NM TRD RPD-41367 2019 free printable template

Show details

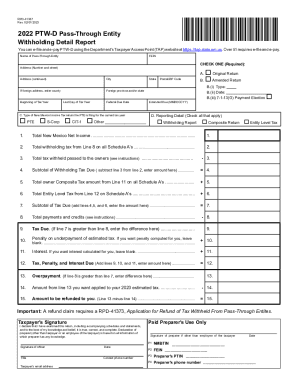

RPD-41367 Rev. 08/24/2018 189080200 New Mexico Taxation and Revenue Department 2018 Pass-Through Entity Withholding Detail PTW-D Report You can e-file and e-pay PTW-D using the Department s Taxpayer Access Point TAP website at https //tap.state. nm.us. A pass-through entity PTE with 51 or more New Mexico payees is required to e-file and e-pay. For tax years 2011 and 2012 estates and trusts that are PTEs were required to file RPD-41367 now called PTW-D instead of FID-D. nm*us. A pass-through...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD RPD-41367

Edit your NM TRD RPD-41367 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD RPD-41367 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM TRD RPD-41367 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NM TRD RPD-41367. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41367 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD RPD-41367

How to fill out NM TRD RPD-41367

01

Gather necessary information such as your name, address, and taxpayer identification number.

02

Download the NM TRD RPD-41367 form from the official website or obtain a physical copy from the New Mexico Taxation and Revenue Department.

03

Fill in your personal information in the designated fields on the form.

04

Provide details regarding the property, including its location, type, and any relevant identifiers.

05

Indicate the reason for the application in the appropriate section.

06

Sign and date the form at the end.

07

Make a copy of the completed form for your records.

08

Submit the form to the New Mexico Taxation and Revenue Department by mail or online, as per the instructions provided.

Who needs NM TRD RPD-41367?

01

Property owners in New Mexico who want to request an exemption or make adjustments related to property taxes.

02

Individuals or entities that are applying for a specific property tax refund or relief.

Fill

form

: Try Risk Free

People Also Ask about

What services are exempt from sales tax in New Mexico?

Traditional Goods or Services Prescription medicine, groceries, and gasoline are all tax-exempt. New Mexico is unique in the fact that the state requires gross receipts tax to be paid on all services.

What is NM withholding?

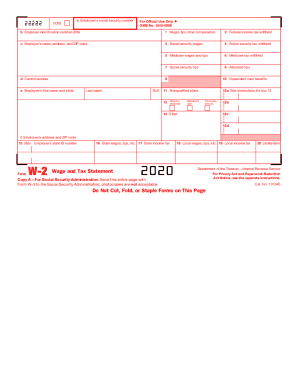

Employers must withhold a part of the employee's wages for payment of income tax. New Mexico bases its withholding tax on an estimate of an employee's State income tax liability. The State credits taxes withheld against the employee's actual income tax liability on the New Mexico personal income tax return.

How do I file gross receipts tax in New Mexico?

If you need assistance, call 1-866-809-2335. Once you're online filing your return, you can also pay online. For no additional charge, you may pay using an electronic check that authorizes the Department to debit your checking account in the amount and on the date you specify.

How do I file my gross receipts tax in New Mexico?

If you need assistance, call 1-866-809-2335. Once you're online filing your return, you can also pay online. For no additional charge, you may pay using an electronic check that authorizes the Department to debit your checking account in the amount and on the date you specify.

Are consulting services taxable in New Mexico?

In New Mexico, professional services (legal, architectural, etc) are subject to sales tax unless specifically exempted.

What is New Mexico RPD 41367?

The pass-through entity must file and pay the tax using form RPD-41367, Annual Withholding of Net Income From a Pass-Through Entity Detail Report. Form RPD-41367 can be filed and paid electronically on the Department's web file services page or through a third-party software.

Is New Mexico gross receipts tax deductible?

(Available July 1, 2018 until July 1,2022). Gross receipts are taxable, exempt, or deductible. If your receipts do not fall under any exemption or deduction, those receipts are taxable.

What is nm rpd 41367?

The pass-through entity must file and pay the tax using form RPD-41367, Annual Withholding of Net Income From a Pass-Through Entity Detail Report. Form RPD-41367 can be filed and paid electronically on the Department's web file services page or through a third-party software.

Do I need to file a New Mexico tax return?

New Mexico's law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New Mexico. You must also file a New Mexico return if you want to claim: a refund of New Mexico state income tax withheld from your pay, or.

Are services subject to sales tax in NM?

Generally speaking, sales and leases of goods and other property, both tangible and intangible, are taxable. Unlike many other states, sales and performances of most services are taxable in New Mexico.

Does New Mexico require state income tax?

New Mexico has a graduated individual income tax, with rates ranging from 1.70 percent to 5.90 percent. New Mexico also has a 4.8 percent to 5.9 percent corporate income tax rate.

Are repair services taxable in New Mexico?

In New Mexico, services are taxable unless they are specifically exempted from taxation.

Who is required to file a NM tax return?

If you are a New Mexico resident, you must file if you meet any of the following conditions: You file a federal return; You want to claim a refund of any New Mexico state income tax withheld from your pay, or. You want to claim any New Mexico rebates or credits.

Do I have to file a state tax return in New Mexico?

New Mexico's law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New Mexico.

Where is my nm rebate?

Taxpayers who have filed a 2021 tax return should use the Call Center (1-866-285-2996) if they still have not received any of the rebates.

Do I have to file a Mexico tax return?

Tax returns All residents receiving income during the calendar year are required to file an annual tax return no later than 30 April of the succeeding year, except in certain cases. When an individual earns Mexican bank interest only, and it is less than MXN 100,000 per year, no tax return filing is required.

How do I report gross receipts?

If you operate your business as a Sole Proprietorship or a single-member Limited Liability Company (LLC), gross receipts go on Schedule C of your IRS Form 1040.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NM TRD RPD-41367 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing NM TRD RPD-41367 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit NM TRD RPD-41367 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit NM TRD RPD-41367.

How do I edit NM TRD RPD-41367 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign NM TRD RPD-41367 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is NM TRD RPD-41367?

NM TRD RPD-41367 is a form used by taxpayers in New Mexico to report certain information related to tax credits and deductions.

Who is required to file NM TRD RPD-41367?

Taxpayers who are claiming specific tax credits or deductions as outlined by the New Mexico Taxation and Revenue Department are required to file NM TRD RPD-41367.

How to fill out NM TRD RPD-41367?

To fill out NM TRD RPD-41367, taxpayers must provide their identifying information, details related to the specific credits or deductions they are claiming, and any required supporting documentation.

What is the purpose of NM TRD RPD-41367?

The purpose of NM TRD RPD-41367 is to allow taxpayers to officially document and claim applicable tax credits and deductions granted by the state of New Mexico.

What information must be reported on NM TRD RPD-41367?

The information that must be reported on NM TRD RPD-41367 includes taxpayer identification details, specific tax credits or deductions being claimed, and any additional information as required by the form instructions.

Fill out your NM TRD RPD-41367 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD RPD-41367 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.