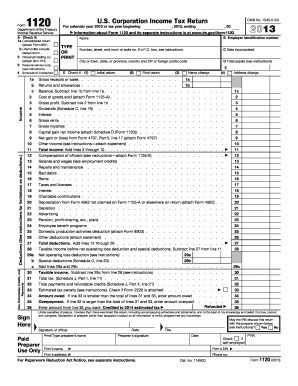

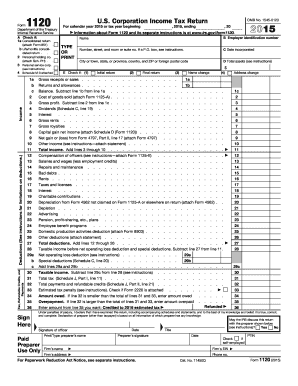

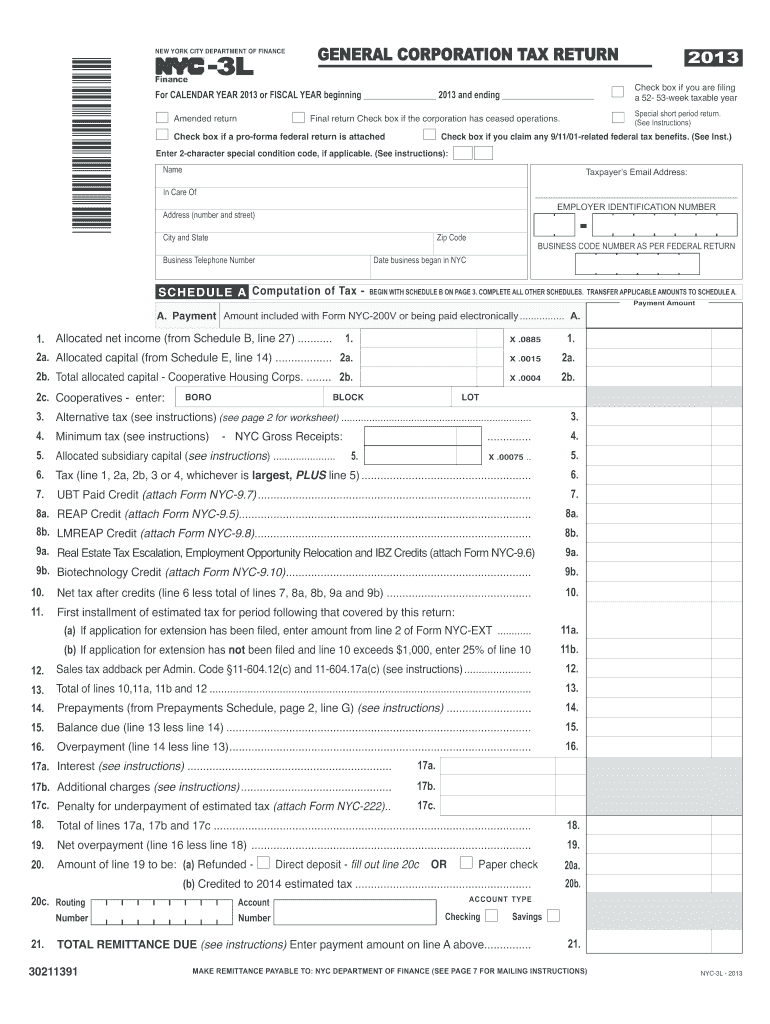

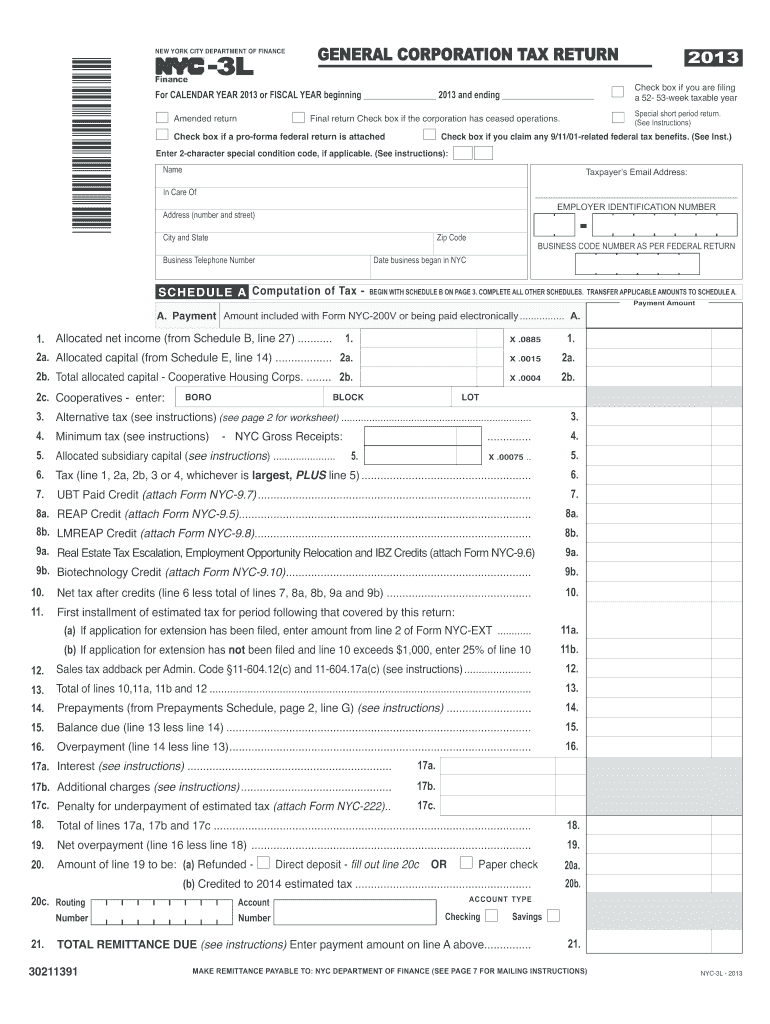

NYC DoF NYC-3L 2013 free printable template

Show details

MAKE REMITTANCE PAYABLE TO NYC DEPARTMENT OF FINANCE SEE PAGE 7 FOR MAILING INSTRUCTIONS NYC-3L - 2013 form nyC-3L - 2013 namE SCHEdULE a - Continued Computation of tax - EIn 21a. Issuer s allocation percentage from Schedule E line 15. 30211391 -3L GENERAL CORPORATION TAX RETURN nEw york CIty dEpartmEnt of fInanCE For CALENDAR YEAR 2013 or FISCAL YEAR beginning 2013 and ending n Amended return Final return Check box if the corporation has ceased operations. Check box if a pro-forma federal...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC DoF NYC-3L

Edit your NYC DoF NYC-3L form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC DoF NYC-3L form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NYC DoF NYC-3L online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NYC DoF NYC-3L. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC DoF NYC-3L Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC DoF NYC-3L

How to fill out NYC DoF NYC-3L

01

Start by downloading the NYC DoF NYC-3L form from the official NYC Department of Finance website.

02

Read the accompanying instructions carefully to understand the requirements for filling out the form.

03

Fill out your personal information in the designated sections, including your name, address, and contact details.

04

Provide information about the property in question, including its address and owner details.

05

Report any financial details required, such as income and expenses associated with the property.

06

Review the filled form for accuracy and completeness.

07

Sign and date the form as required before submission.

08

Submit the completed form via mail or through the appropriate online portal as specified in the instructions.

Who needs NYC DoF NYC-3L?

01

Property owners in New York City who are applying for a property tax exemption or seeking to claim a specific type of benefit related to their property.

Instructions and Help about NYC DoF NYC-3L

Fill

form

: Try Risk Free

People Also Ask about

How do I avoid New York City taxes?

For example, you can avoid NYC income taxes if you live in New Jersey and commute to work in the city. And you can reach Manhattan in as little as thirty minutes from cities like Hoboken, Jersey City, or the many suburban towns in NJ.

Do taxes depend on where you live or where you work?

The easy rule is that you must pay non-resident income taxes for the state in which you work and resident income taxes for the state in which you live, and you must file income tax returns for both states. There are some exceptions to this general rule. One exception occurs when one state does not impose income taxes.

