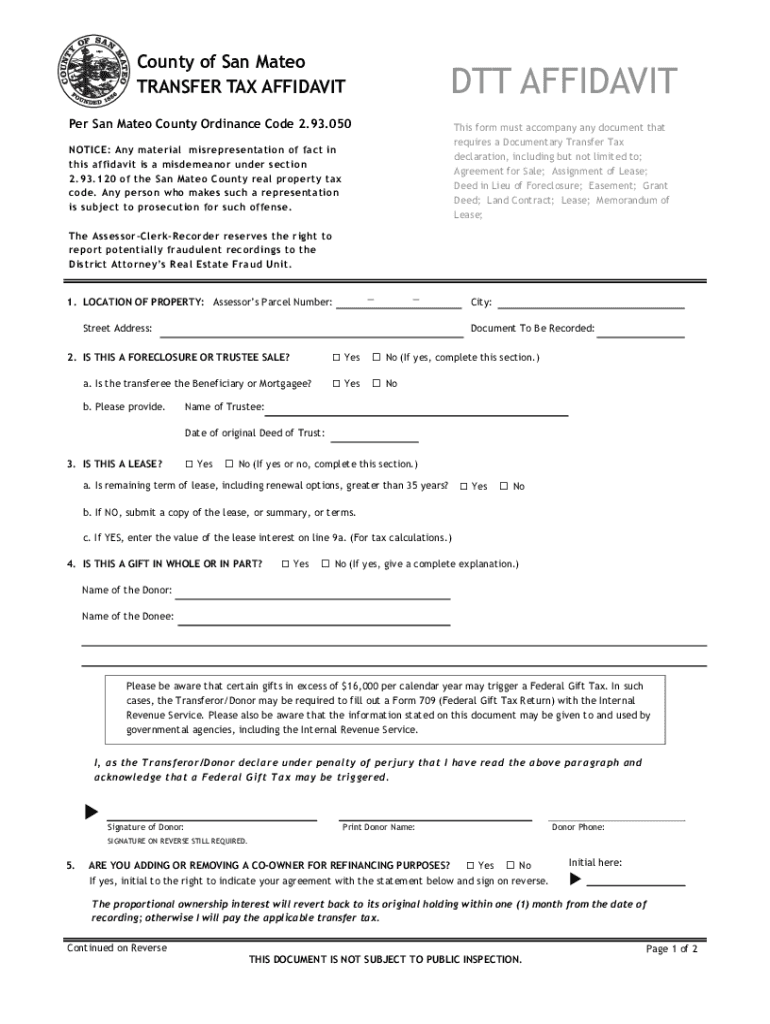

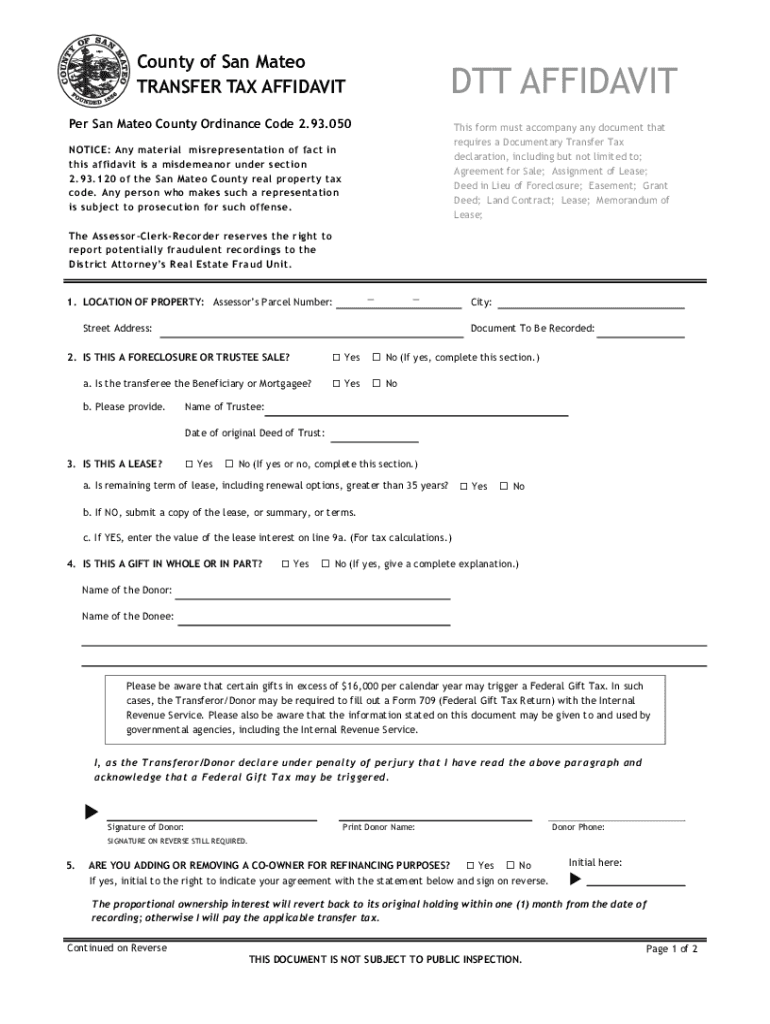

CA DTT Affidavit 2021 free printable template

Get, Create, Make and Sign CA DTT Affidavit

Editing CA DTT Affidavit online

Uncompromising security for your PDF editing and eSignature needs

CA DTT Affidavit Form Versions

How to fill out CA DTT Affidavit

How to fill out CA DTT Affidavit

Who needs CA DTT Affidavit?

Instructions and Help about CA DTT Affidavit

RANDOM A21BREAKING NEWS-ANIVO DENNIS BACK TO OUR BREAKING NEWS — WHERE AN OFFICER- INVOLVED SHOOTING INVESTIGATION CONTINUES IN MERCED COUNTY AFTER A SHOOTOUT BETWEEN DEPUTIES AND A SUSPECT A23STEVENSON OIS-1×1 BOX DENNIS AJ NATO IS LIVE OBSCENE AJ WHAT CAN YOU TELL US AJ NATO THIS HAPPENED AROUND SEVEN P-M ABOUT 4 MILES DOWN HIGHWAY 165 BUT THIS IS AS CLOSE AS ANYONE IS BEING LET TO THE SCENE AJ NATO DEPUTIES SAY IT STARTED WITH AN INVESTIGATION INTO GANG ACTIVITY IN THE PILLAR AREA JUST NORTH OF HERE THE MERCED SHERIFFS STAR TEAM WAS INVESTIGATING GANG ACTIVITY ATTEMPTING TO PULL OVER A MAN SUSPECTED OF HAVING ILLEGAL FIRE ARMS THEY SAY THE SUSPECT DID NOT STOP LEADING THEM ON A SHORT CHASE LASTING ABOUT FOUR MILES WITH SPEEDS REACHING MORE THAN 120 MILES PER HOUR Deputy Daryl Allen Merced County sheriffs office He lost control of the vehicle and at that point he came out of the