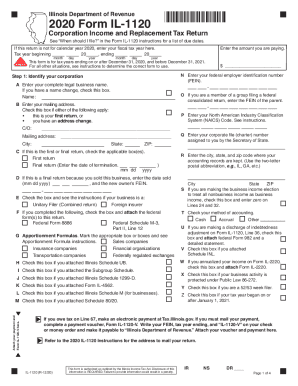

IL DoR IL-1120-ST 2020 free printable template

Show details

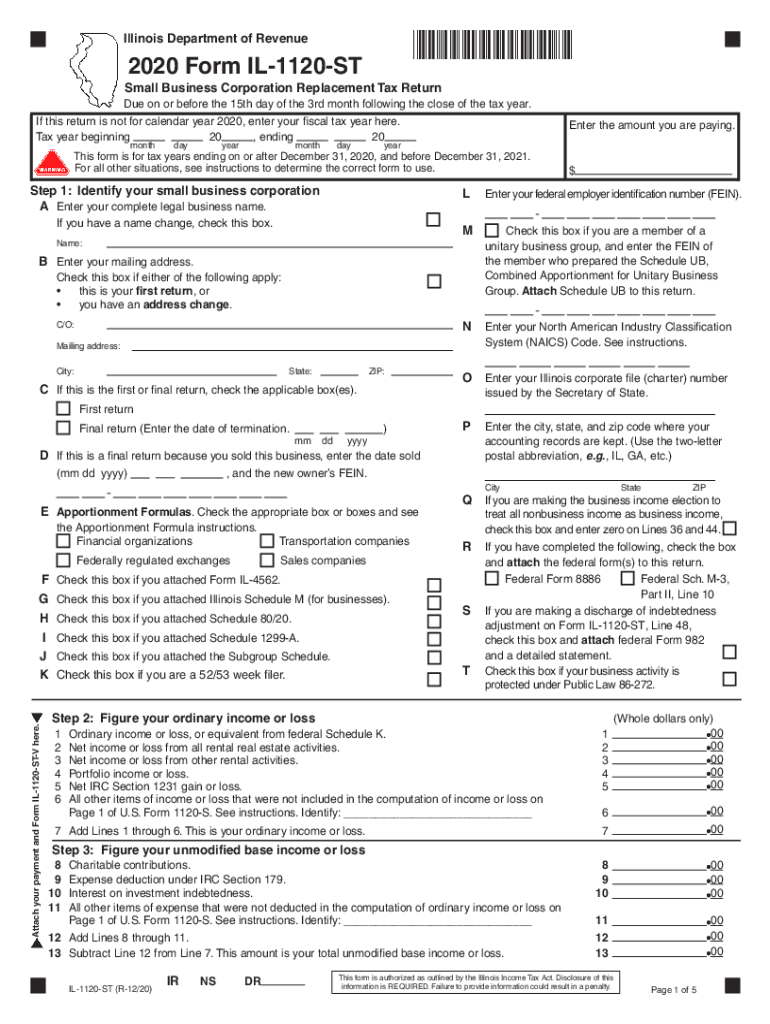

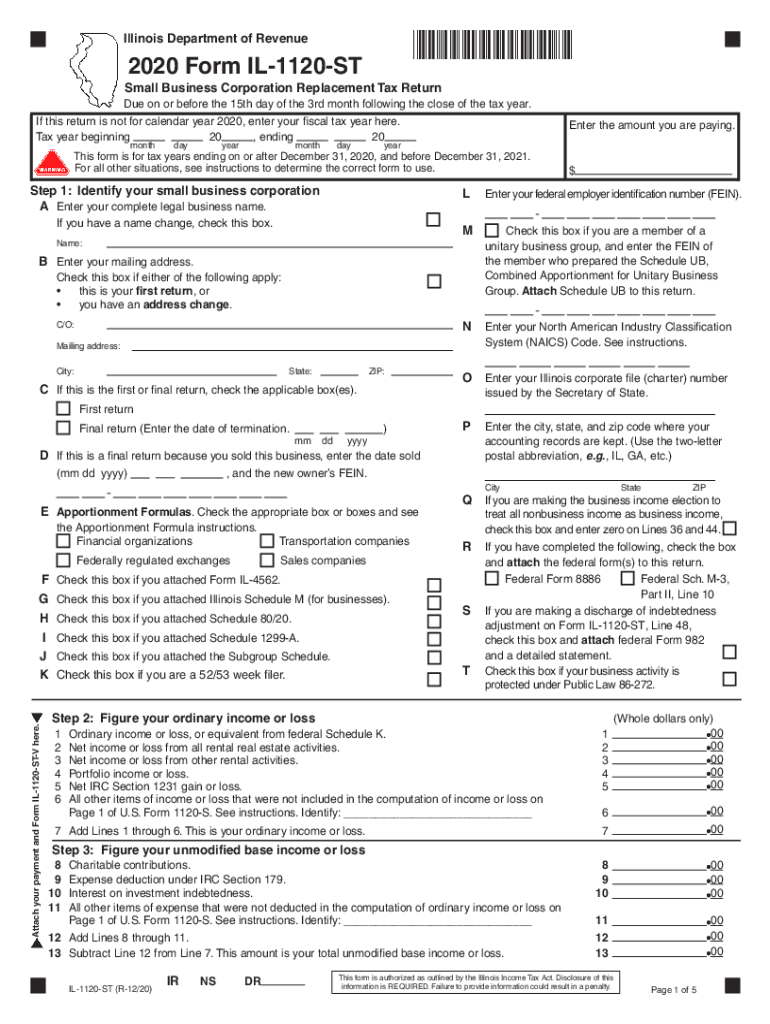

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. Illinois Department of Revenue2020 Form IL1120ST×32712201W×Small Business Corporation Replacement

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-1120-ST

Edit your IL DoR IL-1120-ST form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-1120-ST form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL DoR IL-1120-ST online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IL DoR IL-1120-ST. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-1120-ST Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-1120-ST

How to fill out IL DoR IL-1120-ST

01

Obtain the IL-1120-ST form from the Illinois Department of Revenue website.

02

Fill in the top section with your business name, address, and tax period.

03

Provide your federal employer identification number (FEIN).

04

Complete the income section with your total gross receipts and any applicable deductions.

05

Calculate your net income and fill in the appropriate line.

06

If applicable, include any investment credits or other tax credits.

07

Sign and date the form to certify the information provided is accurate.

08

Mail the completed IL-1120-ST to the address specified in the form instructions.

Who needs IL DoR IL-1120-ST?

01

Any corporation that has a business situs in Illinois and meets the eligibility requirements for the S Corporation status needs to file IL DoR IL-1120-ST.

02

Businesses that are taxed as S Corporations for federal purposes and wish to report their income and taxes in Illinois are also required to file this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the number 1 attraction in Illinois?

