NY TC TC208 2024 free printable template

Show details

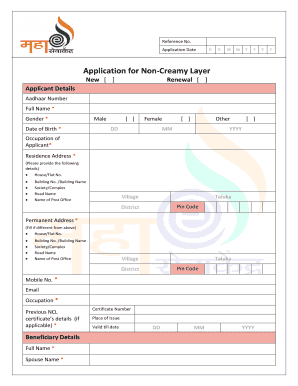

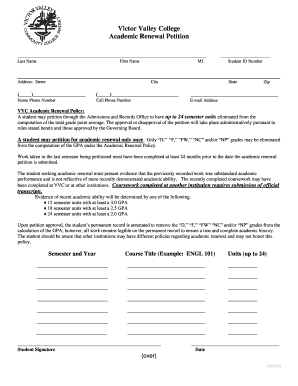

TAX COMMISSION OF THE CITY OF NEW YORK 1 Centre Street Room 2400 New York NY 10007 TC208 2024/25 INCOME AND EXPENSE SCHEDULE FOR A HOTEL ATTACH TO APPLICATION. TC208 IS NOT VALID IF FILED SEPARATELY. COMPLETE ALL PARTS* ANSWER YES OR NO TO QUESTIONS MARKED. REPORT INCOME AND EXPENSES FOR THE PAST CALENDAR YEAR OR MOST RECENTLY COMPLETED FISCAL YEAR* REPORTING FOR THE PRIOR YEAR IS OPTIONAL* REPORTING EXPENSES OTHER THAN OPERATING EXPENSES AND RENT IS OPTIONAL BUT THESE EXPENSES MUST BE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY TC TC208

Edit your NY TC TC208 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY TC TC208 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY TC TC208 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY TC TC208. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TC TC208 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY TC TC208

How to fill out NY TC TC208

01

Obtain Form TC TC208 from the New York State Department of Taxation and Finance website.

02

Fill in your personal information in the designated fields, including your name, address, and identification number.

03

Complete the sections that apply to your tax situation, such as income details and deductions.

04

Ensure that all calculations are accurate and all necessary documents are attached.

05

Review the form for any errors or missing information before submitting.

06

Sign and date the form before submitting it according to the provided instructions.

Who needs NY TC TC208?

01

Individuals or businesses filing specific tax returns in New York State that require the TC TC208 form.

02

Taxpayers looking to report particular credits or deductions related to New York State taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is better form 8917 or 8863?

Form 8917 offers a tax deduction called the Tuition and Fees Deduction, while Form 8863 offers two tax credits. The two tax credits you can claim on Form 8863 are the American Opportunity Tax Credit and the Lifetime Learning Credit. A tax deduction reduces your taxable income, thus lowering your tax bill indirectly.

What is form 8817?

Form 8817 is filed by certain. cooperatives to report their income and deductions by. patronage and nonpatronage sources.

What is form 8917 for 2017?

Use Form 8917 to figure and take the deduction for tuition and fees expenses paid in 2017. This deduction is based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). See Qualified Education Expenses, later, for more information.

What is tax form 8917 used for?

Use Form 8917 to figure and take the deduction for tuition and fees expenses paid.

Which is better American Opportunity credit or tuition and fees deduction?

If you paid for college in the last year, you may be able to claim the American opportunity credit or lifetime learning credit, or the the tuition and fees deduction. The American opportunity credit is generally the most valuable education tax credit, if you qualify.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NY TC TC208?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the NY TC TC208 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for the NY TC TC208 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your NY TC TC208 in minutes.

Can I edit NY TC TC208 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute NY TC TC208 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is NY TC TC208?

NY TC TC208 is a tax form used in New York State for reporting certain transactions related to the sale of property or services that may qualify for specific tax treatments.

Who is required to file NY TC TC208?

Individuals, businesses, or organizations that engage in qualifying transactions subject to New York State tax regulations are required to file NY TC TC208.

How to fill out NY TC TC208?

Filling out NY TC TC208 requires providing relevant transaction details, including the type of transaction, dates, parties involved, and any applicable tax information. Instructions specific to the form must be followed carefully.

What is the purpose of NY TC TC208?

The purpose of NY TC TC208 is to ensure accurate reporting and assessment of tax obligations related to specific transactions in New York State, maintaining compliance with state tax laws.

What information must be reported on NY TC TC208?

Information that must be reported on NY TC TC208 includes transaction details, involved parties' names and addresses, the nature of the transaction, dates, the amount of tax applicable, and any relevant documentation.

Fill out your NY TC TC208 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TC tc208 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.