NY TC TC208 2019 free printable template

Show details

TAX COMMISSION OF THE CITY OF NEW YORK

1 Center Street, Room 2400, New York, NY 10007TC208

2019/20INCOME AND EXPENSE SCHEDULE FOR A HOTELATTACH TO APPLICATION. TC208 IS NOT VALID IF FILED SEPARATELY.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY TC TC208

Edit your NY TC TC208 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY TC TC208 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

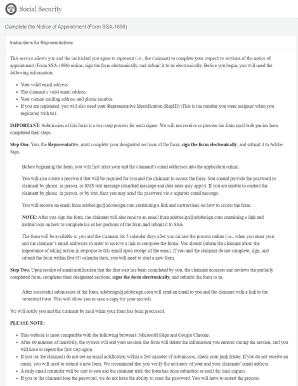

How to edit NY TC TC208 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY TC TC208. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TC TC208 Form Versions

Version

Form Popularity

Fillable & printabley

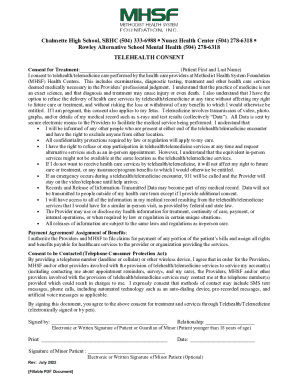

How to fill out NY TC TC208

How to fill out NY TC TC208

01

Obtain the NY TC TC208 form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate the type of tax request you are making.

04

Provide the necessary details regarding your financial situation, including income and deductions.

05

Review the form for accuracy and completeness.

06

Sign and date the form.

07

Submit the form to the appropriate tax authority as instructed.

Who needs NY TC TC208?

01

Individuals or businesses seeking to address or amend tax liabilities in New York.

02

Taxpayers who need to clarify their tax situation or seek a resolution on outstanding tax issues.

Fill

form

: Try Risk Free

People Also Ask about

What is better form 8917 or 8863?

Form 8917 offers a tax deduction called the Tuition and Fees Deduction, while Form 8863 offers two tax credits. The two tax credits you can claim on Form 8863 are the American Opportunity Tax Credit and the Lifetime Learning Credit. A tax deduction reduces your taxable income, thus lowering your tax bill indirectly.

What is form 8817?

Form 8817 is filed by certain. cooperatives to report their income and deductions by. patronage and nonpatronage sources.

What is form 8917 for 2017?

Use Form 8917 to figure and take the deduction for tuition and fees expenses paid in 2017. This deduction is based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). See Qualified Education Expenses, later, for more information.

What is tax form 8917 used for?

Use Form 8917 to figure and take the deduction for tuition and fees expenses paid.

Which is better American Opportunity credit or tuition and fees deduction?

If you paid for college in the last year, you may be able to claim the American opportunity credit or lifetime learning credit, or the the tuition and fees deduction. The American opportunity credit is generally the most valuable education tax credit, if you qualify.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NY TC TC208 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your NY TC TC208, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit NY TC TC208 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute NY TC TC208 from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete NY TC TC208 on an Android device?

Use the pdfFiller app for Android to finish your NY TC TC208. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NY TC TC208?

NY TC TC208 is a form used by taxpayers in New York to report certain tax credits and adjustments relevant to their state tax returns.

Who is required to file NY TC TC208?

Individuals or entities that qualify for specific tax credits or need to make adjustments to their tax obligations in New York are required to file NY TC TC208.

How to fill out NY TC TC208?

To fill out NY TC TC208, provide accurate personal or business information, report any credit claims, and ensure all calculations meet the guidelines set by the New York State Department of Taxation and Finance.

What is the purpose of NY TC TC208?

The purpose of NY TC TC208 is to facilitate the reporting of tax credits and to ensure that taxpayers receive the appropriate deductions and adjustments on their state tax returns.

What information must be reported on NY TC TC208?

Information that must be reported on NY TC TC208 includes taxpayer identification details, the specific tax credits being claimed, relevant calculations, and any necessary supporting documentation.

Fill out your NY TC TC208 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TC tc208 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.