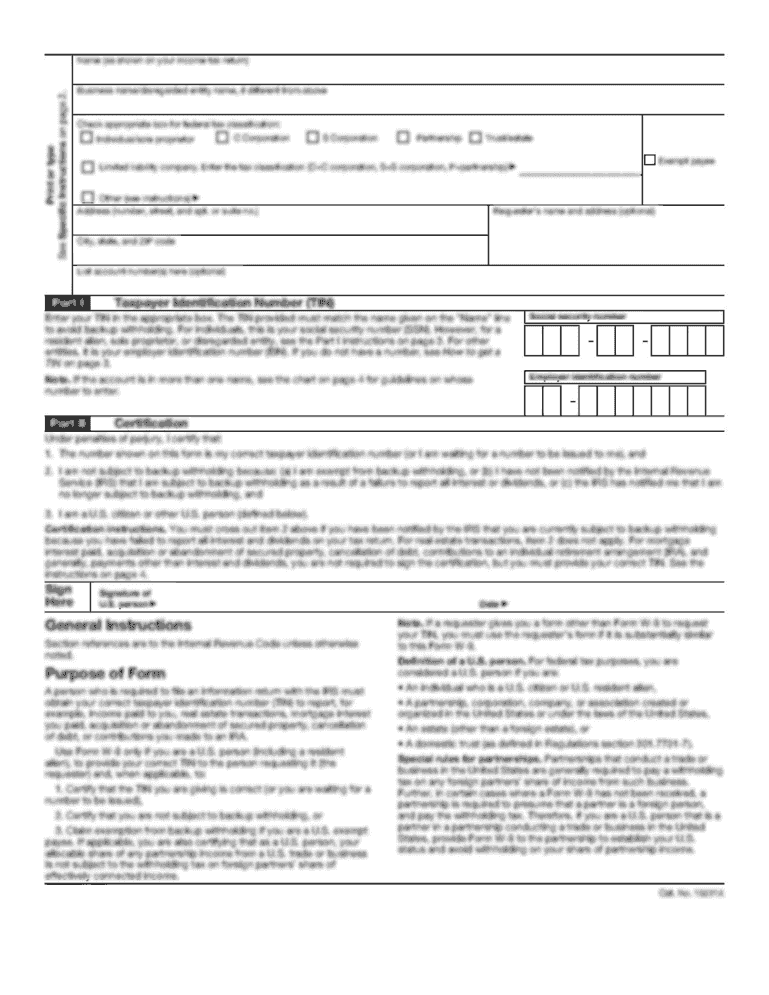

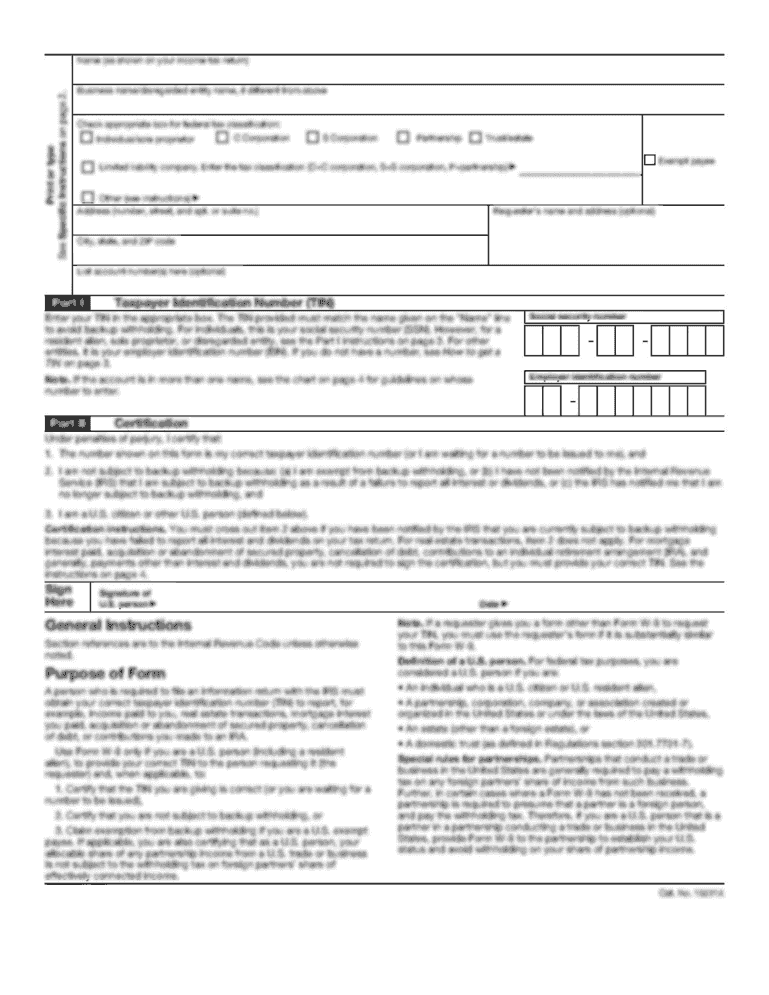

See instructions on Form W3 and back of Copy D. For Of?coal Use Only. 1Federal income tax withheld. Department of the Treasurylnternal Evan service. Wage and Tax Statement. Type or print. EMPLOYER'S

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign apa itu irs institute

Edit your apa itu irs institute form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your apa itu irs institute form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit apa itu irs institute online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit apa itu irs institute. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out apa itu irs institute

How to fill out apa itu irs institute?

01

Start by gathering all the required documents such as proof of identity, academic records, and any relevant certifications or licenses.

02

Research the specific requirements and eligibility criteria for apa itu irs institute. This may include academic qualifications, work experience, or specific skills.

03

Complete the application form accurately and thoroughly. Make sure to provide all the requested information and double-check for any errors or omissions.

04

Pay attention to any additional requirements such as personal statements, letters of recommendation, or interviews. Prepare these materials in advance to meet the submission deadline.

05

Submit your completed application either online or through the designated mailing address. Ensure that all documents are properly organized and securely packaged.

06

Follow up with the apa itu irs institute to confirm receipt of your application. You may want to inquire about any further steps or additional information required.

Who needs apa itu irs institute?

01

Individuals who are interested in pursuing a career in research and development within the field of information technology.

02

Students who are seeking a comprehensive education in advanced IT concepts and innovative research methodologies.

03

Professionals who want to enhance their technical skills and knowledge in order to keep up with the rapidly evolving IT industry.

04

Researchers who are looking for a platform to collaborate with industry experts and conduct cutting-edge research in IT.

05

Individuals who aspire to become leaders and contribute to the advancement of IT through their research and innovative ideas.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is apa itu irs institute?

Apa itu IRS Institute is an educational institution that specializes in offering courses and training related to taxation and finance.

Who is required to file apa itu irs institute?

Individuals or organizations who have completed courses or training at IRS Institute are required to file any applicable tax forms related to their new expertise.

How to fill out apa itu irs institute?

To fill out IRS Institute forms, individuals need to provide accurate information about their training, certifications, and any income related to their new skills.

What is the purpose of apa itu irs institute?

The purpose of IRS Institute is to provide quality education and training in the field of taxation and finance to individuals seeking to enhance their skills and knowledge.

What information must be reported on apa itu irs institute?

Information such as course completion certificates, training records, and any income earned from using skills acquired at IRS Institute must be reported.

How can I edit apa itu irs institute from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your apa itu irs institute into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit apa itu irs institute online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your apa itu irs institute to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the apa itu irs institute in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your apa itu irs institute directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your apa itu irs institute online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Apa Itu Irs Institute is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.