PA NPT 2019 free printable template

Show details

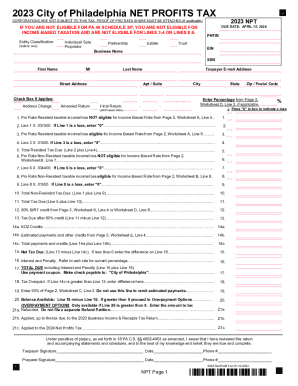

No Staples2019 OPACITY OF PHILADELPHIA2019 NET PROFITS CORPORATIONS ARE NOT SUBJECT TO THIS TAX IF CLAIMING THE INCREASED WAGE RATE PROOF OF PA 40 SCHEDULE SP MUST BE INCLUDED2141DUE DATE: APRIL 15,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA NPT

Edit your PA NPT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA NPT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA NPT online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA NPT. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA NPT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA NPT

How to fill out PA NPT

01

Gather all necessary personal and financial information required for the PA NPT.

02

Obtain the PA NPT form from the relevant Pennsylvania governmental website or office.

03

Fill out the form accurately, ensuring all sections are completed as per the guidelines.

04

Double-check all entered information for correctness to avoid delays in processing.

05

Submit the completed form as per the instructions provided, either online or via mail.

Who needs PA NPT?

01

Individuals or organizations required to report non-profit transactions in Pennsylvania.

02

Non-profit organizations that are filing for tax exemption status.

03

Any businesses or individuals seeking to apply for financial aid or benefits linked to non-profit activities.

Instructions and Help about PA NPT

Fill

form

: Try Risk Free

People Also Ask about

What is NPT filing?

The NPT file extension is known as Portfolio NetPublish Template which was developed by Extensis.

Who needs to file Philadelphia NPT?

The Net Profits Tax (NPT) is imposed on the net profits from the operation of a trade, business, profession, enterprise, or other activity by: Philadelphia residents, even if their business is conducted outside of Philadelphia. Non-residents who conduct business in Philadelphia.

What is a Philadelphia net profits tax form?

These forms help taxpayers compute and file 2022 Net Profits Tax (NPT). Net Profits Tax applies to Philadelphia residents who are self-employed (even if their business is conducted outside the City), and non-residents who conduct business in Philadelphia.

What is NPT in immigration?

Nunc pro tunc (NPT) is a discretionary remedy by which the USCIS may approve a late filed request to change or extend status, based on facts and extenuating circumstances presented.

What does NPT stand for in taxes?

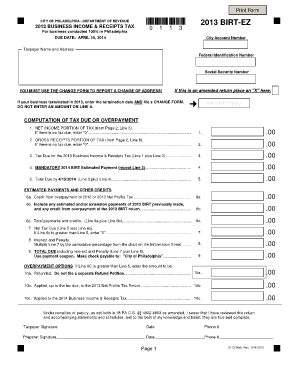

The Business Income & Receipts Tax (BIRT, est. 1985) and the Net Profits Tax (NPT, est.

Where do I pay my NPT tax in Philadelphia?

You can file NPT returns and make payments through the Philadelphia Tax Center.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA NPT for eSignature?

Once you are ready to share your PA NPT, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in PA NPT?

With pdfFiller, the editing process is straightforward. Open your PA NPT in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out PA NPT using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign PA NPT. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is PA NPT?

PA NPT stands for Pennsylvania Nonprofit Corporation Incorporation Filing, which is a form used for annual reports by nonprofit organizations in Pennsylvania.

Who is required to file PA NPT?

Nonprofit corporations registered in Pennsylvania are required to file the PA NPT.

How to fill out PA NPT?

To fill out the PA NPT, organizations must provide details about their operations, financial statements, and compliance with nonprofit regulations in Pennsylvania.

What is the purpose of PA NPT?

The purpose of PA NPT is to ensure transparency and accountability of nonprofit organizations operating in Pennsylvania, allowing the state to monitor their activities.

What information must be reported on PA NPT?

The PA NPT requires reporting of the organization's name, address, EIN, financial information, board members, and a summary of activities.

Fill out your PA NPT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA NPT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.