NY TC TC208 2015 free printable template

Show details

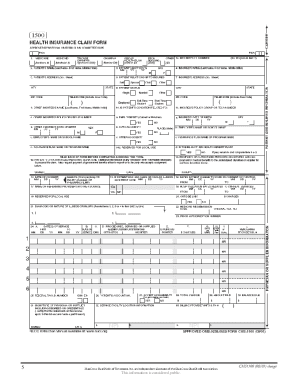

TAX COMMISSION OF THE CITY OF NEW YORK 1 Centre Street Room 1137 New York NY 10007 TC208 INCOME AND EXPENSE SCHEDULE FOR A HOTEL ATTACH TO APPLICATION. TC208 IS NOT VALID IF FILED SEPARATELY. COMPLETE ALL PARTS* ANSWER YES OR NO TO QUESTIONS MARKED. REPORT INCOME AND EXPENSES FOR THE PAST CALENDAR YEAR OR MOST RECENTLY COMPLETED FISCAL YEAR* REPORTING FOR THE PRIOR YEAR IS OPTIONAL* REPORTING EXPENSES OTHER THAN OPERATING EXPENSES AND RENT IS OPTIONAL BUT THESE EXPENSES MUST BE REPORTED ONLY...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY TC TC208

Edit your NY TC TC208 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY TC TC208 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY TC TC208 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY TC TC208. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

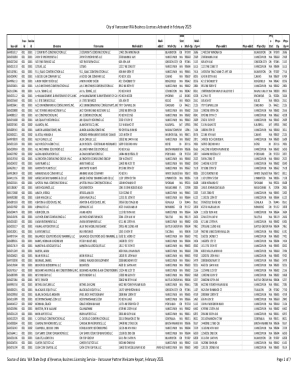

NY TC TC208 Form Versions

Version

Form Popularity

Fillable & printabley

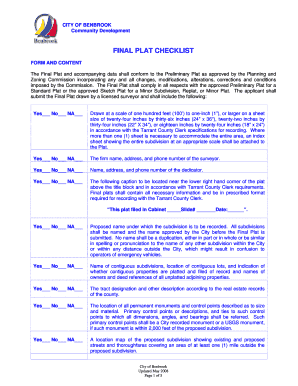

How to fill out NY TC TC208

How to fill out NY TC TC208

01

Obtain a copy of NY TC TC208 form from the New York State Department of Taxation and Finance website.

02

Fill in your name, address, and Social Security Number in the appropriate fields.

03

Indicate the year for which you are filing the form.

04

Provide details of the income and tax credits you are claiming.

05

Double-check all entries for accuracy.

06

Sign and date the form certifying that all information is correct.

07

Submit the form electronically or mail it to the specified address.

Who needs NY TC TC208?

01

Individuals or entities who are required to report income and claim tax credits in New York State.

Fill

form

: Try Risk Free

People Also Ask about

Are commission expenses deductible?

ing to the IRS, sales commissions and related expenses are part of the cost of selling your property. But keep in mind that you can't deduct those fees like you might write off your home mortgage interest. Rather, you would subtract those commission fees from the sales price received from the sale.

What expenses can you deduct from commission income?

As a commission employee, there are a variety of expenses that you can claim on Form T777, Statement of Employment Expenses, when you file your personal income tax return. These costs commonly include accounting fees, legal fees, and costs for business cards, promotional gifts, cellphones, and computers.

How do I deduct commission fees?

You typically pay a commission when you buy, and you pay another commission when you sell. The IRS does not consider investment commissions to be a tax-deductible expense. Instead, the commission becomes part of the investment's cost basis, which still provides you with some tax relief.

How do you write off commission expenses?

Where to Show Deductions on Your Business Tax Return For sole proprietors and single-member LLCs, commissions and fees are totaled on the "Expenses" section of Schedule C. For partnerships and multiple-member LLCs, commissions and fees are totaled in the "Deductions" section of Form 1065.

Are commission expenses tax-deductible?

ing to the IRS, sales commissions and related expenses are part of the cost of selling your property. But keep in mind that you can't deduct those fees like you might write off your home mortgage interest. Rather, you would subtract those commission fees from the sales price received from the sale.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NY TC TC208 online?

pdfFiller has made it simple to fill out and eSign NY TC TC208. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit NY TC TC208 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your NY TC TC208, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit NY TC TC208 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign NY TC TC208 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is NY TC TC208?

NY TC TC208 is a New York State tax credit certificate used to claim certain tax credits for eligible individuals and entities.

Who is required to file NY TC TC208?

Individuals or businesses that qualify for the specific tax credits that NY TC TC208 covers are required to file this form.

How to fill out NY TC TC208?

To fill out NY TC TC208, you need to provide personal or business identification information, detail the tax credits being claimed, and include any supporting documentation as required.

What is the purpose of NY TC TC208?

The purpose of NY TC TC208 is to allow eligible taxpayers to formally request and claim specific tax credits that reduce their overall tax liability.

What information must be reported on NY TC TC208?

The information reported on NY TC TC208 includes taxpayer identification details, the specific tax credits being claimed, supporting details or documentation for those credits, and any other required signatures or declarations.

Fill out your NY TC TC208 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TC tc208 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.