CA DTT Affidavit 2011 free printable template

Show details

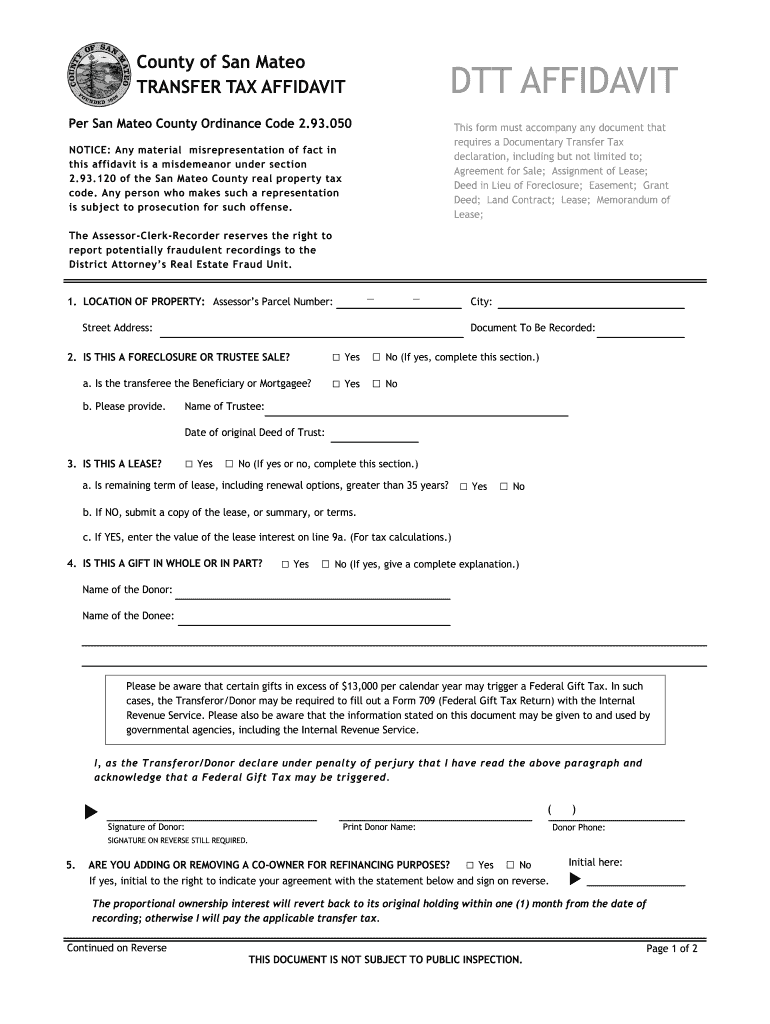

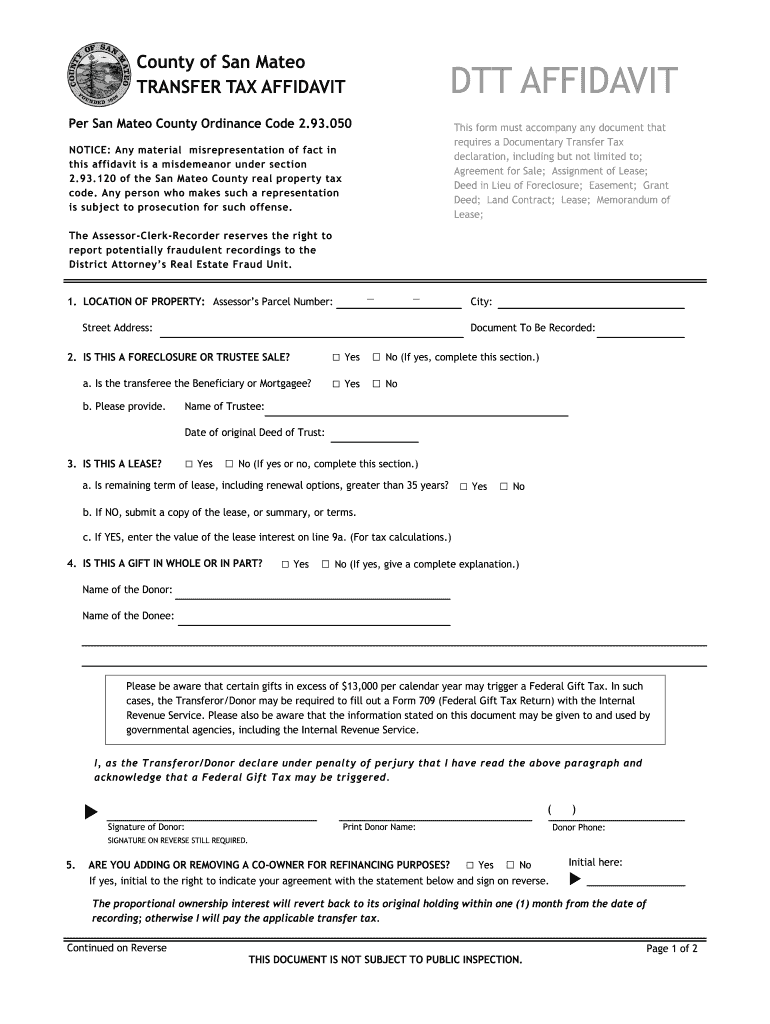

County of San Mateo TRANSFER TAX AFFIDAVIT DTT AFFIDAVIT Per San Mateo County Ordinance Code 2. 93. 050 This form must accompany any document that requires a Documentary Transfer Tax declaration including but not limited to Agreement for Sale Assignment of Lease Deed in Lieu of Foreclosure Easement Grant Deed Land Contract Lease Memorandum of Lease NOTICE Any material misrepresentation of fact in this affidavit is a misdemeanor under section 2. 93. 120 of the San Mateo County real property...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign affidavit transfer tax 2011

Edit your affidavit transfer tax 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit transfer tax 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing affidavit transfer tax 2011 online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit affidavit transfer tax 2011. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DTT Affidavit Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out affidavit transfer tax 2011

How to fill out CA DTT Affidavit

01

Obtain a copy of the CA DTT Affidavit form from the appropriate tax authority website or office.

02

Read the instructions carefully to understand the requirements and purpose of the affidavit.

03

Fill out your personal information in the designated fields, including your name, address, and tax identification number.

04

Provide detailed information regarding your income sources and the applicable tax treaties that relate to your income.

05

Ensure to include any necessary supporting documentation as required by the form.

06

Review the filled form for accuracy and completeness.

07

Sign and date the affidavit in the designated area.

08

Submit the completed affidavit to the relevant tax authority or institution as instructed.

Who needs CA DTT Affidavit?

01

Individuals or entities receiving income that may be subject to withholding tax in California.

02

Taxpayers claiming benefits under a tax treaty between the United States and another country.

03

Foreign investors or businesses doing business in California who need to validate their treaty eligibility.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for an Affidavit in South Carolina?

To be an admissible Affidavit, the acknowledgment must be sworn to be true and correct to the best personal knowledge of the affiant. Furthermore, the affiant must declare that the statements contained in the Affidavit are true and correct under penalties of perjury.

Who pays the transfer tax in South Carolina?

It is customary for the seller of the property to pay all real estate transfer taxes in South Carolina. The transfer taxes are usually due at the time of closing, alongside other fees such as appraisal fees or agent fees.

How do you transfer property in South Carolina?

