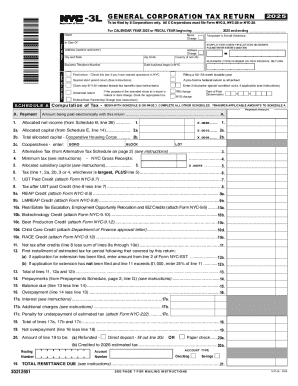

NYC DoF NYC-3L 2024 free printable template

Show details

This form is designed for S Corporations to report their general corporation tax obligations to the New York City Department of Finance, including various computations and allocations of income, capital,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nyc 3l form

Edit your nyc general corporation tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form nyc 3l instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nyc 3l form online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nyc 3l form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC DoF NYC-3L Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nyc form 3l

How to fill out NYC DoF NYC-3L

01

Obtain the NYC DoF NYC-3L form from the NYC Department of Finance website or your local finance office.

02

Provide your name and address in the appropriate fields at the top of the form.

03

Indicate the tax year for which you are filing the form.

04

Fill out the section regarding your property details, including the block and lot numbers.

05

Complete the income section carefully, reporting all applicable income sources.

06

Include any applicable deductions or exemptions you are eligible for.

07

Review the form for accuracy and completeness before submission.

08

Sign and date the form at the designated area.

Who needs NYC DoF NYC-3L?

01

Property owners in New York City who are claiming the Enhanced or Senior Citizen Rent Increase Exemption (SCRIE/DRIE) benefits.

02

Individuals seeking to report their income for property tax benefits.

03

Eligible seniors or disabled individuals who require assistance with property tax relief applications.

Fill

nyc 3l

: Try Risk Free

People Also Ask about nyc3l pdffiller

What is NYS mandatory first installment?

MTA surcharge – A first installment equal to 25% of the second preceding year's MTA surcharge is also required if your second preceding year's franchise, excise, or gross receipts tax after credits is more than $1,000 and you are subject to the MTA surcharge.

What is NYS CT-400?

Form CT-400, Estimated Tax for Corporations.

Who Must File a New York City return?

New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the 5 boroughs (hired on or after January 4, 1973) must file Form NYC-1127.

What is Form CT-3 New York?

New York's corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return. For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York.

Can I file my NY state taxes online?

Most New York State taxpayers can e-file their returns. If you earned $73,000 or less last year, you can Free File using brand name software accessed through our website. If you earned more, you can purchase approved commercial software or use a paid tax preparer to e-file your return.

Who is subject to NY MTA surcharge?

MTA Surcharge Filing If a taxpayer has $1 million or more of MTA receipts, it is subject to the MTA surcharge. …

What is NY Form CT 300?

Form CT-300, Mandatory First Installment (MFI) of Estimated Tax for Corporations.

What is form CT-3 New York?

New York's corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return. For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York.

Can I file NYS CT-3 online?

File using our Online Services or your NYS approved e-file software. To use our Online Services, create an account, log in, and select File a corporation tax online extension. If you are unable to file electronically, call (518) 457-5431 and request a form.

What is mandatory first installment New York?

Corporations whose tax liability for the second preceding year exceeds $1,000 are required to pay 25% of the tax liability for the second preceding year as a first installment of estimated tax for the current year (MFI).

Why can't I Efile my NY state return?

All electronic filing for income tax is closed until next filing season. We anticipate the season will open in late January 2023. If you need to file a personal income tax return before then, you must file a paper return. See Current-year income tax forms and Previous-year income tax forms for a paper form.

Who files NYC 3L?

S CORPORATIONS An S Corporation is subject to the General Corporation Tax and must file either Form NYC-4S, NYC-4S-EZ or NYC-3L, whichever is applicable.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form nyc 3l instructions 2024?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the new york general corporation tax in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the form nyc in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your form nyc 3l in seconds.

How do I fill out the nyc 3l form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign nyc3l and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is NYC DoF NYC-3L?

NYC DoF NYC-3L is a form used by the New York City Department of Finance for reporting certain business income and expenses.

Who is required to file NYC DoF NYC-3L?

Businesses that are subject to the Unincorporated Business Tax (UBT) in New York City must file the NYC DoF NYC-3L.

How to fill out NYC DoF NYC-3L?

To fill out the NYC DoF NYC-3L, review the instructions provided by the NYC Department of Finance, gather the required financial information, and complete the form accurately based on the given guidelines.

What is the purpose of NYC DoF NYC-3L?

The purpose of NYC DoF NYC-3L is to report income, deductions, and credits related to self-employment and evaluate the tax liability under the Unincorporated Business Tax.

What information must be reported on NYC DoF NYC-3L?

The NYC DoF NYC-3L requires reporting of total income, operating expenses, profit or loss, and any applicable deductions and credits related to the business activities.

Fill out your NYC DoF NYC-3L online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyc 300 Form is not the form you're looking for?Search for another form here.

Keywords relevant to understanding the nyc dof nyc 3l form for 2 text the nyc dof nyc 3l form is a tax return the fiscal or calendar year

Related to nys corporation tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.