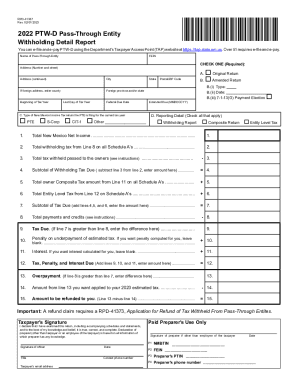

NM TRD RPD-41367 2012 free printable template

Show details

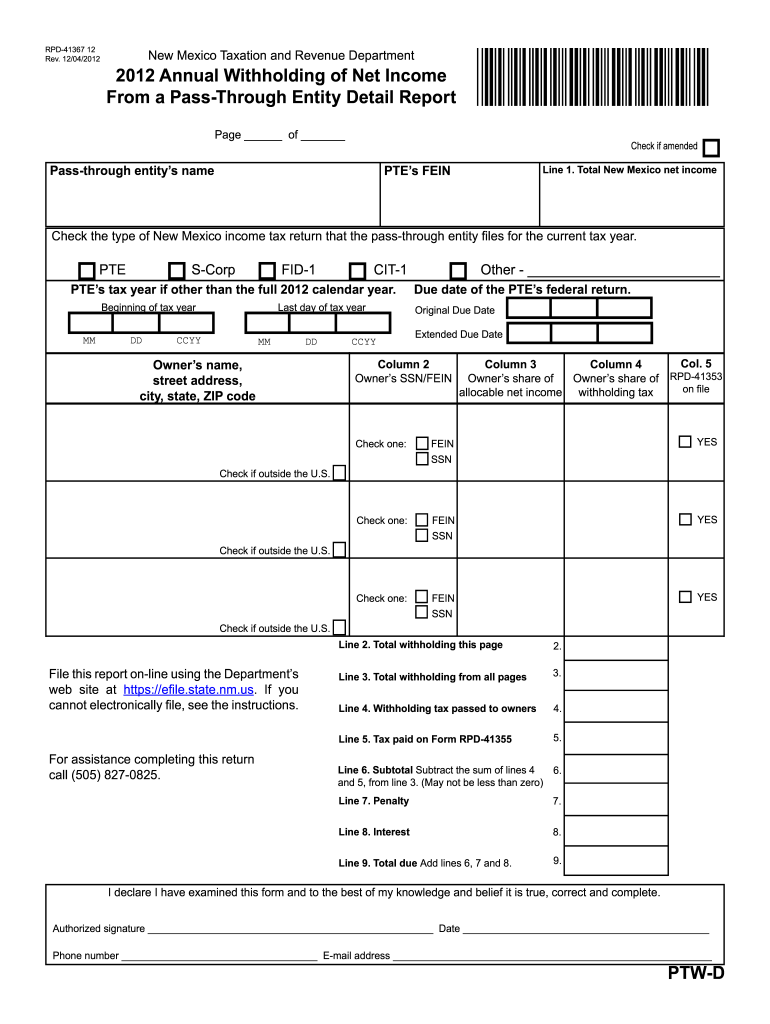

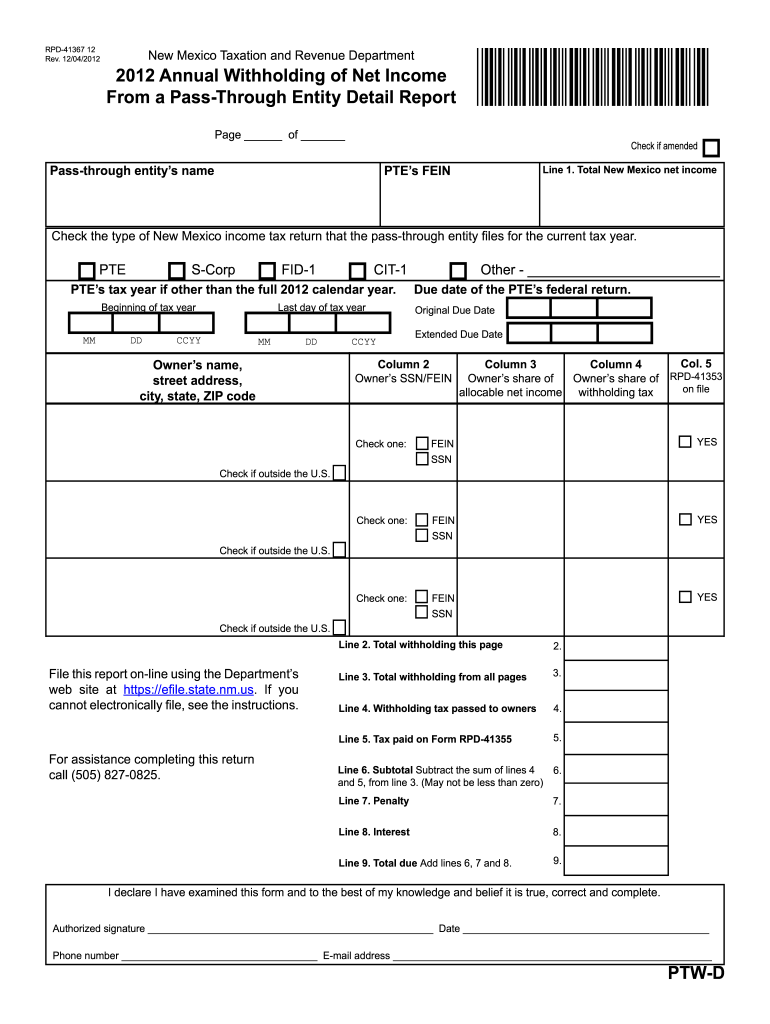

The estate or trust must file and pay the tax withheld on the annual report Form RPD-41367 it distributes taxable New Mexico net income. File Electronically If a PTE has more than 50 payees who receive New Mexico net income the PTE is required to electronically file Form RPD-41367 through the Department s web site. The PTE must report for all owners and mark the indicator box on Form RPD-41367 if the PTE entered into an agreement with the owner that the owner files and pays the tax due on the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD RPD-41367

Edit your NM TRD RPD-41367 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD RPD-41367 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NM TRD RPD-41367 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NM TRD RPD-41367. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41367 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD RPD-41367

How to fill out NM TRD RPD-41367

01

Obtain the NM TRD RPD-41367 form from the official New Mexico Taxation and Revenue Department website or at their office.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill in your personal information, including your name, address, and identification number in the designated fields.

04

Provide details regarding the type of tax and the tax period applicable to your situation.

05

Calculate the amount you owe or the refund you expect, and fill in the appropriate sections.

06

Review all the entries for accuracy and completeness before submitting the form.

07

Submit the completed form either online, by mail, or in person at your local tax office, following the submission guidelines.

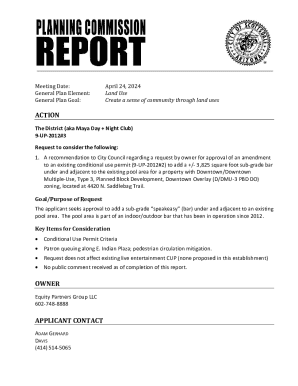

Who needs NM TRD RPD-41367?

01

Individuals or businesses that have certain tax obligations in New Mexico.

02

Taxpayers seeking to claim specific deductions or credits related to their state taxes.

03

People who need to report their tax situation as required by New Mexico tax law.

Fill

form

: Try Risk Free

People Also Ask about

What is the form 41367 in New Mexico?

What is New Mexico RPD 41367? The pass-through entity must file and pay the tax using form RPD-41367, Annual Withholding of Net Income From a Pass-Through Entity Detail Report. Form RPD-41367 can be filed and paid electronically on the Departments web file services page or through a third-party software.

What is New Mexico withholding tax?

Single Tax Withholding Table If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $6,475 but not over $11,975$0.00 plus 1.7% of excess over $6,475Over $11,975 but not over $17,475$93.50 plus 3.2% of excess over $11,975Over $17,475 but not over $22,475$269.50 plus 4.7% of excess over $17,4757 more rows • Mar 30, 2022