Top Attractions in Illinois The Art Institute of Chicago. 24,390. Art Museums. Millennium Park. 24,980. Points of Interest & Landmarks • Parks. Cloud Gate. 18,199. Wrigley Field. 9,904. Museum of Science and Industry. 11,116. The Magnificent Mile. 15,758. Skydeck Chicago - Willis Tower. 17,702. Field Museum. 8,836.

What is the #1 college in Illinois?

University of Illinois Urbana-Champaign.

What are all the cities in Illinois?

Looking for a list of cities, counties or zips in Illinois? RankCityPopulation1Chicago2,696,5552Aurora179,2663Joliet150,3724Naperville149,104157 more rows

What is Illinois state famous for?

Cities in Illinois that start with S Sadorus. Sailor Springs. Salem. Sammons Point. Sandoval. Sandwich. San Jose. Sauget.

What's the prettiest town in Illinois?

Best Cities to Live in Illinois Chicago. Often called “The Windy City,” Chicago is one of the largest cities in the United States and is found in the northeast of Illinois on the shores of Lake Michigan. Naperville. Springfield. Buffalo Grove. Evanston.

What are the top 5 major cities in Illinois?

The 10 Most Charming Small Towns in Illinois Princeton, Il. Rockton, Il. Nauvoo, Il. Ottawa, Il. Quincy, Il. Fulton, Il. Lebanon, Il. Arthur And Arcola, Il.

What is Illinois country code?

Illinois Area Codes Area codesSelected cities312, 773Chicago618Carbondale, East St. Louis630Aurora, Naperville708Chicago Heights, Cicero5 more rows

What state number is il?

For the majority of felonies, the Illinois criminal statute of limitations is three years. For misdemeanors in Illinois, the statute of limitations is 18 months. Certain serious crimes, however, are exempt from the statute of limitations entirely.

