LPL Financial CM107-CDT 2012 free printable template

Show details

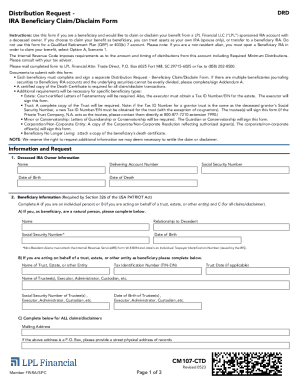

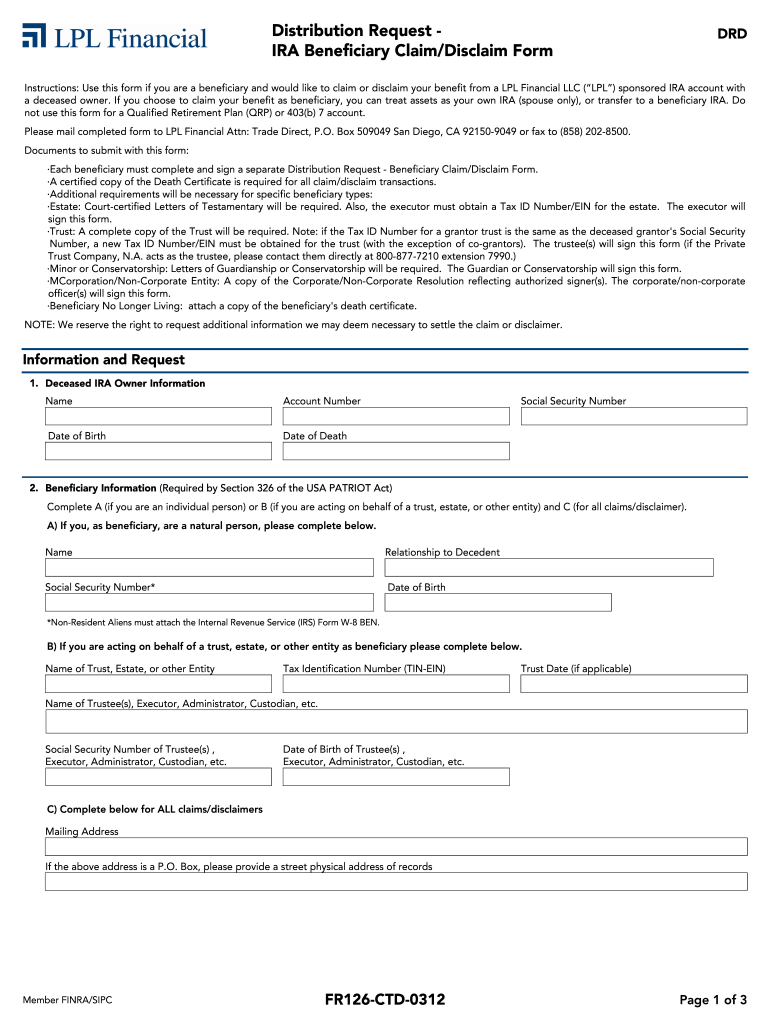

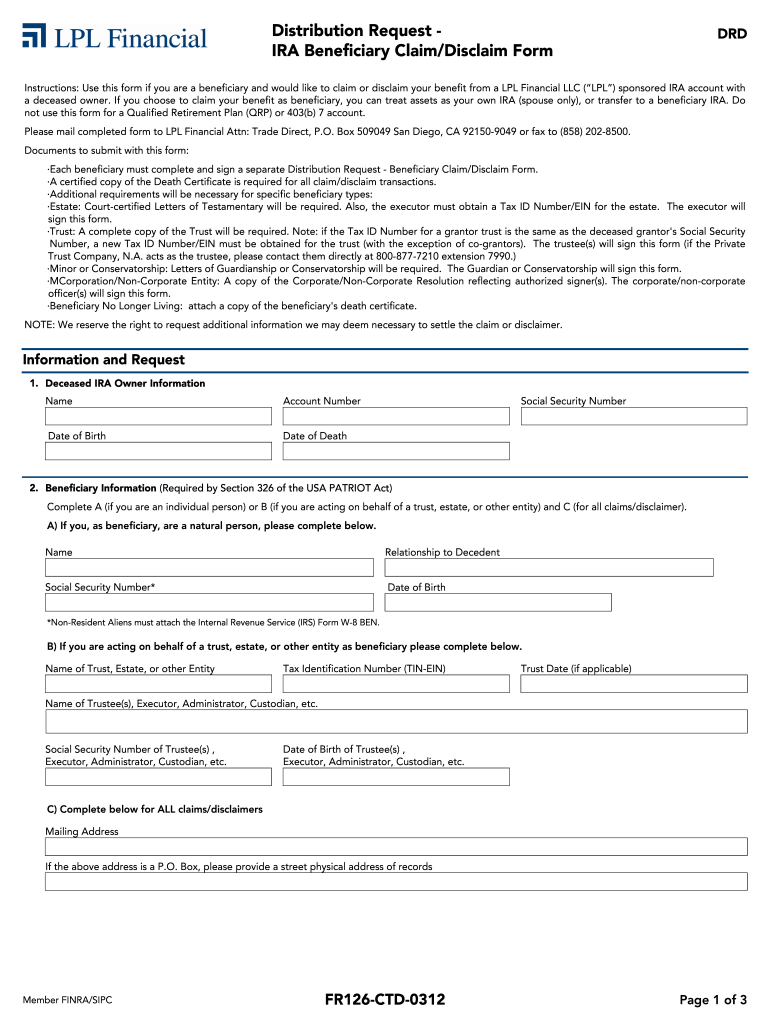

Distribution Request IRA Beneficiary Claim/Disclaim Form DRD Instructions Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a LPL Financial LLC LPL sponsored IRA account with a deceased owner. If you choose to claim your benefit as beneficiary you can treat assets as your own IRA spouse only or transfer to a beneficiary IRA. Do not use this form for a Qualified Retirement Plan QRP or 403 b 7 account. T...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sample letter to disclaim

Edit your sample letter to disclaim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample letter to disclaim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sample letter to disclaim online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sample letter to disclaim. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LPL Financial CM107-CDT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sample letter to disclaim

How to fill out sample letter to disclaim

01

Begin with your name and address at the top of the letter.

02

Include the date below your address.

03

Write the recipient's name and address.

04

Start the letter with a formal greeting, such as 'Dear [Recipient's Name],'.

05

Clearly state the purpose of the letter - to disclaim any claims or rights.

06

Provide a brief explanation of the context of the disclaimer.

07

Include any relevant details or references that support your disclaimer.

08

Conclude with a statement reaffirming your intent to disclaim any rights or claims.

09

Sign off with a formal closing, such as 'Sincerely,' followed by your signature and typed name.

Who needs sample letter to disclaim?

01

Individuals or businesses looking to formally disclaim rights or claims in a legal context.

02

Parties involved in agreements or contracts who wish to clarify their position.

03

People who may inherit property or assets and want to decline those claims.

04

Professionals who need to provide documentation for legal proceedings.

Fill

form

: Try Risk Free

People Also Ask about

Why would you disclaim an IRA?

Beneficiaries who do not want to receive inherited IRA assets may disclaim their interest in the IRA, but they only have a certain amount of time to do so. A beneficiary cannot simply delay or do nothing with the IRA in hopes that it will all go away.

What happens when a beneficiary disclaims?

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

Can a beneficiary disclaim a portion of an IRA?

A beneficiary may disclaim a whole or partial interest in an IRA, ing to Internal Revenue Code Section (IRC Sec.) 2518. As a result, the beneficiary is treated as though he had never been named a beneficiary in the first place or as though he predeceased the original IRA owner.

How do I disclaim an inheritance from my IRA?

