IL DoR IL-1120-ST 2010 free printable template

Show details

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

*032701110*

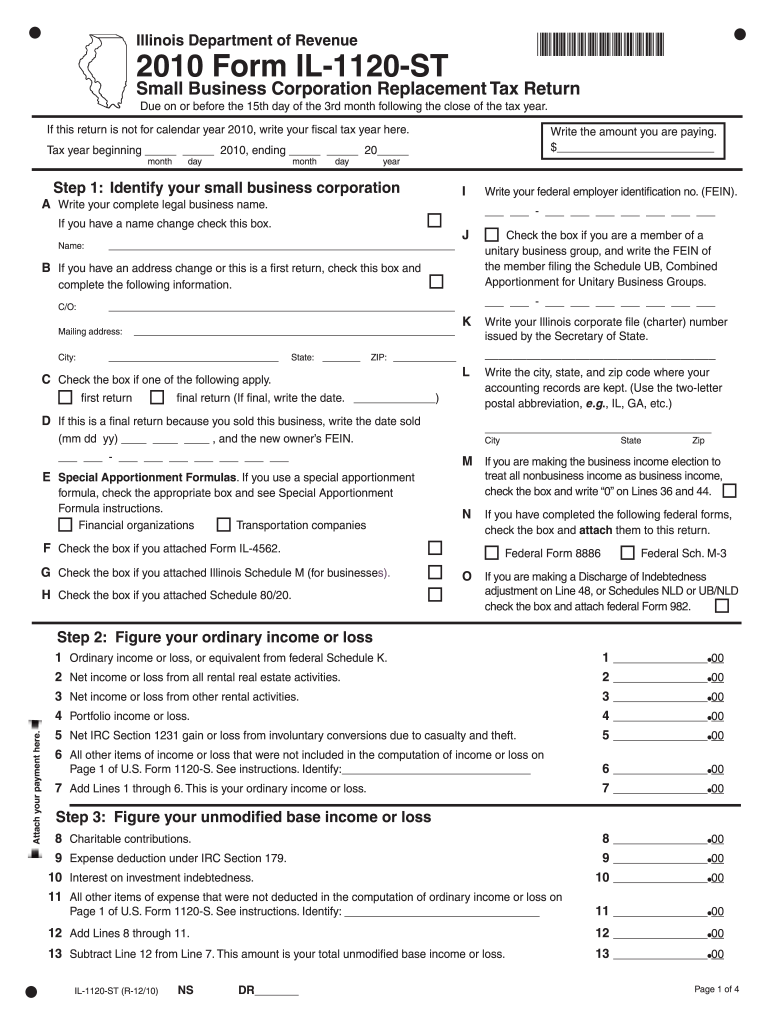

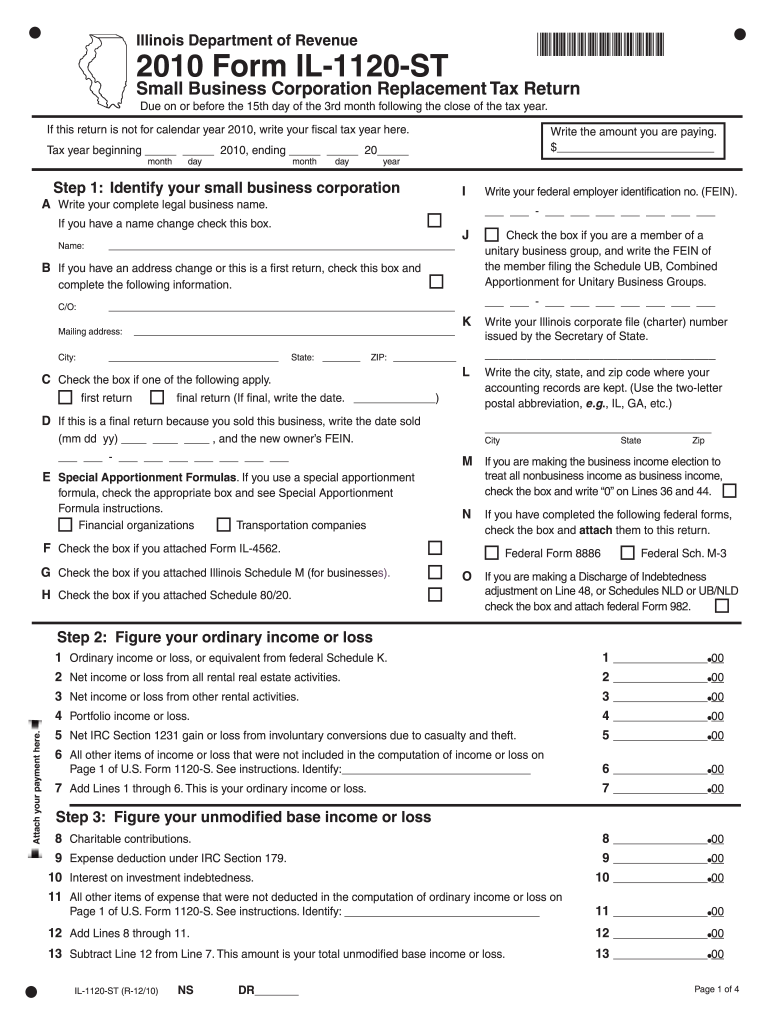

Illinois Department of Revenue

2010 Form IL-1120-ST

Small Business Corporation

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-1120-ST

Edit your IL DoR IL-1120-ST form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-1120-ST form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL DoR IL-1120-ST online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL DoR IL-1120-ST. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-1120-ST Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-1120-ST

How to fill out IL DoR IL-1120-ST

01

Gather necessary financial documents and information about your S corporation.