What are 5 things about Illinois?

Illinois Nickname: The Prairie State. Statehood: 1818; 21st state. Population (as of July 2016): 12,801,539. Capital: Springfield. Biggest City: Chicago. Abbreviation: IL. State bird: northern cardinal. State flower: violet.

What is Illinois best known for?

Illinois is known for Chicago, the country's third largest city, but also the Mississippi River, and the start of Route 66. It is famous for the highest skyscraper, tall and famous people like Walt Disney, and Abraham Lincoln.

Why is Illinois special?

2 Illinois was the first state in the U.S. to ratify the Constitution's 13th amendment which abolished slavery. 3 The first McDonald's was built in Des Plaines, IL. 4 Illinois produces more nuclear energy than any other state in the country. 5 Twinkies were first invented in River Forest, IL in 1930.

What are 3 things Illinois is known for?

Illinois was the first state to ratify the 13th Amendment to the Constitution abolishing slavery, 1865. Illinois was home to President Ulysses S. Grant, whose home is preserved in Galena. The Chicago Water Tower and Pumping Station were the only buildings to survive the Great Chicago Fire, 1871.

Is Illinois a rich or poor state?

In 2019, the median U.S. household income was $65,712. The District of Columbia had the highest with $92,266, and Mississippi had the lowest with $45,792.Richest States 2022. StateGDP per CapitaGDP (millions $)Connecticut$78,510283,601California$78,0193,120,386Delaware$75,83576,468Illinois$68,364875,67146 more rows

What is Illinois known for?

Illinois is a great place to travel, with so much to see and do. It is known for its abolition of slavery, its role in the Underground Railroad, and its contributions to the American automotive industry. Illinois is also home to the first McDonald's, Route 66, and the world's largest catsup bottle.

What is Illinois best at?

In addition to business, Illinois' largest industries are manufacturing, education, agriculture, energy and biotechnology. Illinois is also a leader in clean energy technology, with huge wind farms and considerable ethanol fuel production in the state.

Why does Illinois have an S?

Illinois Tax Rates, Collections, and Burdens Illinois has a 6.25 percent state sales tax rate, a 4.75 percent max local sales tax rate, and an average combined state and local sales tax rate of 8.81 percent. Illinois's tax system ranks 36th overall on our 2022 State Business Tax Climate Index.

What is Illinois rank?

The 2022-23 U.S. News & World Report's America's Best Colleges rankings rated Illinois as the number 13 public university and the number 41 national university.

What cities in Illinois start with an S?

Common law marriages are not valid in Illinois. You need a license to be legally married in this state. Unless you entered into a common law marriage in another state that allows them or allowed them while you were living together, you were not married.

What are 4 facts about Illinois?

State Seal 1 The Sears Tower in Chicago is the tallest building in America. 2 Illinois was the first state in the U.S. to ratify the Constitution's 13th amendment which abolished slavery. 3 The first McDonald's was built in Des Plaines, IL. 4 Illinois produces more nuclear energy than any other state in the country.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IL DoR IL-1120-ST online?

pdfFiller has made it simple to fill out and eSign IL DoR IL-1120-ST. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the IL DoR IL-1120-ST in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your IL DoR IL-1120-ST in minutes.

How can I fill out IL DoR IL-1120-ST on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your IL DoR IL-1120-ST. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IL DoR IL-1120-ST?

IL DoR IL-1120-ST is a form used by multiple types of corporations for state tax purposes in Illinois to report income and apportionment.

Who is required to file IL DoR IL-1120-ST?

Corporations that do business in Illinois and are classified as S Corporations or Corporations electing to be treated as such for tax purposes must file IL DoR IL-1120-ST.

How to fill out IL DoR IL-1120-ST?

To fill out IL DoR IL-1120-ST, you need to provide information on your corporation's income, deductions, and credits, as well as specific apportionment factors and complete the requisite calculations on the form.

What is the purpose of IL DoR IL-1120-ST?

The purpose of IL DoR IL-1120-ST is to accurately report the income and tax owed by S Corporations and to ensure compliance with Illinois state tax laws.

What information must be reported on IL DoR IL-1120-ST?

The IL DoR IL-1120-ST requires reporting of the corporation's gross income, allowable deductions, non-business income, apportionment factors, credits, and tax calculation.

Fill out your IL DoR IL-1120-ST online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-1120-ST is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.