WV Schedule M IT-140 2012 free printable template

Show details

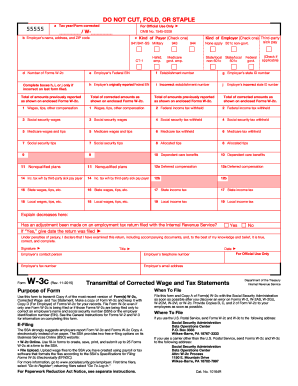

SCHEDULE M Form IT-140 W Modifications to Adjusted Gross Income PRIMARY LAST NAME SHOWN ON FORM IT-140 SOCIAL SECURITY NUMBER 32. Interest or dividend income on federal obligations which is exempt from federal tax but subject to state tax. 34. Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax. 35. Qualifying 402 e lump-sum income NOT included in federal adjusted gross income but subject to state tax.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WV Schedule M IT-140

Edit your WV Schedule M IT-140 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WV Schedule M IT-140 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WV Schedule M IT-140 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WV Schedule M IT-140. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV Schedule M IT-140 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WV Schedule M IT-140

How to fill out WV Schedule M IT-140

01

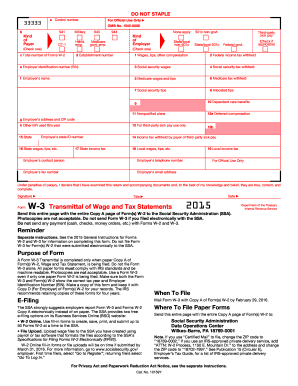

Gather necessary documents: Collect your income statements, W-2s, 1099s, and other tax-related documents.

02

Obtain the WV Schedule M IT-140 form: Download it from the West Virginia state tax website or retrieve it from a tax office.

03

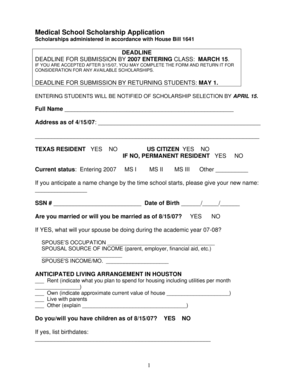

Complete your personal information: Fill in your name, address, and Social Security number at the top of the form.

04

Report your income: Enter your total income as it appears on your federal tax return.

05

Adjust for West Virginia tax rules: Follow instructions to make any necessary adjustments or deductions specific to West Virginia tax laws.

06

Calculate your tax liability: Use the provided tables or formulas to calculate the amount of tax you owe or the refund you expect.

07

Review and double-check: Ensure all information is accurate and complete to avoid any issues with filing.

08

Submit the form: Mail the completed form to the address specified in the instructions or e-file it if applicable.

Who needs WV Schedule M IT-140?

01

Residents of West Virginia who have a tax obligation need to fill out the WV Schedule M IT-140.

02

Individuals who have income from sources within West Virginia that is subject to state tax.

03

Anyone filing their state tax return in conjunction with their federal tax return.

Fill

form

: Try Risk Free

People Also Ask about

What line is the taxable income on 1040?

Your total adjustments to income appear on line 10 of your 1040. Taxable income: Your AGI is then used to calculate your taxable income, or the portion of your income that will be taxed. Your taxable income is shown on line 15 of your 1040.

How do I get my AGI from last year?

If you do not have a copy of your tax return, you can get your AGI from one of the IRS self-service tools: Use your online account to immediately view your AGI on the Tax Records tab. If you're a new user, have your photo identification ready.

Where can I find my AGI from last year on my w2?

You can't find AGI on W-2 Forms. You'll calculate your adjusted gross income (AGI) on Form 1040. Your AGI includes amounts from your W-2. However, it isn't based solely on those amounts.

Who must file schedule M?

Partnerships must file Schedule M-3 if any of the following are true: The amount of total assets at the end of the tax year reported on Schedule L, line 14, column (d), is equal to $10 million or more. The amount of adjusted total assets for the tax year is equal to $10 million or more.

Where do I find my taxable income on my 1040?

Your adjusted gross income (AGI) consists of the total amount of income and earnings you made for the tax year minus certain adjustments to income. For tax year 2022, your AGI is on Line 11 on Form 1040, 1040-SR, and 1040-NR. It is located on different lines on forms from earlier years.

Who must file 140NR?

If you are a nonresident (including nonresident aliens), you must file Arizona Form 140NR, Nonresident Personal Income Tax Return. What if a Taxpayer Died? If a taxpayer died before filing a return for 2021, the taxpayer's spouse or personal representative may have to file and sign a return for that taxpayer.

What is a 140 tax form?

Form 140 - Resident Personal Income Tax Form -- Calculating Personal income tax return filed by resident taxpayers.

What is the Schedule M on your tax return?

What is the purpose of Schedule M? Schedule M, Other Additions and Subtractions for Individuals, allows you to figure the total amount of additions you must include on Form IL-1040, Individual Income Tax Return, Line 3 and subtractions you may claim on Form IL-1040, Line 7.

Can I look up my AGI from last year?

If you do not have a copy of your tax return, you can get your AGI from one of the IRS self-service tools: Use your online account to immediately view your AGI on the Tax Records tab. If you're a new user, have your photo identification ready. Use Get Transcript by Mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WV Schedule M IT-140 to be eSigned by others?

To distribute your WV Schedule M IT-140, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the WV Schedule M IT-140 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your WV Schedule M IT-140 in minutes.

How do I edit WV Schedule M IT-140 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign WV Schedule M IT-140 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is WV Schedule M IT-140?

WV Schedule M IT-140 is a form used by West Virginia taxpayers to report adjustments to their federal taxable income for state income tax purposes.

Who is required to file WV Schedule M IT-140?

Taxpayers who have adjustments to their federal taxable income, such as modifications, deductions, or credits that affect their West Virginia state tax liability are required to file WV Schedule M IT-140.

How to fill out WV Schedule M IT-140?

To fill out WV Schedule M IT-140, taxpayers must complete sections detailing their federal income, report adjustments, and provide necessary supporting information relevant to each modification noted on the schedule.

What is the purpose of WV Schedule M IT-140?

The purpose of WV Schedule M IT-140 is to determine the correct amount of West Virginia state tax owed by adjusting the federal taxable income to reflect state-specific modifications.

What information must be reported on WV Schedule M IT-140?

Taxpayers must report their federal adjusted gross income, any state-specific income adjustments, deductions, credits, and other relevant modifications that may affect their state income tax calculation.

Fill out your WV Schedule M IT-140 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WV Schedule M IT-140 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.