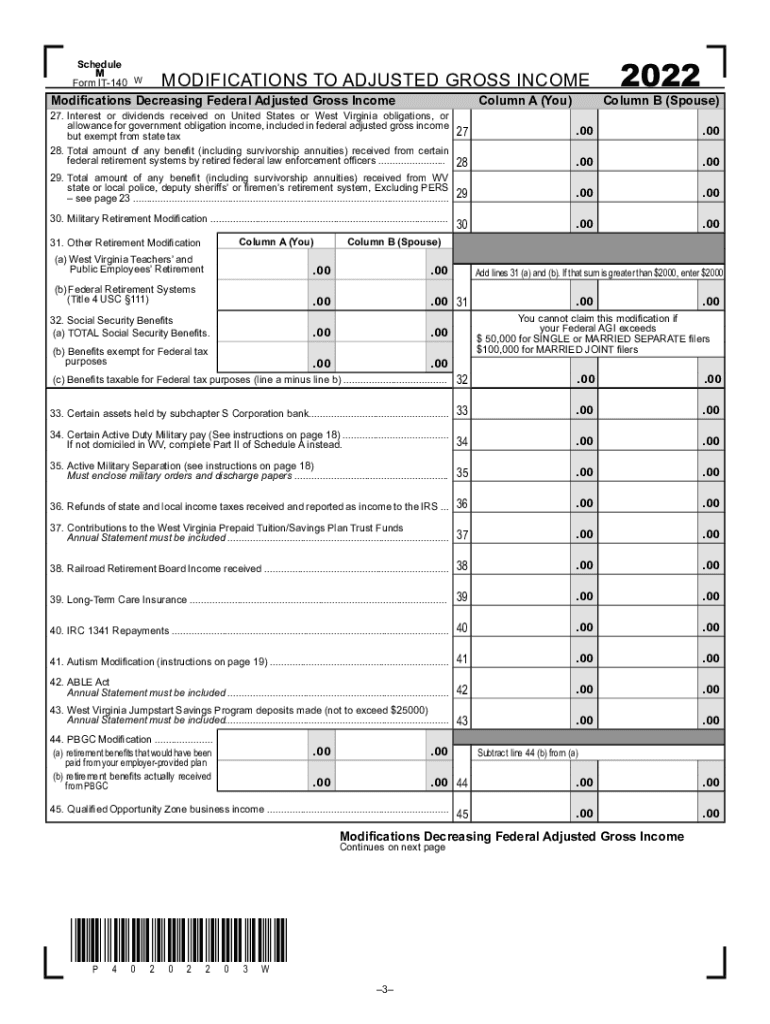

WV Schedule M IT-140 2022 free printable template

Show details

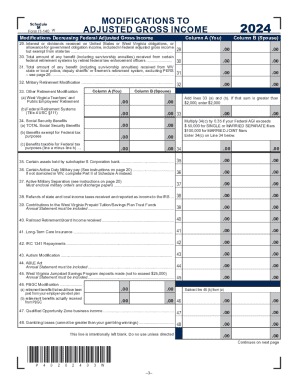

Schedule

M

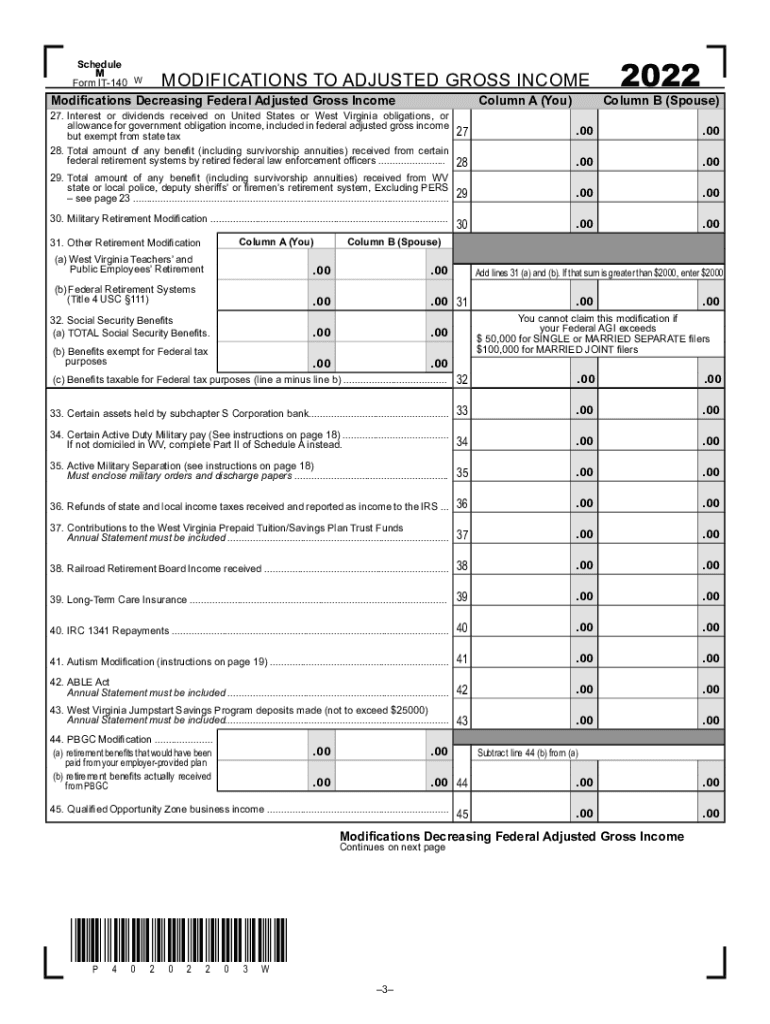

Form IT140 MODIFICATIONS TO ADJUSTED GROSS INCOMEModifications Decreasing Federal Adjusted Gross IncomeColumn A (You)27. Interest or dividends received on the United States or West Virginia

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WV Schedule M IT-140

Edit your WV Schedule M IT-140 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WV Schedule M IT-140 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WV Schedule M IT-140 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WV Schedule M IT-140. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV Schedule M IT-140 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WV Schedule M IT-140

How to fill out WV Schedule M IT-140

01

Obtain the WV Schedule M IT-140 form from the West Virginia State Tax Department's website.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Follow the instructions for entering your federal adjusted gross income (AGI) from your federal tax return.

04

Complete any relevant supplemental sections related to modifications to your income as outlined in the instructions.

05

Review the list of adjustments and choose the appropriate deductions or additions that apply to your tax situation.

06

Calculate your total modifications by adding or subtracting the amounts from your income.

07

Transfer the final modified income amount to the appropriate line on your WV tax return.

08

Double-check all entries for accuracy before submitting your completed form.

Who needs WV Schedule M IT-140?

01

West Virginia residents who are filing their personal income tax returns and need to report adjustments to their federal income.

02

Taxpayers who have specific deductions, exemptions, or credits that necessitate filling out Schedule M.

03

Individuals who have earned income that has been modified due to state-specific tax laws.

Fill

form

: Try Risk Free

People Also Ask about

What is the deadline to pay WV state taxes?

January 17: Due date for tax year 2022 fourth quarter estimated tax payment. January 23: West Virginia begins 2023 tax season. The West Virginia Tax Division will begin accepting individual 2022 tax returns on this date. April 18: Due date to file 2022 tax return, request an extension, and pay tax owed.

How do you know if you owe taxes or get a refund?

Check your federal tax return status Whether you are expecting to owe taxes or receive a refund, there are several ways you can check the status of your federal tax return. Check your tax refund status using the IRS Where's My Refund tool. Sign in to view your IRS online account information. Call the IRS.