What is the New Mexico non-resident withholding tax?

The State of New Mexico requires pass-through entities (which may be a state law partnership or a limited liability company taxed as a partnership) to withhold tax at 5.9% on earnings of non-resident partners or members if the owner's distributive share of net income is over $100 in a year.

Is there a New Mexico state tax form?

Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return. Depending upon your residency status and your own personal situation, you may need other forms and schedules.

Does New Mexico require nonresident withholding?

New Mexico also requires you to deduct and withhold tax from each non-resident owner's allocable share of net income. The tax withheld is required to be remitted to the Department annually.

What is the New Mexico withholding form?

New Mexico withholding taxpayers may file Form RPD- 41072, Annual Summary of Withholding Tax. The report is available for taxpayer's use but is not required to be filed.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NM TRD RPD-41367 for eSignature?

Once you are ready to share your NM TRD RPD-41367, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I sign the NM TRD RPD-41367 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your NM TRD RPD-41367 in seconds.

Can I create an electronic signature for signing my NM TRD RPD-41367 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your NM TRD RPD-41367 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is NM TRD RPD-41367?

NM TRD RPD-41367 is a tax form used by businesses in New Mexico to report specific sales and compensating taxes.

Who is required to file NM TRD RPD-41367?

Businesses engaging in taxable activities in New Mexico, specifically those that collect gross receipts tax or compensating tax, are required to file NM TRD RPD-41367.

How to fill out NM TRD RPD-41367?

To fill out NM TRD RPD-41367, businesses must provide detailed information on their gross receipts, deductions, and tax calculations as specified in the form instructions.

What is the purpose of NM TRD RPD-41367?

The purpose of NM TRD RPD-41367 is to ensure accurate reporting and remittance of state taxes due from gross receipts and compensating activities.

What information must be reported on NM TRD RPD-41367?

The form requires information on total gross receipts, deductions, type and amount of tax collected, and other pertinent details related to the business's taxable activities.

Fill out your NM TRD RPD-41367 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD RPD-41367 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.