NYC DoF NYC-3L 2019 free printable template

Show details

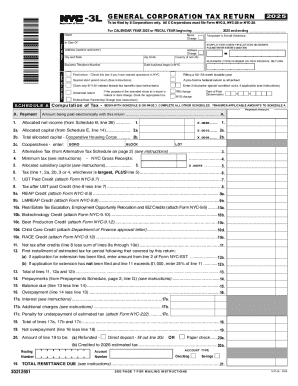

GENERAL CORPORATION TAX RETURN2019To be filed by S Corporations only. All C Corporations must file Form NYC2, NYC2S or NYC2AFor CALENDAR YEAR 2019 or FISCAL YEAR beginning 2019 and ending Namesake

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC DoF NYC-3L

Edit your NYC DoF NYC-3L form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC DoF NYC-3L form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NYC DoF NYC-3L online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NYC DoF NYC-3L. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC DoF NYC-3L Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC DoF NYC-3L

How to fill out NYC DoF NYC-3L

01

Begin by downloading the NYC DoF NYC-3L form from the official NYC website.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill out your personal information in the designated sections, including your name, address, and contact details.

04

Provide information regarding the property in question, including its address and parcel number.

05

Indicate the reason for filing the NYC-3L form, such as requesting a reduction in property valuation.

06

Attach any necessary supporting documentation that substantiates your request.

07

Carefully review the completed form for accuracy before submission.

08

Submit the NYC-3L form by mail or in person at the designated office, ensuring you follow the submission guidelines.

Who needs NYC DoF NYC-3L?

01

Property owners in New York City who believe their real estate assessment is too high and wish to request a reduction.

02

Individuals seeking to challenge their property tax assessment or valuation.

Fill

form

: Try Risk Free

People Also Ask about

What form do I need to file NY state tax return?

Form IT-201, Resident Income Tax Return.

Where can I get NYS tax forms?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

What is NYC tax rate?

New York has a 6.50 percent to 7.25 percent corporate income tax rate. New York has a 4.00 percent state sales tax rate, a max local sales tax rate of 4.875 percent, and an average combined state and local sales tax rate of 8.52 percent.

What is the NYC corporate tax rate for 2023?

Entire net income base — 8.85 percent of entire net income. Total capital base — 0.15 percent of business and investment capital. There are numerous variables to consider with this method.

Who is subject to NYC unincorporated business tax?

What Activities are Subject to This Tax? Unincorporated Businesses include: trades, professions, and certain occupations of an individual, partnership, limited liability company, fiduciary, association, estate or trust.

Who is eligible for NYC tax?

You are a New York State resident if your domicile is New York State OR: you maintain a permanent place of abode in New York State for substantially all of the taxable year; and. you spend 184 days or more in New York State during the taxable year.

What are local taxes in New York City?

New York has a 6.50 percent to 7.25 percent corporate income tax rate. New York has a 4.00 percent state sales tax rate, a max local sales tax rate of 4.875 percent, and an average combined state and local sales tax rate of 8.52 percent.

How is NYC GCT calculated?

GCT Tax Rates Entire net income base — 8.85 percent of entire net income. Total capital base — 0.15 percent of business and investment capital. Alternative tax base — 8.85 percent of 15 percent of net income + the amount of compensation paid to any individual who owned more than 5 percent of the payer's capital stock.

What is Form NYC 3L?

NYC-3L - General Corporation Tax Return. Download Instructions. Download General Corporation Tax Worksheet - You must attach this worksheet to amended returns reporting changes or corrections to taxable income or other bases of tax by the IRS or New York State DTF.

How do I form a corporation in NY?

How to Start a corporation in New York Choose a name for your business. Designate a Registered Agent in New York. File Your Certificate of Incorporation in New York. Create your Corporate Bylaws. Appoint your Corporate Directors. Hold the First Meeting of the Board of Directors. Authorize the issuance of shares of stock.

Do I have to file local taxes in NYC?

All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax. The rules regarding New York City domicile are also the same as for New York State domicile.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NYC DoF NYC-3L online?

pdfFiller has made it simple to fill out and eSign NYC DoF NYC-3L. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my NYC DoF NYC-3L in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your NYC DoF NYC-3L and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit NYC DoF NYC-3L on an iOS device?

You certainly can. You can quickly edit, distribute, and sign NYC DoF NYC-3L on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is NYC DoF NYC-3L?

NYC DoF NYC-3L is a specific form used by the New York City Department of Finance to report certain financial information related to properties in New York City.

Who is required to file NYC DoF NYC-3L?

Property owners, landlords, and real estate companies that meet specific criteria related to property ownership or income reporting are required to file the NYC DoF NYC-3L.

How to fill out NYC DoF NYC-3L?

To fill out NYC DoF NYC-3L, you need to provide accurate financial information regarding your property, which typically includes income, expenses, and other financial details as outlined in the instructions provided with the form.

What is the purpose of NYC DoF NYC-3L?

The purpose of NYC DoF NYC-3L is to ensure compliance with local tax laws by collecting relevant financial data from property owners and facilitating the accurate assessment of property taxes.

What information must be reported on NYC DoF NYC-3L?

Information that must be reported on NYC DoF NYC-3L includes property income, operating expenses, and any other financial details relevant to the property's financial status.

Fill out your NYC DoF NYC-3L online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC DoF NYC-3l is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.