How do I pay taxes when I file?

How to pay your taxes Electronic Funds Withdrawal. Pay using your bank account when you e-file your return. Direct Pay. Pay directly from a checking or savings account for free. Credit or debit cards. Pay your taxes by debit or credit card online, by phone, or with a mobile device. Pay with cash. Installment agreement.

How do I register for withholding tax in WV?

Apply online at the Business for West Virginia portal to receive an Employer Account Number within 3 days. Find an existing Employer Account Number: on Form WV /IT-101Q, Employer's Quarterly Return of Income Tax Withheld. visit the WV State Tax Department via the contact page.

How do I pay my WV income tax?

You can use the Pay Personal Income Tax link on the MyTaxes Website. website to begin remitting payments electronically using the ACH Debit method. Credit Cards – All major credit cards accepted. You can visit the Credit Card Payments page for more information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my WV Schedule M IT-140 directly from Gmail?

WV Schedule M IT-140 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete WV Schedule M IT-140 online?

pdfFiller has made filling out and eSigning WV Schedule M IT-140 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the WV Schedule M IT-140 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your WV Schedule M IT-140 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is WV Schedule M IT-140?

WV Schedule M IT-140 is a form used by taxpayers in West Virginia to claim certain modifications to their income when filing their state income tax return.

Who is required to file WV Schedule M IT-140?

Taxpayers who have certain income modifications, such as those related to federal adjustments or specific income exclusions, are required to file WV Schedule M IT-140.

How to fill out WV Schedule M IT-140?

To fill out WV Schedule M IT-140, taxpayers must provide their personal information, report their adjusted gross income, indicate the types of modifications they are claiming, and calculate the total modifications to derive their taxable income.

What is the purpose of WV Schedule M IT-140?

The purpose of WV Schedule M IT-140 is to allow taxpayers to report modifications to their income that affect their tax liability in West Virginia, ensuring accurate tax calculations.

What information must be reported on WV Schedule M IT-140?

WV Schedule M IT-140 requires taxpayers to report their adjusted gross income, the specific modifications being claimed, and any relevant attachments or supporting documentation.

Fill out your WV Schedule M IT-140 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WV Schedule M IT-140 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.