CO DoR UITR-3 2014 free printable template

Show details

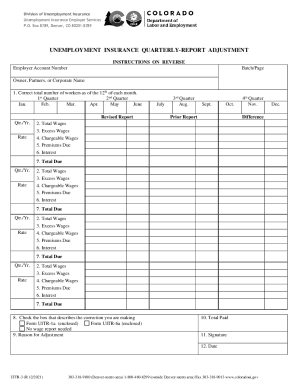

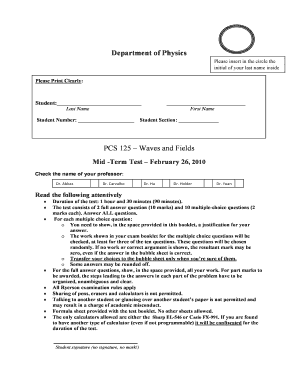

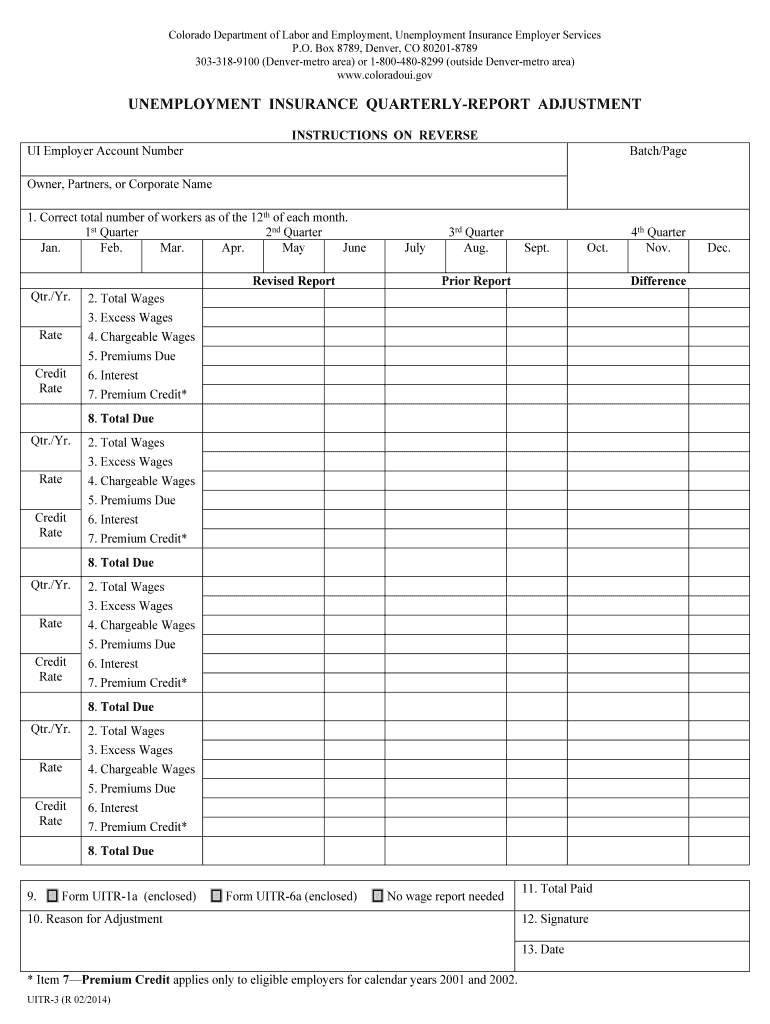

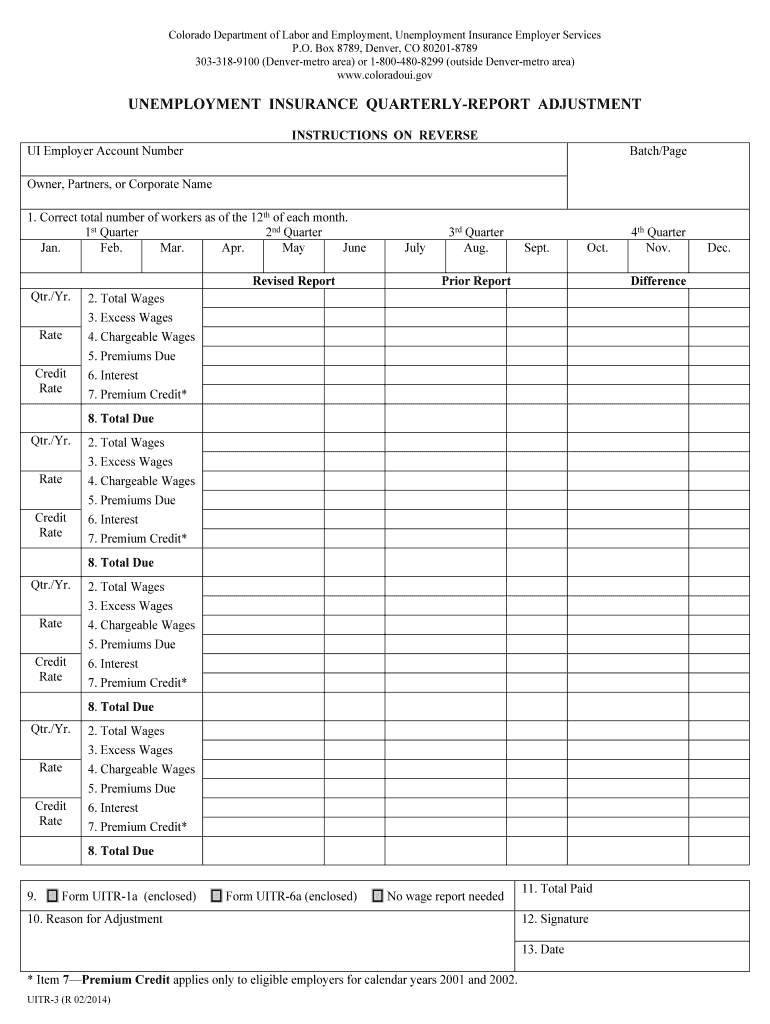

UITR-3 R 02/2014 4th Quarter Nov. Dec. 1. Number of Workers Complete this item if the number of workers reported on the original Form UITR-1 Unemployment Insurance Quarterly Report was incorrect. Rate Credit July 3rd Quarter Aug. Sept. Oct. Prior Report Difference 2. Total Wages 3. Excess Wages 4. Chargeable Wages 5. Premiums Due 6. Interest 7. Premium Credit 8. Total Due Form UITR-1a enclosed No wage report needed 10. Enter the correct total number of workers for each month. accrued but not...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DoR UITR-3

Edit your CO DoR UITR-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DoR UITR-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO DoR UITR-3 online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CO DoR UITR-3. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DoR UITR-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DoR UITR-3

How to fill out CO DoR UITR-3

01

Step 1: Obtain the CO DoR UITR-3 form from the appropriate regulatory authority.

02

Step 2: Review the instructions provided with the form to ensure compliance with requirements.

03

Step 3: Fill out the applicant's information in the designated section, including name and contact details.

04

Step 4: Provide detailed information regarding the specific transaction or purpose for which the form is being filled out.

05

Step 5: Include any additional documentation or supporting materials as required.

06

Step 6: Review the completed form for accuracy and completeness before submission.

07

Step 7: Submit the form to the relevant authority according to their submission guidelines.

Who needs CO DoR UITR-3?

01

Individuals or organizations applying for a specific transaction or operation governed by CO DoR regulations.

02

Businesses seeking compliance with state or federal regulations related to their operations.

03

Entities that are required to report specific data or transactions for oversight by regulatory authorities.

Fill

form

: Try Risk Free

People Also Ask about

What disqualifies you from unemployment in Colorado?

Eligibility guidelines for unemployment include the length of employment, earnings, and the reason you lost your job. Workers may be disqualified from receiving unemployment if they quit a job, were terminated for cause, or didn't meet the time worked or earnings criteria.

How are excess wages calculated in Colorado?