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

What is Section 12 24 70 in South Carolina?

SECTION 12-24-70. Affidavits. (A)(1) The clerk of court or register of deeds shall require an affidavit showing the value of the realty to be filed with a deed. The affidavit required by this section must be signed by a responsible person connected with the transaction, and the affidavit must state that connection.

What is the transfer tax in South Carolina?

In South Carolina, the formula for the transfer tax, mostly referred to as deed stamps, is $1.85 per $500 of consideration; this is the combined amount for city, county and state taxes. If the consideration is $100,000, the transfer tax is $370, and paid directly to the County Register of Deeds by the closing attorney.

What is the transfer tax rate in South Carolina?

The transfer tax is a percentage of the appraised value of the property or the sale price. In South Carolina, you have a combined state and local transfer tax of 0.37% on the sale price (or $1.85 for every $500).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my affidavit transfer tax 2011 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign affidavit transfer tax 2011 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit affidavit transfer tax 2011 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including affidavit transfer tax 2011, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete affidavit transfer tax 2011 on an Android device?

Complete affidavit transfer tax 2011 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is CA DTT Affidavit?

The CA DTT Affidavit is a legal document submitted to the California tax authorities to claim tax treaty benefits and to confirm the non-resident status of a taxpayer.

Who is required to file CA DTT Affidavit?

Non-resident individuals or entities who wish to claim benefits under a tax treaty between their country and the United States are typically required to file the CA DTT Affidavit.

How to fill out CA DTT Affidavit?

To fill out the CA DTT Affidavit, taxpayers must provide identification information, details regarding the tax treaty claimed, and necessary financial information relevant to the income being reported.

What is the purpose of CA DTT Affidavit?

The purpose of the CA DTT Affidavit is to allow non-resident taxpayers to claim exemptions or reductions on certain income tax obligations by providing proof of their eligibility for benefits under applicable tax treaties.

What information must be reported on CA DTT Affidavit?

The CA DTT Affidavit must report personal and contact information, details about the income subject to the tax treaty, the specific treaty being invoked, and any other relevant financial data confirming the taxpayer's eligibility for treaty benefits.

Fill out your affidavit transfer tax 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit Transfer Tax 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.