Do you pay New York City tax if you work in the city?

New York City Tax (NYC1) is a resident tax. If an employee lives in NYC and works anywhere, then the employer must withhold the NYC resident tax, which is remitted with the state income tax.

How do I get the most out of self-employment tax?

Here are some tax recommendations for self-employed entrepreneurs from top tax pros: Understand the self-employment (SE) tax. Make estimated tax payments on time. Employ family members to save taxes. Set up a business retirement plan. Deduct health-care related expenses. Take all the business tax deductions you can.

Is New York City tax based on where you live or work?

All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax. The rules regarding New York City domicile are also the same as for New York State domicile.

What are the taxes for freelancers in NYC?

Anyone who is self employed is considered both the employer and the employee, meaning thet New York self employment tax must be paid. That amount is 15.3%, comprising 12.4% for Social Security, old-age, survivors, and disability insurance, and 2.9% for Medicare or hospital insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NYC DoF NYC-3L straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing NYC DoF NYC-3L right away.

Can I edit NYC DoF NYC-3L on an Android device?

You can make any changes to PDF files, such as NYC DoF NYC-3L, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I fill out NYC DoF NYC-3L on an Android device?

Use the pdfFiller Android app to finish your NYC DoF NYC-3L and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is NYC DoF NYC-3L?

NYC DoF NYC-3L is a form used by property owners in New York City to report information about their real property and its income-generating status to the Department of Finance.

Who is required to file NYC DoF NYC-3L?

Property owners who own income-producing properties in New York City, such as rentals or commercial spaces, are required to file NYC DoF NYC-3L.

How to fill out NYC DoF NYC-3L?

To fill out NYC DoF NYC-3L, property owners should provide details regarding property ownership, income generated, operating expenses, and any applicable deductions according to the instructions provided with the form.

What is the purpose of NYC DoF NYC-3L?

The purpose of NYC DoF NYC-3L is to accurately assess property taxes based on the income and expenses reported, ensuring fair taxation for residential and commercial properties.

What information must be reported on NYC DoF NYC-3L?

The information that must be reported on NYC DoF NYC-3L includes property identification details, total income, operating expenses, and other relevant financial information specific to the property.

Fill out your NYC DoF NYC-3L online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC DoF NYC-3l is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.