IL DoR IL-1120-ST 2013 free printable template

Show details

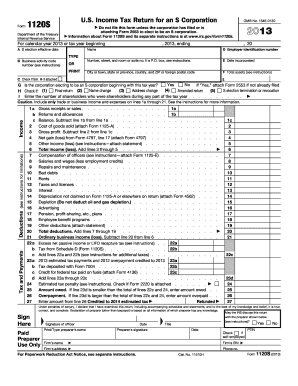

Illinois Department of Revenue 332701110 2013 Form IL-1120-ST Small Business Corporation Replacement Tax Return Due on or before the 15th day of the 3rd month following the close of the tax year. Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. Write the amount you are paying. If this return is not for calendar year 2013 write your fiscal tax year here. Tax year beginning month day ending year Step 1 Identify your small business...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-1120-ST

Edit your IL DoR IL-1120-ST form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-1120-ST form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL DoR IL-1120-ST online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IL DoR IL-1120-ST. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-1120-ST Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-1120-ST

How to fill out IL DoR IL-1120-ST

01

Begin by downloading the IL DoR IL-1120-ST form from the Illinois Department of Revenue website.

02

Fill in your business information at the top of the form, including the business name, address, and FEIN.

03

Indicate the tax year for which you are filing the return.

04

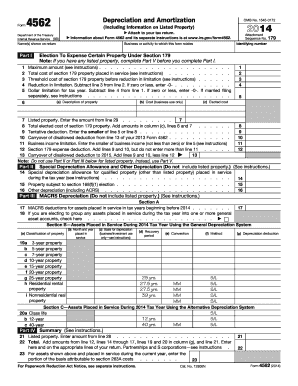

Complete the income section by reporting your business income, including gross receipts and any other income.

05

Fill out the deductions section to report any allowable business expenses.

06

Calculate the net income by subtracting deductions from your total income.

07

Enter the appropriate tax rate and calculate the tax owed based on your net income.

08

If applicable, report any prior payments or credits to reduce your tax liability.

09

Review the entire form for accuracy before signing and dating it.

10

Submit the completed form by mailing it to the address specified in the instructions.

Who needs IL DoR IL-1120-ST?

01

Businesses operating in Illinois that are classified as S Corporations and are required to report their income and taxes.

02

Any entity that earned income in Illinois and needs to comply with state tax regulations as part of their annual tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What is the replacement tax in Illinois?

What are the rates? Corporations pay a 2.5 percent replacement tax on their net Illinois income. Partnerships, trusts, and S corporations pay a 1.5 percent replacement tax on their net Illinois income. Public utilities pay a 0.8 percent tax on invested capital.

What is the extended due date for IL-1120-ST?

In general, Form IL-1120-ST is due on or before the 15th day of the 3rd month following the close of the taxable year. We grant you an automatic seven-month extension of time to file your small business corporate tax return. See our Subchapter S (Small Business) Corporation web page for more information.

What is IL 1120 ST?

Small Business Corporation Replacement Tax Return This form is for tax years ending on or after December 31, 2022, and before December 31, 2023.

What is the state tax in Illinois for a business?

Illinois also has a 9.50 percent corporate income tax rate. Illinois has a 6.25 percent state sales tax rate, a 4.75 percent max local sales tax rate, and an average combined state and local sales tax rate of 8.82 percent. Illinois's tax system ranks 36th overall on our 2023 State Business Tax Climate Index.

Can I file IL 1120 ST online?

Estimated tax payments — S corporations who elect to pay PTE tax and reasonably expect their total tax liability to exceed $500 are required to make estimated tax payments using Form IL-1120-ST-V, either electronically or by mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IL DoR IL-1120-ST?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific IL DoR IL-1120-ST and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete IL DoR IL-1120-ST online?

Easy online IL DoR IL-1120-ST completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit IL DoR IL-1120-ST straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing IL DoR IL-1120-ST.

What is IL DoR IL-1120-ST?

IL DoR IL-1120-ST is a form used for Illinois tax purposes that is specifically designed for S corporations to report their income, deductions, and tax obligations.

Who is required to file IL DoR IL-1120-ST?

S corporations operating in Illinois are required to file IL DoR IL-1120-ST if they have income, deductions, or credits to report.

How to fill out IL DoR IL-1120-ST?

To fill out IL DoR IL-1120-ST, taxpayers must provide their business information, report income and deductions, calculate tax liabilities, and sign the form.

What is the purpose of IL DoR IL-1120-ST?

The purpose of IL DoR IL-1120-ST is to allow S corporations to report their income and tax information to the Illinois Department of Revenue accurately.

What information must be reported on IL DoR IL-1120-ST?

The form requires reporting on total income, allowed deductions, tax credits, and any other relevant financial information for the S corporation.

Fill out your IL DoR IL-1120-ST online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-1120-ST is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.