CO DoR UITR-3 2003 free printable template

Show details

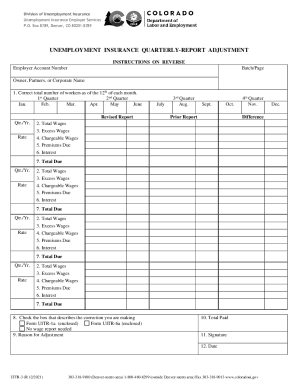

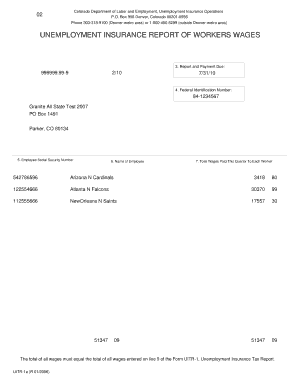

Colorado Department of Labor and Employment Unemployment Insurance Operations, Tax P.O. Box 8789, Denver, CO 80201-8789 UNEMPLOYMENT INSURANCE TAX REPORT ADJUSTMENT INSTRUCTIONS ON REVERSE Employer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DoR UITR-3

Edit your CO DoR UITR-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DoR UITR-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CO DoR UITR-3 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CO DoR UITR-3. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DoR UITR-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DoR UITR-3

How to fill out CO DoR UITR-3

01

Obtain the CO DoR UITR-3 form from the appropriate administrative website or office.

02

Fill out the applicant's information in the designated fields, including name, address, and contact details.

03

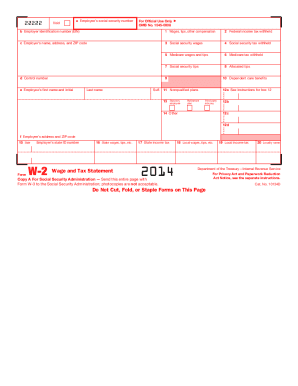

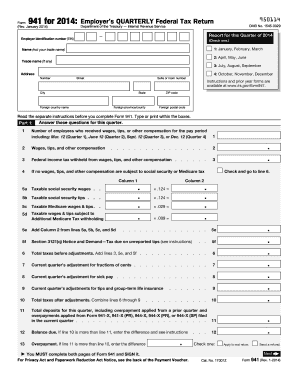

Provide the necessary identification numbers, such as Social Security Number or tax ID.

04

Describe the purpose of the form in the relevant section, specifying any relevant details.

05

Review any specific requirements or attachments needed, such as supporting documentation.

06

Sign and date the form where indicated to confirm the accuracy of the information provided.

07

Submit the completed form to the designated office or department as instructed.

Who needs CO DoR UITR-3?

01

Individuals or businesses needing to report information as required by Colorado's regulatory framework.

02

Taxpayers fulfilling state reporting obligations.

03

Entities engaged in activities that are regulated by the state and require formal documentation.

Fill

form

: Try Risk Free

People Also Ask about

What disqualifies you from unemployment in Colorado?

Eligibility guidelines for unemployment include the length of employment, earnings, and the reason you lost your job. Workers may be disqualified from receiving unemployment if they quit a job, were terminated for cause, or didn't meet the time worked or earnings criteria.

How are excess wages calculated in Colorado?

The formula for a computed rate is: Total Premiums Paid in to the account minus Total Benefits Charged to the account divided by the Average Chargeable Payroll. The result of this formula is the percent of excess.

Can you get unemployment for being fired in Colorado?

Am I eligible to draw benefits if I am fired? If you are fired in Colorado, you can typically collect unemployment benefits as long as your employer didn't discharge you for gross misconduct.

What is the maximum unemployment benefit in Colorado?

Colorado provides up to 26 weeks of regular unemployment benefits.

How many hours can you work and still get unemployment in Colorado?

You must be working fewer than 32 hours and earning less than the weekly amount unemployment may pay you to receive unemployment insurance benefits. If your earnings are also reduced, you may be able to receive partial unemployment benefits.

What are the rules for Colorado unemployment?

In order to qualify for benefits, you must: Be unemployed through no fault of your own. Be able, available, and actively seeking work. Have earned $2,500 during your base period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CO DoR UITR-3 online?

pdfFiller has made it easy to fill out and sign CO DoR UITR-3. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the CO DoR UITR-3 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your CO DoR UITR-3 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit CO DoR UITR-3 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share CO DoR UITR-3 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is CO DoR UITR-3?

CO DoR UITR-3 is a reporting form used by certain entities to disclose specific information as required by the Department of Revenue.

Who is required to file CO DoR UITR-3?

Entities that meet specific criteria as defined by the Department of Revenue, typically those involved in particular types of transactions or business activities, are required to file CO DoR UITR-3.

How to fill out CO DoR UITR-3?

To fill out CO DoR UITR-3, individuals or entities should carefully follow the instructions provided with the form, ensuring that all required fields are completed accurately.

What is the purpose of CO DoR UITR-3?

The purpose of CO DoR UITR-3 is to ensure compliance with revenue collection regulations and to provide transparency in financial reporting by required entities.

What information must be reported on CO DoR UITR-3?

CO DoR UITR-3 requires reporting of specific financial information, including transaction details, entity identification information, and any other data mandated by the Department of Revenue.

Fill out your CO DoR UITR-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DoR UITR-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.