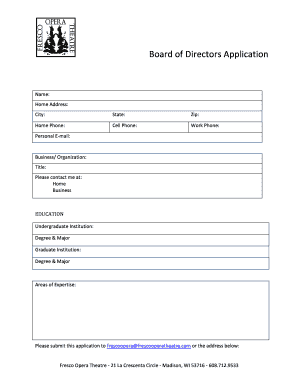

AR Tax Tables 2014 free printable template

Show details

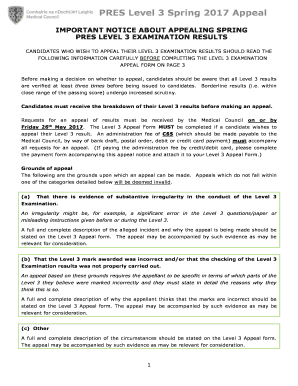

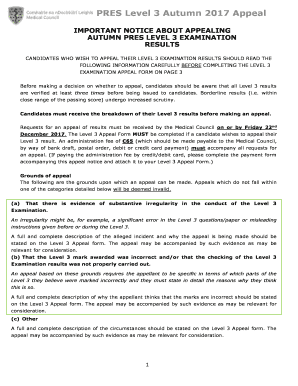

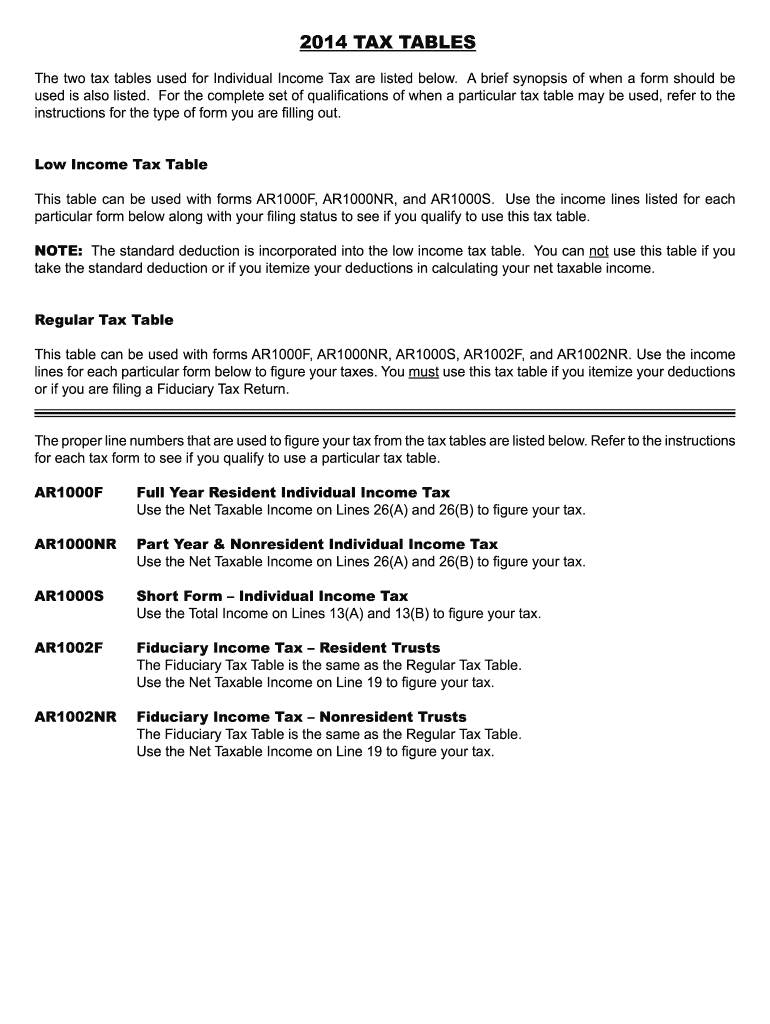

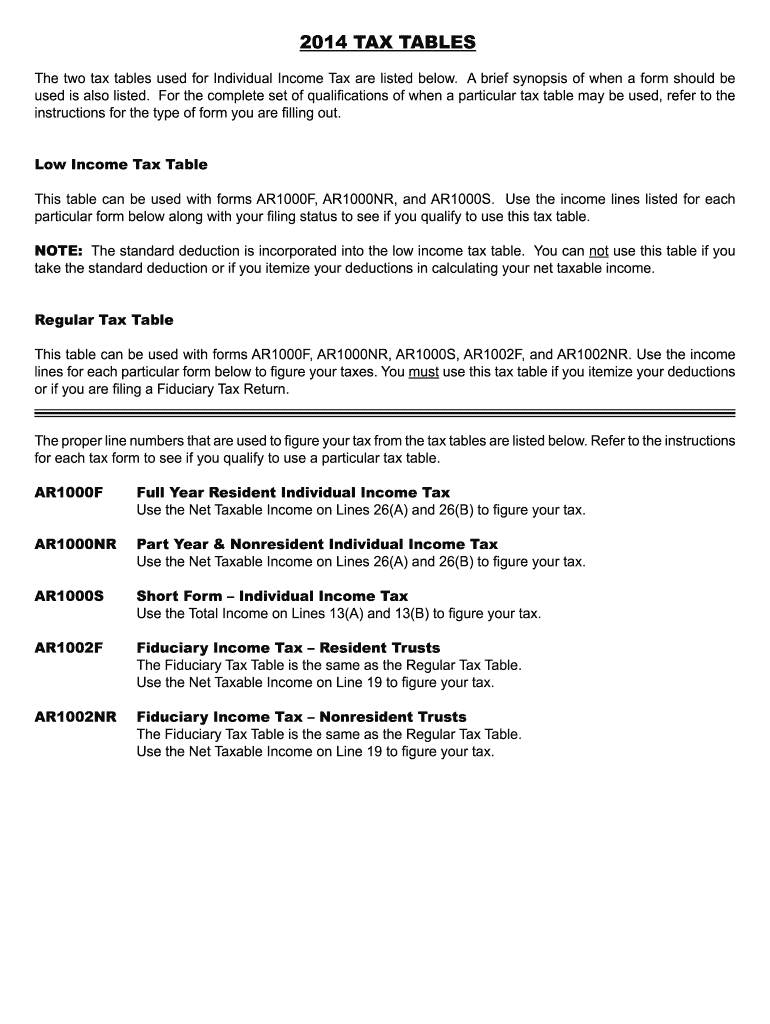

2014 Low Income Tax Tables QUALIFICATIONS Your total income from all sources regardless of whether the income is taxable to Arkansas must fall within the limits of the appropriate table based on your filing status. 2014 TAX TABLES The two tax tables used for Individual Income Tax are listed below. A brief synopsis of when a form should be used is also listed* For the complete set of qualifications of when a particular tax table may be used refer to the instructions for the type of form you...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR Tax Tables

Edit your AR Tax Tables form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR Tax Tables form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR Tax Tables online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AR Tax Tables. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR Tax Tables Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR Tax Tables

How to fill out AR Tax Tables

01

Gather all necessary financial documents that pertain to the tax year in question.

02

Locate the AR Tax Tables provided by your state’s revenue department.

03

Determine your filing status (single, married, etc.) as this will affect the tax rate.

04

Identify your income range from your total earnings over the tax year.

05

Find the corresponding tax rates or brackets in the tables based on your filing status and income range.

06

Calculate the tax owed by applying the appropriate rates to your taxable income.

07

Complete any additional required forms or schedules related to your tax filing.

08

Review your calculations and ensure all information is accurate before submitting your tax return.

Who needs AR Tax Tables?

01

Individuals who reside in Arkansas and earn income.

02

Business owners operating within Arkansas.

03

Tax preparers and accountants handling AR tax filings for clients.

04

Any entity required to comply with Arkansas tax laws.

Fill

form

: Try Risk Free

People Also Ask about

Does Arkansas have a state income tax form?

Arkansas State Income Tax Forms for the current Tax Year can be e-Filed in conjunction with a IRS Income Tax Return. Details on how to only prepare and print an Arkansas Tax Return. Prior back taxes forms can no longer be e-Filed.

