PA NPT 2013 free printable template

Show details

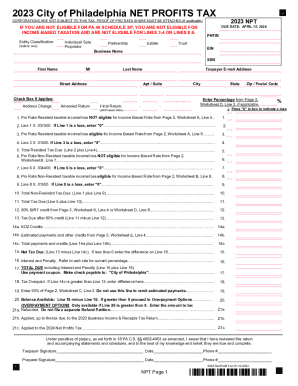

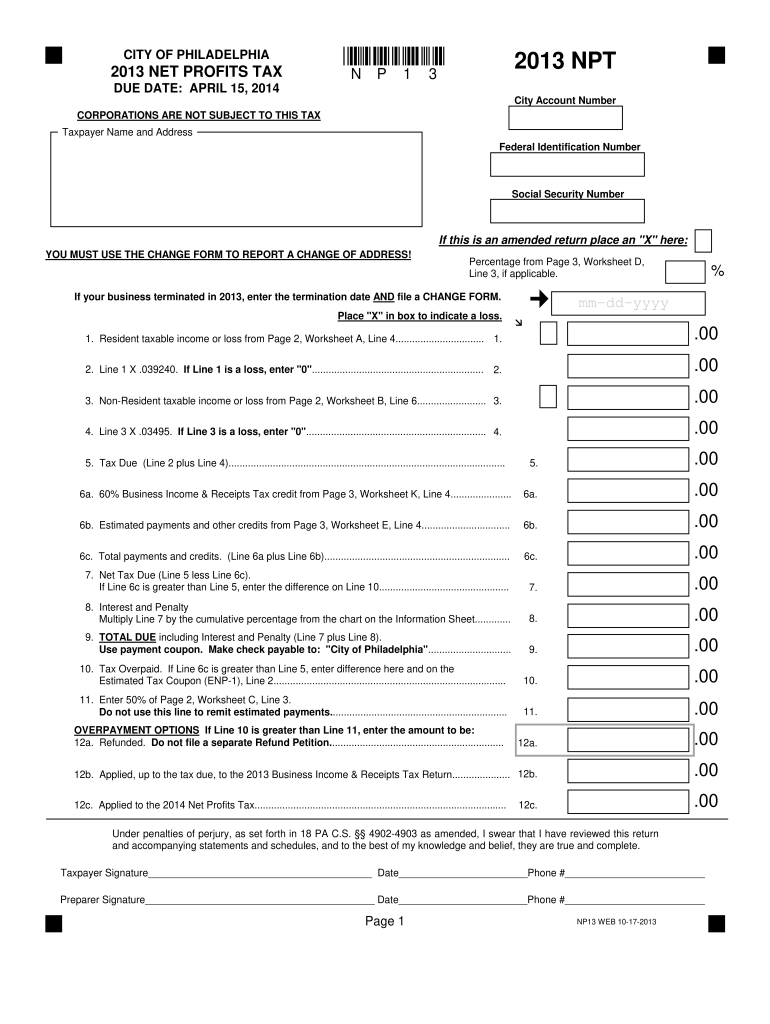

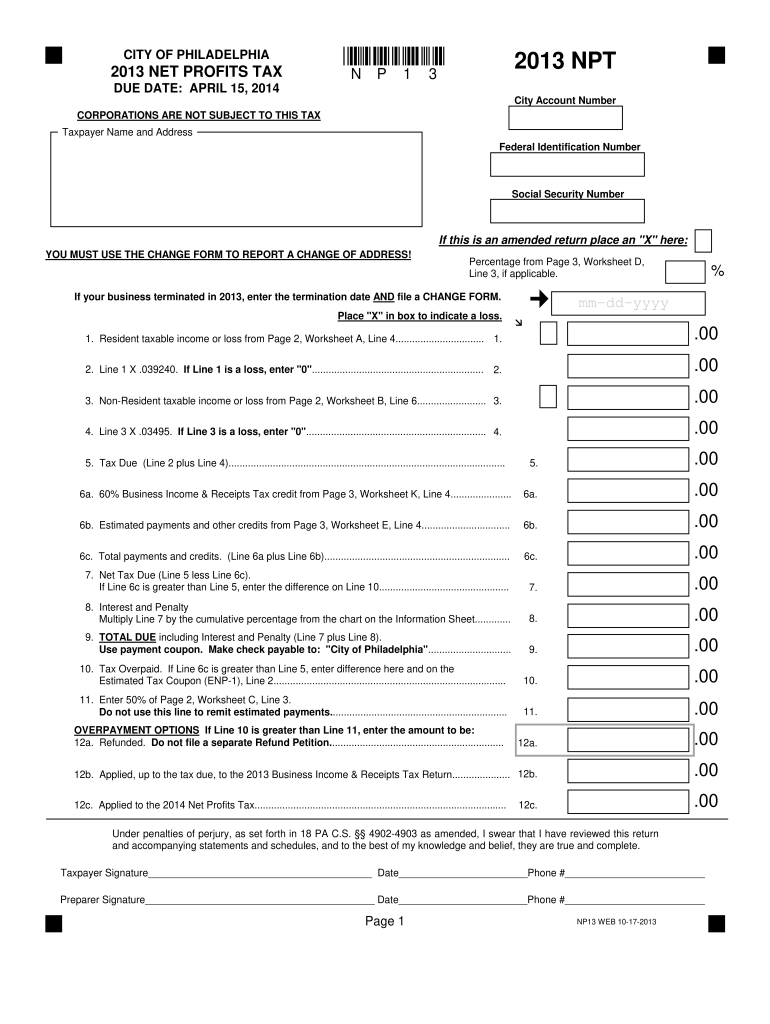

CITY OF PHILADELPHIA 2013 NET PROFITS TAX N P 2013 NPT DUE DATE APRIL 15 2014 City Account Number CORPORATIONS ARE NOT SUBJECT TO THIS TAX Taxpayer Name and Address Federal Identification Number Social Security Number If this is an amended return place an X here YOU MUST USE THE CHANGE FORM TO REPORT A CHANGE OF ADDRESS Percentage from Page 3 Worksheet D Line 3 if applicable. If your business terminated in 2013 enter the termination date AND file a CHANGE FORM. mm-dd-yyyy Place X in box to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA NPT

Edit your PA NPT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA NPT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA NPT online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit PA NPT. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA NPT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA NPT

How to fill out PA NPT

01

Begin by gathering all necessary personal information: name, address, and contact details.

02

Review the instructions for the PA NPT to ensure you understand the requirements.

03

Fill out the application form completely, providing accurate information for each section.

04

Make sure to indicate any relevant details specific to your situation, such as financial information if required.

05

Double-check all entries for accuracy and completeness before submission.

06

Sign and date the application where indicated.

07

Submit the PA NPT form through the appropriate channel, whether online or via mail.

Who needs PA NPT?

01

Individuals seeking support from the Pennsylvania program.

02

Families needing assistance with financial planning or resource allocation.

03

Anyone applying for benefits related to public assistance or welfare programs.

Instructions and Help about PA NPT

Fill

form

: Try Risk Free

People Also Ask about

What is NPT filing?

The NPT file extension is known as Portfolio NetPublish Template which was developed by Extensis.

Who needs to file Philadelphia NPT?

The Net Profits Tax (NPT) is imposed on the net profits from the operation of a trade, business, profession, enterprise, or other activity by: Philadelphia residents, even if their business is conducted outside of Philadelphia. Non-residents who conduct business in Philadelphia.