02

Download the IL-1120-ST form from the Illinois Department of Revenue website.

03

Fill in the identification section with your business name, address, and federal employer identification number (EIN).

04

Complete the revenue lines by reporting your total income and any adjustments.

05

Calculate your Illinois S corporation income by following the instructions provided on the form.

06

Enter any applicable credits and adjustments on the form.

07

Determine your total tax by applying the appropriate rates to your calculated income.

08

Review your completed form for accuracy and ensure all required signatures are present.

09

Submit the form by mail or electronically, following the instructions provided on the form.

Who needs IL DoR IL-1120-ST?

01

The IL DoR IL-1120-ST is needed by S corporations operating in Illinois that wish to report their income and calculate their state tax liability.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file an 1120?

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Domestic corporations must file Form 1120, unless they are required, or elect to file a special return.

Can you pay form 1120 online?

There are electronic filing options available for many of the taxes and forms that small businesses are required to file, such as excise and employment taxes, Forms 1120, 7004, 1041 and various information returns.

Can I pay my 1120 taxes online?

There are electronic filing options available for many of the taxes and forms that small businesses are required to file, such as excise and employment taxes, Forms 1120, 7004, 1041 and various information returns.

Can I pay my state taxes online illinois?

We encourage you to use electronic methods to ensure timely receipt of payments. The following electronic methods available to pay your individual income tax are: MyTax Illinois (electronic payment taken from your checking or savings account) Credit Card (Visa, MasterCard, Discover, or American Express)

What is Illinois 1120 St?

The Illinois Department of Revenue April 1 issued revised instructions for Form IL-1120-ST, Small Business Corporation Replacement Tax Return, for individual income, corporate income, and trust income tax purposes. Taxpayers can use the form for a tax year ending on or after Dec. 31, 2021, and before Dec. 31, 2022.

What type of company is 1120?

Schedule PH (Form 1120), U.S. Personal Holding Company (PHC) Tax. A corporation that is a personal holding company (PHC) uses Schedule PH (Form 1120) to figure the PHC tax.

Who must file Illinois corporate income tax return?

If you have a corporation that (1) has net income or loss, or (2) is qualified to conduct business in the state of Illinois, you will need to file Form IL-1120.

Can I file my Illinois taxes online?

You may choose to file online using computer tax preparation (Tax-Prep) software. This allows you to file your IL-1040 electronically using department approved commercial software or web-based applications.

What is a IL-1120-ST form?

Small Business Corporation Replacement Tax Return.

Who must file an Illinois corporate tax return?

If you have a corporation that (1) has net income or loss, or (2) is qualified to conduct business in the state of Illinois, you will need to file Form IL-1120.

Can I file IL 1120 ST online?

You can electronically file your Form IL-1120, Corporation Income and Replacement Tax Return; IL-1065, Partnership Replacement Tax Return; IL-1120-ST, Small Business Corporation Replacement Tax Return; IL-1041, Fiduciary Income and Replacement Tax Return; attachments; and payments; through our partnership with the IRS

Who must file an IL-1120-ST?

S corporations must complete Form IL-1120-ST. Form IL-1120-ST (R-12/21) is for tax years ending on or after December 31, 2021, and before December 31, 2022. For tax years ending on or after December 31, 2020 and before December 31, 2021, use the 2020 form.

Can I file IL-1120-ST online?

You can electronically file your Form IL-1120, Corporation Income and Replacement Tax Return; IL-1065, Partnership Replacement Tax Return; IL-1120-ST, Small Business Corporation Replacement Tax Return; IL-1041, Fiduciary Income and Replacement Tax Return; attachments; and payments; through our partnership with the IRS

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IL DoR IL-1120-ST in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IL DoR IL-1120-ST and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete IL DoR IL-1120-ST online?

Easy online IL DoR IL-1120-ST completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit IL DoR IL-1120-ST on an Android device?

You can edit, sign, and distribute IL DoR IL-1120-ST on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is IL DoR IL-1120-ST?

IL DoR IL-1120-ST is a form used by corporations in Illinois to report their income and calculate their state tax liability. It is specifically designed for small corporations who may qualify for a simplified filing process.

Who is required to file IL DoR IL-1120-ST?

Small corporations that meet specific criteria set by the Illinois Department of Revenue must file IL DoR IL-1120-ST. This typically includes corporations with a certain level of revenue and those operating within the state.

How to fill out IL DoR IL-1120-ST?

To fill out IL DoR IL-1120-ST, follow the instructions provided for each section of the form, report income and deductions accurately, and ensure that all required signatures are included before submission.

What is the purpose of IL DoR IL-1120-ST?

The purpose of IL DoR IL-1120-ST is to enable small corporations to report their income and calculate their tax liability in a manner that is streamlined and less burdensome than the standard corporate tax forms.

What information must be reported on IL DoR IL-1120-ST?

The information reported on IL DoR IL-1120-ST includes corporate income, deductions, credits, and other relevant financial information that reflects the corporation's tax obligations to the state of Illinois.

Fill out your IL DoR IL-1120-ST online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-1120-ST is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.