The formula for a computed rate is: Total Premiums Paid in to the account minus Total Benefits Charged to the account divided by the Average Chargeable Payroll. The result of this formula is the percent of excess.

Can you get unemployment for being fired in Colorado?

Am I eligible to draw benefits if I am fired? If you are fired in Colorado, you can typically collect unemployment benefits as long as your employer didn't discharge you for gross misconduct.

What is the maximum unemployment benefit in Colorado?

Colorado provides up to 26 weeks of regular unemployment benefits.

How many hours can you work and still get unemployment in Colorado?

You must be working fewer than 32 hours and earning less than the weekly amount unemployment may pay you to receive unemployment insurance benefits. If your earnings are also reduced, you may be able to receive partial unemployment benefits.

What are the rules for Colorado unemployment?

In order to qualify for benefits, you must: Be unemployed through no fault of your own. Be able, available, and actively seeking work. Have earned $2,500 during your base period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my CO DoR UITR-3 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your CO DoR UITR-3 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the CO DoR UITR-3 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign CO DoR UITR-3. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit CO DoR UITR-3 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign CO DoR UITR-3. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is CO DoR UITR-3?

CO DoR UITR-3 is a form used by organizations to report specific financial and operational information to the relevant authorities in compliance with local regulations.

Who is required to file CO DoR UITR-3?

Entities that fall under the jurisdiction of the local regulations requiring financial disclosures are mandated to file CO DoR UITR-3.

How to fill out CO DoR UITR-3?

To fill out CO DoR UITR-3, organizations need to gather the required financial data, follow the provided guidelines for each section of the form, and ensure all information is accurate and complete before submission.

What is the purpose of CO DoR UITR-3?

The purpose of CO DoR UITR-3 is to ensure transparency and accountability in financial reporting, facilitating regulatory oversight and enabling informed decision-making by stakeholders.

What information must be reported on CO DoR UITR-3?

CO DoR UITR-3 requires reporting of financial performance metrics, details on assets and liabilities, compliance information, and other relevant operational data.

Fill out your CO DoR UITR-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DoR UITR-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.