Option #1: “Disclaim” the inherited retirement account By disclaiming the asset, you can potentially pass these assets on to someone in a lower tax bracket. To disclaim, you need to make this choice within nine months of the original owner's death and before taking possession of any assets.

What happens when an IRA beneficiary disclaims?

Disclaim (decline to inherit) all or part of the assets If no other beneficiaries exist, the assets will pass in ance with the IRA provider's custodial agreement. For example, with a Fidelity IRA, the assets will pass to the original IRA owner's surviving spouse and, if none, to the owner's estate.

Why would you disclaim assets?

Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary—for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.

How do you write a disclaimer of inheritance?

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate—usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Why would a beneficiary disclaim an IRA?

Disclaiming inherited assets is often done to avoid taxes but also so that other individuals can receive the assets. A disclaimer that does not meet basic requirements under federal and state law could cause adverse consequences for the person disclaiming the assets as well as any subsequent beneficiaries.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sample letter to disclaim?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific sample letter to disclaim and other forms. Find the template you need and change it using powerful tools.

How do I make changes in sample letter to disclaim?

With pdfFiller, it's easy to make changes. Open your sample letter to disclaim in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete sample letter to disclaim on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your sample letter to disclaim, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is LPL Financial CM107-CDT?

LPL Financial CM107-CDT is a specific compliance form used by LPL Financial to report certain financial activities and disclosures based on regulatory requirements.

Who is required to file LPL Financial CM107-CDT?

Individuals or entities that engage in financial transactions or have advisory relationships with LPL Financial are typically required to file the CM107-CDT form as part of their regulatory obligations.

How to fill out LPL Financial CM107-CDT?

To fill out the LPL Financial CM107-CDT, one needs to provide accurate information regarding financial activities, disclosures, and any required signatures where indicated on the form.

What is the purpose of LPL Financial CM107-CDT?

The purpose of LPL Financial CM107-CDT is to ensure compliance with financial regulations by documenting specific activities, disclosures, and maintaining transparency in financial dealings.

What information must be reported on LPL Financial CM107-CDT?

The information that must be reported on LPL Financial CM107-CDT includes details about financial transactions, disclosures of conflicts of interest, and any relevant personal or professional information required by regulatory bodies.

Fill out your sample letter to disclaim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Letter To Disclaim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.