CO DoR UITR-3 2021 free printable template

Show details

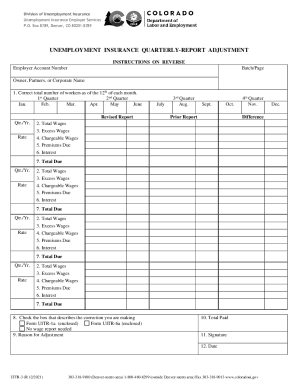

Division of Unemployment Insurance Employer Services P.O. Box 8789, Denver, CO 802018789UNEMPLOYMENT INSURANCE QUARTERLYREPORT ADJUSTMENT INSTRUCTIONS ON REVERSE Employer Account Cumberbatch×Landowner,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DoR UITR-3

Edit your CO DoR UITR-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DoR UITR-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO DoR UITR-3 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CO DoR UITR-3. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DoR UITR-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DoR UITR-3

How to fill out CO DoR UITR-3

01

Obtain the CO DoR UITR-3 form from the official website or relevant authority.

02

Fill in the top section with your personal information, including your name, address, and contact details.

03

Provide the specific incident or transaction details that necessitate the form.

04

Include any required supporting documentation as indicated in the form's instructions.

05

Review the completed form for accuracy and completeness.

06

Submit the form via the designated method, whether online or by mail, as specified by the authority.

Who needs CO DoR UITR-3?

01

Individuals or businesses who have experienced a transaction issue that requires formal reporting.

02

Parties involved in disputes or grievances that need documentation for legal or administrative processes.

03

Anyone required to provide evidence or details of incidents to governmental or regulatory bodies.

Fill

form

: Try Risk Free

People Also Ask about

What disqualifies you from unemployment in Colorado?

Eligibility guidelines for unemployment include the length of employment, earnings, and the reason you lost your job. Workers may be disqualified from receiving unemployment if they quit a job, were terminated for cause, or didn't meet the time worked or earnings criteria.

How are excess wages calculated in Colorado?

The formula for a computed rate is: Total Premiums Paid in to the account minus Total Benefits Charged to the account divided by the Average Chargeable Payroll. The result of this formula is the percent of excess.

Can you get unemployment for being fired in Colorado?

Am I eligible to draw benefits if I am fired? If you are fired in Colorado, you can typically collect unemployment benefits as long as your employer didn't discharge you for gross misconduct.

What is the maximum unemployment benefit in Colorado?

Colorado provides up to 26 weeks of regular unemployment benefits.

How many hours can you work and still get unemployment in Colorado?

You must be working fewer than 32 hours and earning less than the weekly amount unemployment may pay you to receive unemployment insurance benefits. If your earnings are also reduced, you may be able to receive partial unemployment benefits.

What are the rules for Colorado unemployment?

In order to qualify for benefits, you must: Be unemployed through no fault of your own. Be able, available, and actively seeking work. Have earned $2,500 during your base period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CO DoR UITR-3 for eSignature?

Once your CO DoR UITR-3 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete CO DoR UITR-3 online?

pdfFiller has made filling out and eSigning CO DoR UITR-3 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in CO DoR UITR-3?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your CO DoR UITR-3 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is CO DoR UITR-3?

CO DoR UITR-3 is a form used for reporting certain financial transactions related to tax obligations in a jurisdiction.

Who is required to file CO DoR UITR-3?

Entities and individuals who meet specific financial thresholds or engage in certain activities outlined by the tax authority are required to file the CO DoR UITR-3.

How to fill out CO DoR UITR-3?

The CO DoR UITR-3 form should be filled out by providing accurate financial data, completing all sections as per the instructions, and ensuring that all necessary documentation is attached.

What is the purpose of CO DoR UITR-3?

The purpose of CO DoR UITR-3 is to provide a transparent record of financial activities for tax compliance and oversight by the relevant authorities.

What information must be reported on CO DoR UITR-3?

The CO DoR UITR-3 must report information including but not limited to financial transactions, entity identification, tax identification numbers, and supporting details relevant to the reported transactions.

Fill out your CO DoR UITR-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DoR UITR-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.