vehicle and shots were fired between the subject and also the deputies the subject was hit once DENNIS NO DEPUTIES WERE INJURED DENNIS NO DEPUTIES WERE INJURED TONIGHT THE SUSPECT IS NOT BEING IDENTIFIED AND THERE'S NO WORD ON HIS CONDITION AT THIS TIME POLICE SAY HES A KNOWN GANG MEMBER AND WAS IN POSSESSION OF Illegal FIREARMS A27STEVENSON OLIVE AJ NATO INVESTIGATORS ARE NOW REVIEWING ANYBODY CAM VIDEO AND COLLECTING EVIDENCE THE SAY THEY'LL BE WRAPPING UP OUT HERE WITHIN THE HOUR LIVE IN STEVENSON AJ NATO DENNIS AN EMOTIONAL DAY IN MOORE AS MANY GATHERED TO PAY

People Also Ask about

What are the requirements for an Affidavit in South Carolina?

Who pays the transfer tax in South Carolina?

How do you transfer property in South Carolina?

What is Section 12 24 70 in South Carolina?

What is the transfer tax in South Carolina?

What is the transfer tax rate in South Carolina?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CA DTT Affidavit without leaving Google Drive?

How do I execute CA DTT Affidavit online?

How do I edit CA DTT Affidavit straight from my smartphone?

What is CA DTT Affidavit?

Who is required to file CA DTT Affidavit?

How to fill out CA DTT Affidavit?

What is the purpose of CA DTT Affidavit?

What information must be reported on CA DTT Affidavit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.