CA DTT Affidavit 2016 free printable template

Show details

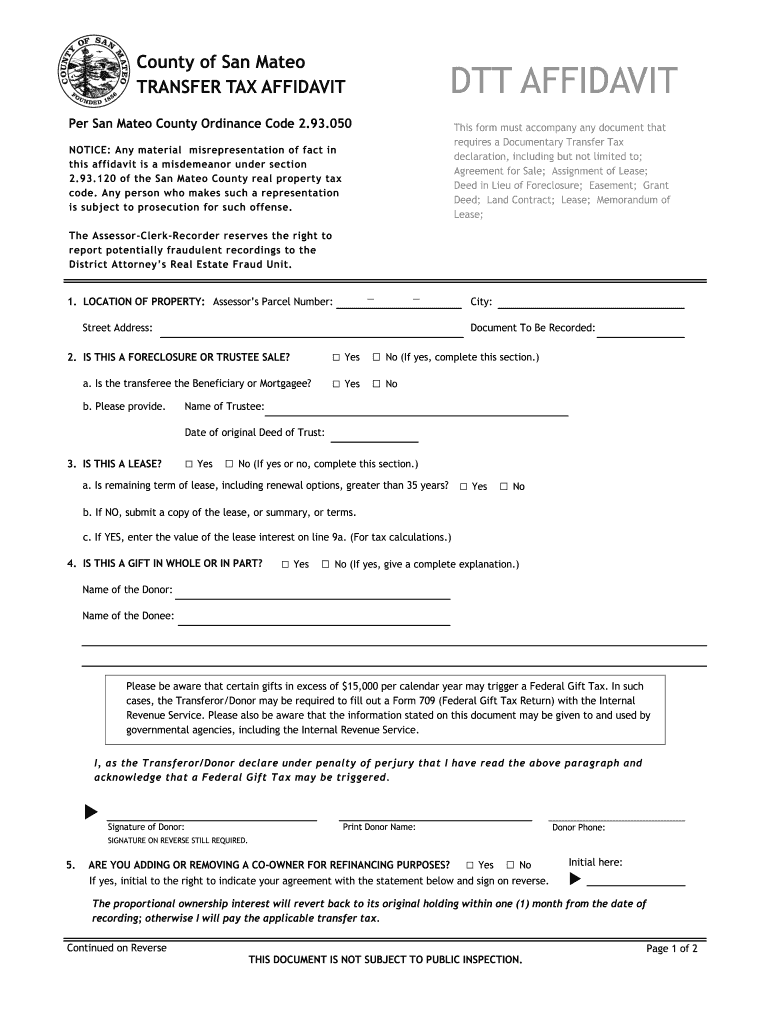

County of San Mateo TRANSFER TAX AFFIDAVIT DTT AFFIDAVIT Per San Mateo County Ordinance Code 2. 93. 050 This form must accompany any document that requires a Documentary Transfer Tax declaration including but not limited to Agreement for Sale Assignment of Lease Deed in Lieu of Foreclosure Easement Grant Deed Land Contract Lease Memorandum of Lease NOTICE Any material misrepresentation of fact in this affidavit is a misdemeanor under section 2. 93. 120 of the San Mateo County real property...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign affidavit transfer tax

Edit your affidavit transfer tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit transfer tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing affidavit transfer tax online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit affidavit transfer tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DTT Affidavit Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out affidavit transfer tax

How to fill out CA DTT Affidavit

01

Obtain the CA DTT Affidavit form from the official website or relevant authority.

02

Read the instructions provided on the form carefully.

03

Fill out your personal information accurately, including your name, address, and contact details.

04

Provide details related to the transaction or agreement for which the affidavit is required.

05

Ensure you include any necessary supporting documents as specified in the instructions.

06

Review the filled form for any errors or omissions.

07

Sign and date the affidavit in the designated section.

08

Submit the completed affidavit to the appropriate authority or keep it for your records as required.

Who needs CA DTT Affidavit?

01

Individuals or entities involved in transactions requiring legal validation.

02

Parties needing to confirm the authenticity of their statements in legal dealings.

03

Anyone involved in tax-related matters that require compliance with Double Taxation Treaties.

04

Entities looking to claim reduced withholding tax rates under treaties.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for an Affidavit in South Carolina?

To be an admissible Affidavit, the acknowledgment must be sworn to be true and correct to the best personal knowledge of the affiant. Furthermore, the affiant must declare that the statements contained in the Affidavit are true and correct under penalties of perjury.

Who pays the transfer tax in South Carolina?

It is customary for the seller of the property to pay all real estate transfer taxes in South Carolina. The transfer taxes are usually due at the time of closing, alongside other fees such as appraisal fees or agent fees.

How do you transfer property in South Carolina?

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

What is Section 12 24 70 in South Carolina?

SECTION 12-24-70. Affidavits. (A)(1) The clerk of court or register of deeds shall require an affidavit showing the value of the realty to be filed with a deed. The affidavit required by this section must be signed by a responsible person connected with the transaction, and the affidavit must state that connection.

What is the transfer tax in South Carolina?

In South Carolina, the formula for the transfer tax, mostly referred to as deed stamps, is $1.85 per $500 of consideration; this is the combined amount for city, county and state taxes. If the consideration is $100,000, the transfer tax is $370, and paid directly to the County Register of Deeds by the closing attorney.

What is the transfer tax rate in South Carolina?

The transfer tax is a percentage of the appraised value of the property or the sale price. In South Carolina, you have a combined state and local transfer tax of 0.37% on the sale price (or $1.85 for every $500).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my affidavit transfer tax directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your affidavit transfer tax and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute affidavit transfer tax online?

pdfFiller makes it easy to finish and sign affidavit transfer tax online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out affidavit transfer tax on an Android device?

Use the pdfFiller Android app to finish your affidavit transfer tax and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is CA DTT Affidavit?

The CA DTT Affidavit is a declaration required by the California Department of Tax and Fee Administration (CDTFA) for taxpayers seeking to claim benefits under a Double Taxation Treaty (DTT) between the U.S. and another country.

Who is required to file CA DTT Affidavit?

Individuals or entities that are residents of a country that has a Double Taxation Treaty with the United States and who are claiming tax benefits under that treaty are required to file a CA DTT Affidavit.

How to fill out CA DTT Affidavit?

To fill out the CA DTT Affidavit, taxpayers should provide their personal information, including name, address, and taxpayer identification number, along with details regarding their residency status and the applicable DTT provisions they wish to claim.

What is the purpose of CA DTT Affidavit?

The purpose of the CA DTT Affidavit is to confirm the taxpayer's eligibility for reduced tax rates or exemption from certain taxes under the provisions of a Double Taxation Treaty.

What information must be reported on CA DTT Affidavit?

The information that must be reported on the CA DTT Affidavit includes the taxpayer's identification details, residency status, the specific treaty provisions being claimed, and any relevant income or gains that qualify for treaty benefits.

Fill out your affidavit transfer tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit Transfer Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.