NYC DoF NYC-3L 2012 free printable template

Show details

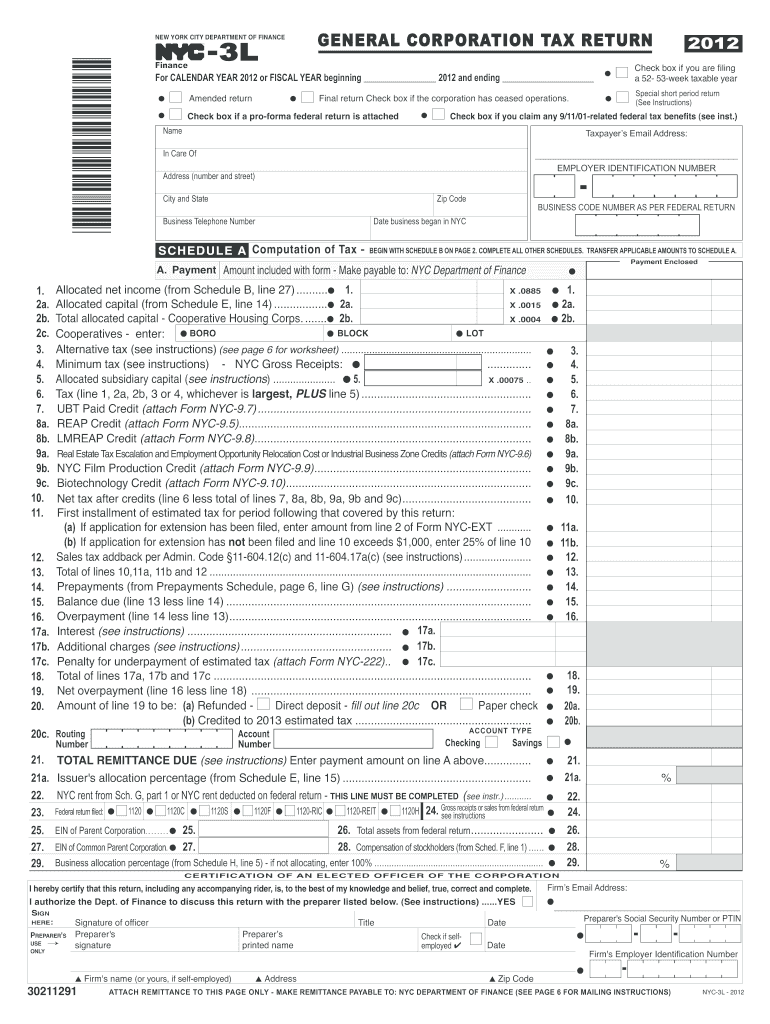

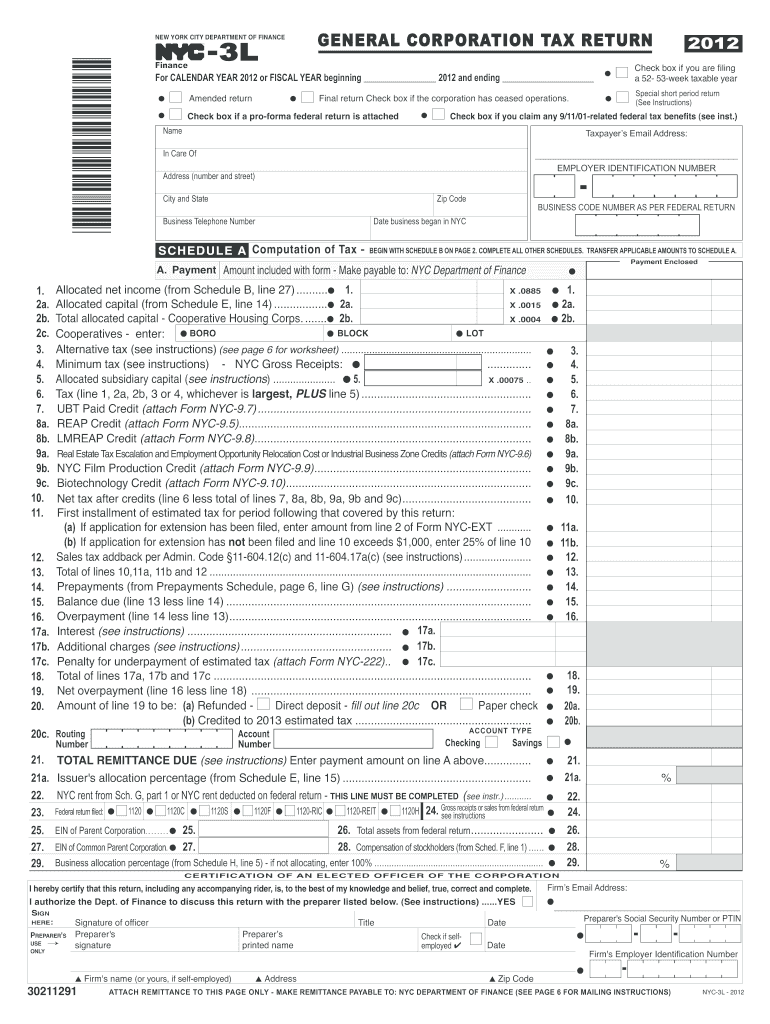

ACCOUNT TYPE Account 20c. Routing Check box if you are filing a 52- 53-week taxable year In Care Of printed name L Address Title Check if selfemployed Date Firm s Email Address Preparer s Social Security Number or PTIN Firm s Employer Identification Number ATTACH REMITTANCE TO THIS PAGE ONLY - MAKE REMITTANCE PAYABLE TO NYC DEPARTMENT OF FINANCE SEE PAGE 6 FOR MAILING INSTRUCTIONS NYC-3L - 2012 5a. 5b. G E N E R A L C O R P O R AT I O N TA X R E T U R N - 3L NEW YORK CITY DEPARTMENT OF...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC DoF NYC-3L