What is a Philadelphia net profits tax form?

These forms help taxpayers compute and file 2022 Net Profits Tax (NPT). Net Profits Tax applies to Philadelphia residents who are self-employed (even if their business is conducted outside the City), and non-residents who conduct business in Philadelphia.

What is NPT in immigration?

Nunc pro tunc (NPT) is a discretionary remedy by which the USCIS may approve a late filed request to change or extend status, based on facts and extenuating circumstances presented.

What does NPT stand for in taxes?

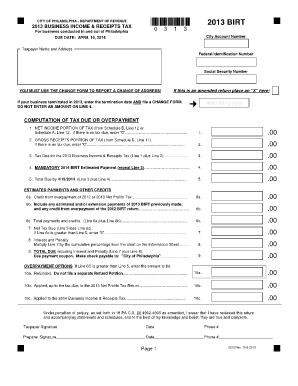

The Business Income & Receipts Tax (BIRT, est. 1985) and the Net Profits Tax (NPT, est.

Where do I pay my NPT tax in Philadelphia?

You can file NPT returns and make payments through the Philadelphia Tax Center.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in PA NPT without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing PA NPT and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I complete PA NPT on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your PA NPT. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out PA NPT on an Android device?

Use the pdfFiller mobile app to complete your PA NPT on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is PA NPT?

PA NPT stands for Pennsylvania Non-Property Transfer. It is a document required for reporting certain non-property transfers in Pennsylvania.

Who is required to file PA NPT?

Individuals or entities involved in non-property transfers in Pennsylvania are required to file the PA NPT.

How to fill out PA NPT?

To fill out the PA NPT, you need to provide specific details about the transfer, including parties involved, nature of transfer, and any applicable tax information. It is often necessary to follow specific guidelines set by the Pennsylvania Department of Revenue.

What is the purpose of PA NPT?

The purpose of the PA NPT is to report non-property transactions for tax purposes and to ensure compliance with Pennsylvania tax laws.

What information must be reported on PA NPT?

Information that must be reported on PA NPT includes the names and addresses of the parties involved, the type of transaction, the date of transfer, and any other relevant details mandated by the state.

Fill out your PA NPT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA NPT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.