NM TRD RPD-41367 2015 free printable template

Show details

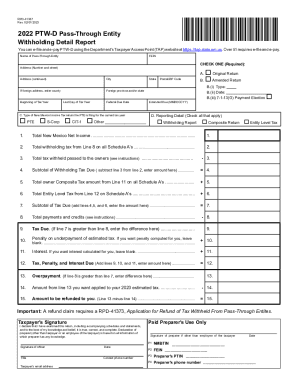

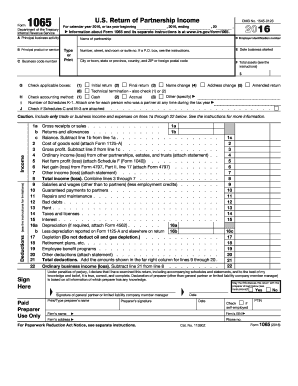

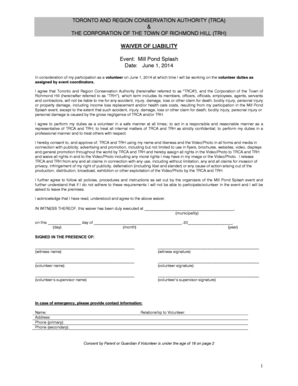

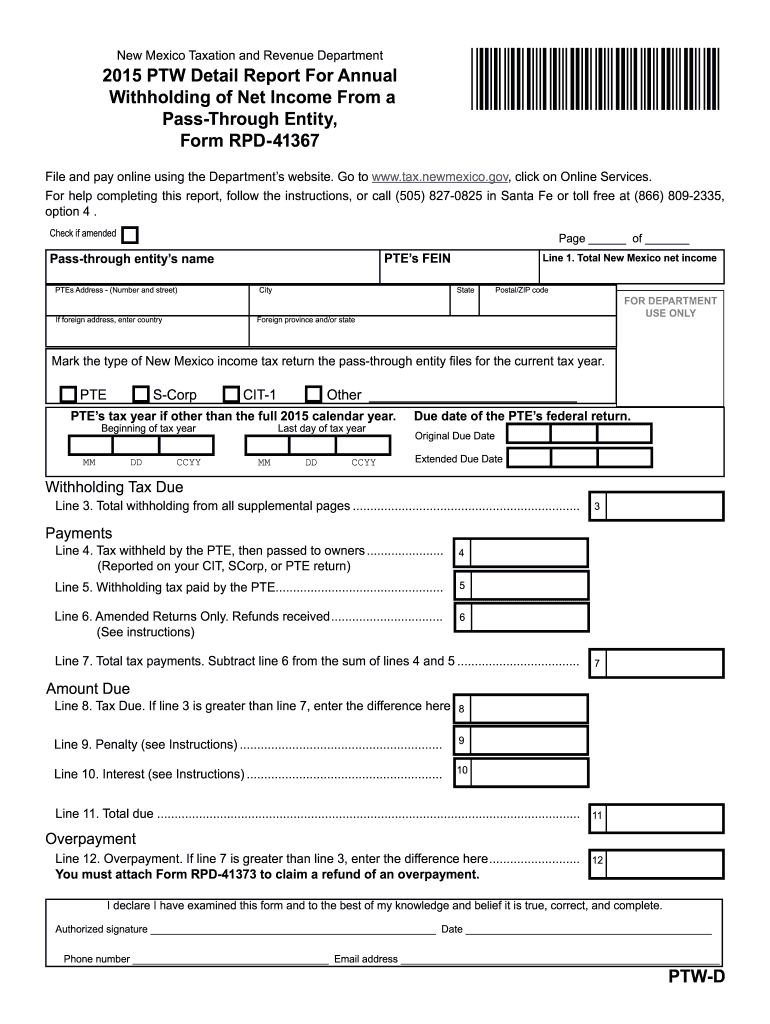

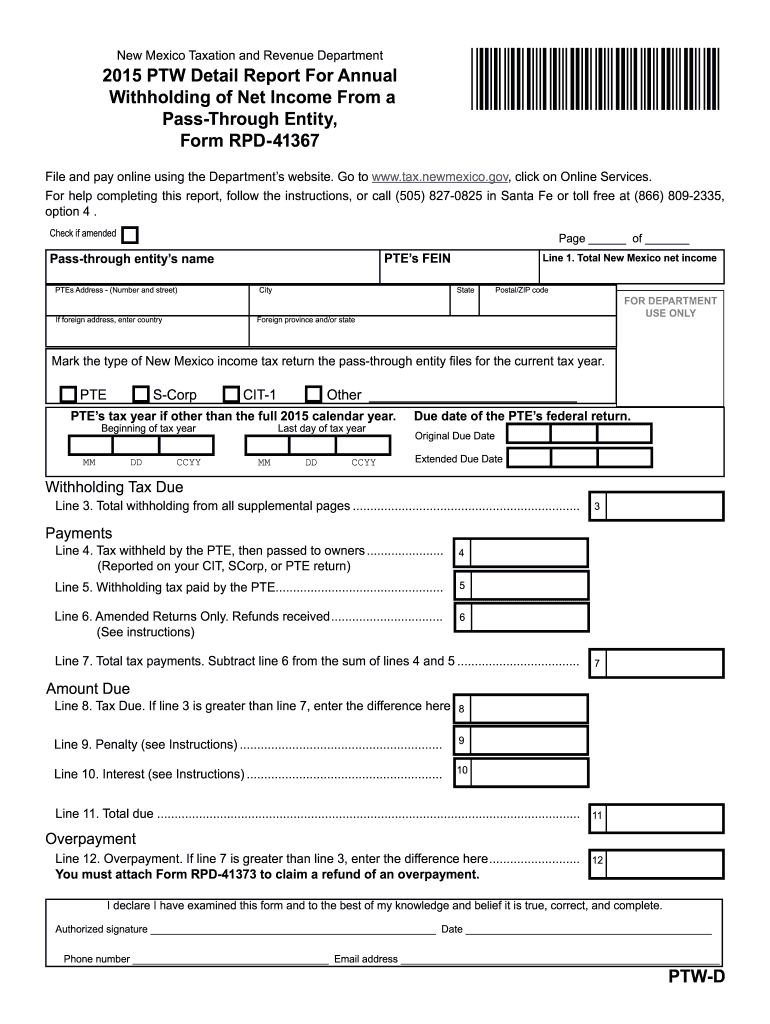

See the FID-D Instructions for more details. For tax years 2011 and 2012 estates and trusts which are pass-through entities were required to file Form RPD-41367 instead of Schedule FID-D. New Mexico Taxation and Revenue Department 159080200 2015 PTW Detail Report For Annual Withholding of Net Income From a Pass-Through Entity Form RPD-41367 File and pay online using the Department s website. On this page. Page 1 of 6 ANSWERS TO COMMONLY ASKED QUESTIONS 1. Does the pass-through entity PTE have...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD RPD-41367

Edit your NM TRD RPD-41367 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD RPD-41367 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NM TRD RPD-41367 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NM TRD RPD-41367. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41367 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD RPD-41367

How to fill out NM TRD RPD-41367

01

Download the NM TRD RPD-41367 form from the New Mexico Taxation and Revenue Department website.

02

Fill out the header with your name, address, and identification number.

03

Indicate the type of tax or credit you are applying for in the designated section.

04

Provide all required financial information as per the instructions on the form.

05

Sign and date the form at the bottom.

06

Double-check all entries for accuracy before submission.

07

Submit the completed form to the relevant tax authority by the specified deadline.

Who needs NM TRD RPD-41367?

01

Individuals or businesses applying for certain tax credits or refunds in New Mexico.

02

Tax professionals preparing submissions on behalf of clients.

03

Anyone required by state law to report specific tax information.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file New Mexico tax return?

Who is required to file? New Mexico's law says every person who meets both of the following conditions must file Form PIT-1, New Mexico Personal Income Tax Return: Every person who is a New Mexico resident or has income from New Mexico sources. Every person who is required to file a federal income tax return.

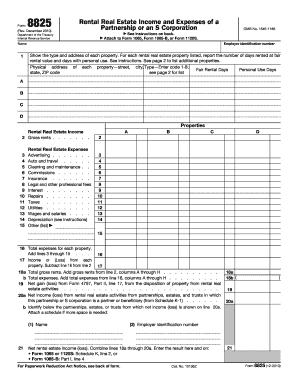

Does New Mexico require nonresident withholding?

New Mexico also requires you to deduct and withhold tax from each non-resident owner's allocable share of net income. The tax withheld is required to be remitted to the Department annually.