Does Arkansas have a state tax return?

State Income Tax Filing Requirements To claim any refund due, you must file an Arkansas income tax return. Residents of Ar- kansas must complete Form AR1000. Nonresidents and Part-Year Residents must complete Form AR1000NR.

Where to find Arkansas tax forms?

State Tax Forms In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock) Email: Individual.Income@rev.state.ar.us.

What is form AR1000NR?

2022 AR1000NR. ARKANSAS INDIVIDUAL. INCOME TAX RETURN. Nonresident and Part Year Resident.

What is the Arkansas state tax form called?

AR1000F Full Year Resident Individual Income Tax Return (Instructions) AR1000NR Part Year or Non-Resident Individual Income Tax Return (Instructions)

What is form AR1000RC5?

The AR1000RC5 form is used by families to receive a $500 tax credit for individuals with developmental disabilities. It is submitted with your state income taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AR Tax Tables?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the AR Tax Tables. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my AR Tax Tables in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your AR Tax Tables and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit AR Tax Tables on an iOS device?

Create, modify, and share AR Tax Tables using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is AR Tax Tables?

AR Tax Tables refer to the tables used to calculate the amount of state income tax that individuals need to withhold from their paychecks in Arkansas.

Who is required to file AR Tax Tables?

Employers in Arkansas are required to file AR Tax Tables to determine and report the correct withholding amount for their employees based on their income.

How to fill out AR Tax Tables?

To fill out AR Tax Tables, employers need to refer to the state's provided tables and instructions, considering the employee's income level, filing status, and any deductions or exemptions.

What is the purpose of AR Tax Tables?

The purpose of AR Tax Tables is to ensure proper withholding of state income tax from employees' wages, facilitating compliance with Arkansas tax laws.

What information must be reported on AR Tax Tables?

The information that must be reported on AR Tax Tables includes employee wages, withholding amounts, filing status, and any exemptions claimed by the employee.

Fill out your AR Tax Tables online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR Tax Tables is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.