Edit your NYC DoF NYC-3L form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC DoF NYC-3L form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NYC DoF NYC-3L online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NYC DoF NYC-3L. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

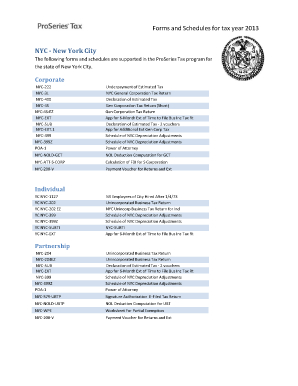

NYC DoF NYC-3L Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC DoF NYC-3L

How to fill out NYC DoF NYC-3L

01

Gather required documents including proof of income, identification, and property information.

02

Obtain the NYC DoF NYC-3L form from the New York City Department of Finance website or local office.

03

Fill out the form with your personal information, including your name, address, and property details.

04

Provide the necessary income details, including income sources and amounts.

05

Review the form for accuracy and completeness.

06

Sign and date the form.

07

Submit the completed form either online, by mail, or in-person at the local Department of Finance office.

Who needs NYC DoF NYC-3L?

01

Homeowners in New York City who are applying for property tax exemption or reduction based on income eligibility.

02

Individuals who may qualify for the senior citizen or disabled person exemption programs.

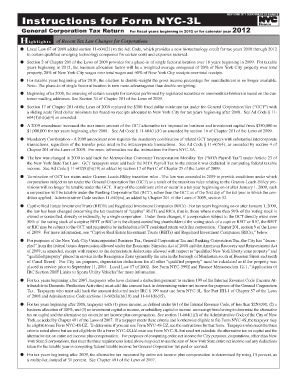

Instructions and Help about NYC DoF NYC-3L

Fill

form

: Try Risk Free

People Also Ask about

What is NYS mandatory first installment?

MTA surcharge – A first installment equal to 25% of the second preceding year's MTA surcharge is also required if your second preceding year's franchise, excise, or gross receipts tax after credits is more than $1,000 and you are subject to the MTA surcharge.

What is NYS CT-400?

Form CT-400, Estimated Tax for Corporations.

Who Must File a New York City return?

New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the 5 boroughs (hired on or after January 4, 1973) must file Form NYC-1127.

What is Form CT-3 New York?

New York's corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return. For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York.

Can I file my NY state taxes online?

Most New York State taxpayers can e-file their returns. If you earned $73,000 or less last year, you can Free File using brand name software accessed through our website. If you earned more, you can purchase approved commercial software or use a paid tax preparer to e-file your return.

Who is subject to NY MTA surcharge?

MTA Surcharge Filing If a taxpayer has $1 million or more of MTA receipts, it is subject to the MTA surcharge. …

What is NY Form CT 300?

Form CT-300, Mandatory First Installment (MFI) of Estimated Tax for Corporations.

What is form CT-3 New York?

New York's corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return. For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York.

Can I file NYS CT-3 online?

File using our Online Services or your NYS approved e-file software. To use our Online Services, create an account, log in, and select File a corporation tax online extension. If you are unable to file electronically, call (518) 457-5431 and request a form.

What is mandatory first installment New York?

Corporations whose tax liability for the second preceding year exceeds $1,000 are required to pay 25% of the tax liability for the second preceding year as a first installment of estimated tax for the current year (MFI).

Why can't I Efile my NY state return?

All electronic filing for income tax is closed until next filing season. We anticipate the season will open in late January 2023. If you need to file a personal income tax return before then, you must file a paper return. See Current-year income tax forms and Previous-year income tax forms for a paper form.

Who files NYC 3L?

S CORPORATIONS An S Corporation is subject to the General Corporation Tax and must file either Form NYC-4S, NYC-4S-EZ or NYC-3L, whichever is applicable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NYC DoF NYC-3L online?

With pdfFiller, you may easily complete and sign NYC DoF NYC-3L online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in NYC DoF NYC-3L without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing NYC DoF NYC-3L and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit NYC DoF NYC-3L on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit NYC DoF NYC-3L.

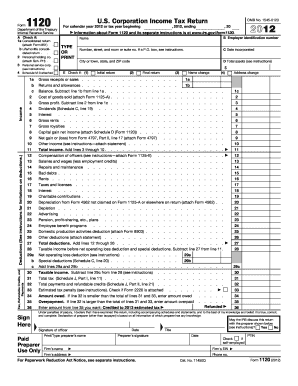

What is NYC DoF NYC-3L?

NYC DoF NYC-3L is a specific form used by the New York City Department of Finance for reporting income and expenses related to residential property tax abatements and exemptions.

Who is required to file NYC DoF NYC-3L?

Property owners who are receiving certain tax benefits, such as the ICIP (Industrial and Commercial Incentive Program) or similar exemptions, are required to file NYC DoF NYC-3L.

How to fill out NYC DoF NYC-3L?

To fill out NYC DoF NYC-3L, property owners must provide detailed financial information about their property, including income, expenses, and any applicable deductions. The form typically requires accurate reporting and supporting documentation.

What is the purpose of NYC DoF NYC-3L?

The purpose of NYC DoF NYC-3L is to gather necessary financial information from property owners to determine eligibility and compliance for ongoing tax exemptions or abatements.

What information must be reported on NYC DoF NYC-3L?

NYC DoF NYC-3L requires reported information such as property income, operating expenses, specific deductions, and any changes in ownership or property use that may affect tax benefits.

Fill out your NYC DoF NYC-3L online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC DoF NYC-3l is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.