What is the New Mexico withholding form?

New Mexico withholding taxpayers may file Form RPD- 41072, Annual Summary of Withholding Tax. The report is available for taxpayer's use but is not required to be filed.

What is the New Mexico non-resident withholding tax?

The State of New Mexico requires pass-through entities (which may be a state law partnership or a limited liability company taxed as a partnership) to withhold tax at 5.9% on earnings of non-resident partners or members if the owner's distributive share of net income is over $100 in a year.

What is the New Mexico withholding tax rate?

New Mexico's SUI rates range from 0.33% to 6.4%. The taxable wage base in 2023 is $30,100 for each employee, up from $28,700 in 2022. If you are a new small business owner (congratulations, by the way!), your rates range between 1% – 1.06%. More information for new employers is available per industry here.

Where can I get New Mexico tax forms?

At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

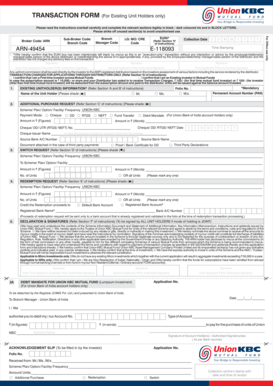

How can I send NM TRD RPD-41367 to be eSigned by others?

Once you are ready to share your NM TRD RPD-41367, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit NM TRD RPD-41367 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign NM TRD RPD-41367 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit NM TRD RPD-41367 on an Android device?

You can make any changes to PDF files, such as NM TRD RPD-41367, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is NM TRD RPD-41367?

NM TRD RPD-41367 is a form used by taxpayers in New Mexico to report certain tax information and ensure compliance with state tax regulations.

Who is required to file NM TRD RPD-41367?

Individuals or businesses in New Mexico that meet specific criteria set by the New Mexico Taxation and Revenue Department are required to file NM TRD RPD-41367.

How to fill out NM TRD RPD-41367?

To fill out NM TRD RPD-41367, taxpayers should follow the instructions provided on the form, ensuring that all required fields are completed accurately, and supporting documentation is included.

What is the purpose of NM TRD RPD-41367?

The purpose of NM TRD RPD-41367 is to collect necessary tax information, facilitate the assessment of tax obligations, and ensure compliance with New Mexico tax laws.

What information must be reported on NM TRD RPD-41367?

The information that must be reported on NM TRD RPD-41367 typically includes taxpayer identification details, financial data relevant to the tax year, and any applicable deductions or credits.

Fill out your NM TRD RPD-41367 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD RPD-41367 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.