AR Tax Tables 2016 free printable template

Show details

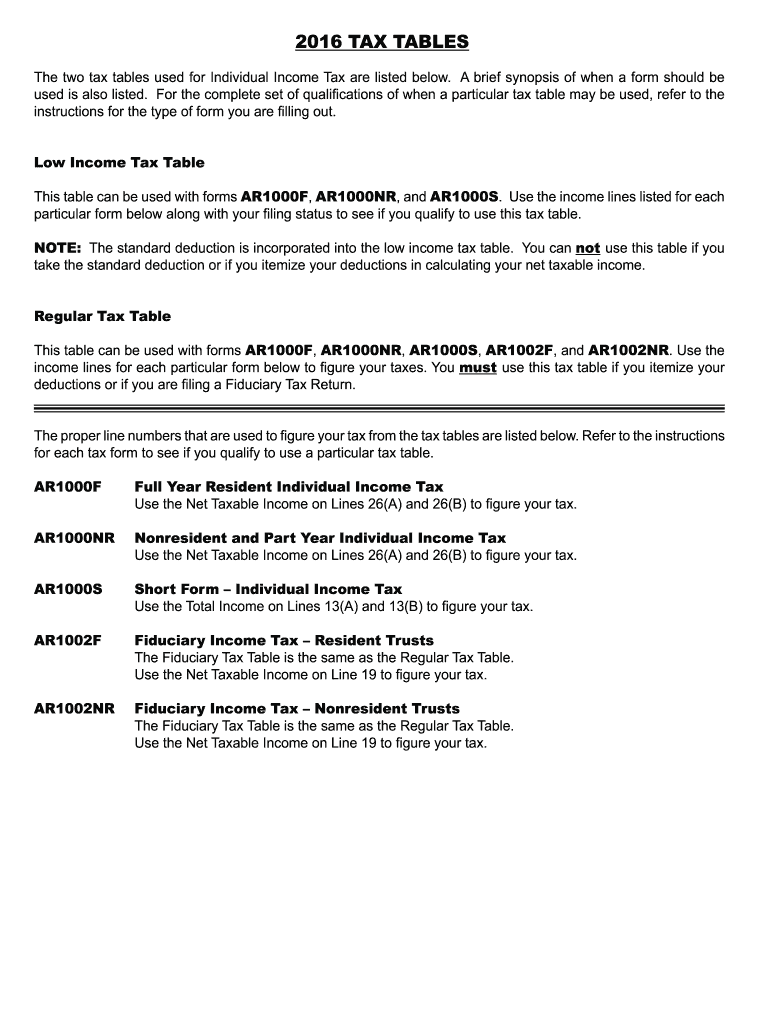

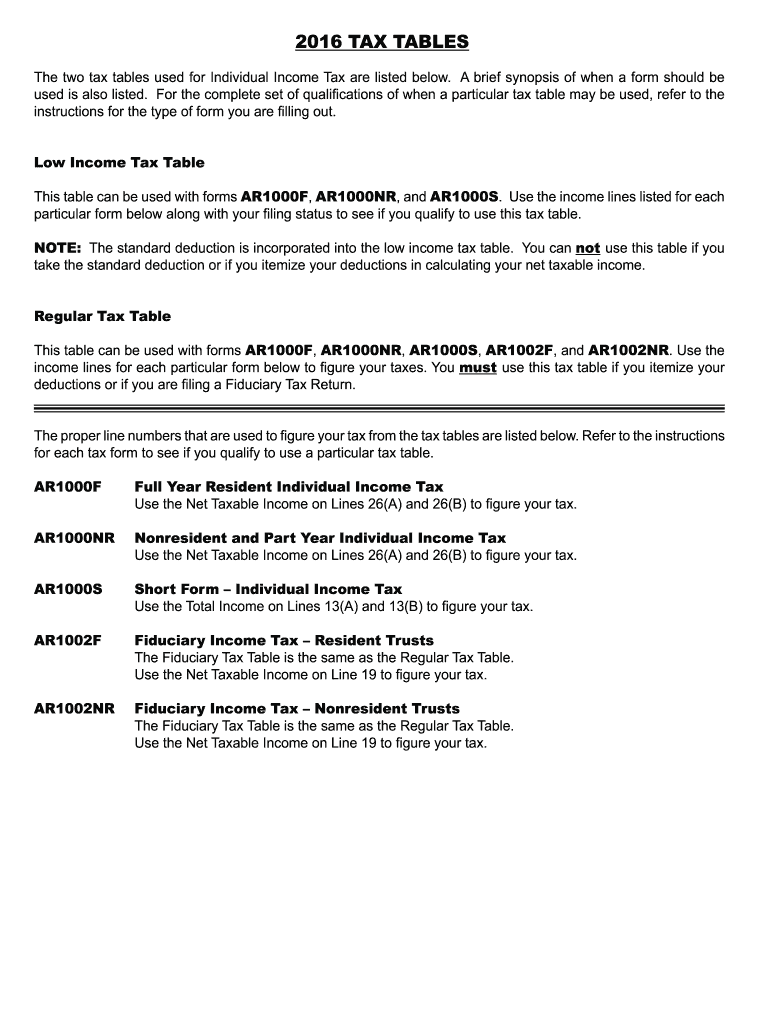

2016 TAX TABLES The two tax tables used for Individual Income Tax are listed below. A brief synopsis of when a form should be VH LV DOOR SOLVING)RU BKH FRPSOHWH VH WRI TXDOLFDWLRQV RI ZKH D SDUWLFXODU

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR Tax Tables

Edit your AR Tax Tables form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR Tax Tables form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AR Tax Tables online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AR Tax Tables. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR Tax Tables Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR Tax Tables

How to fill out AR Tax Tables

01

Start by gathering your financial documents, including income statements and expense records.

02

Obtain the current AR Tax Tables from the official Arkansas Department of Finance and Administration website or your accountant.

03

Identify your filing status (single, married, etc.) as this will determine which section of the tax table to use.

04

Locate your taxable income on your financial documents.

05

Find the corresponding range in the AR Tax Tables that matches your taxable income.

06

Follow the calculation guidelines provided with the tables to compute your tax liability.

07

If applicable, apply any tax credits or deductions you qualify for according to AR tax laws.

08

Complete the tax forms that require this information and double-check your calculations.

09

Submit your completed tax forms by the state deadline.

Who needs AR Tax Tables?

01

Residents of Arkansas who have earned income and are required to file a state income tax return.

02

Businesses operating in Arkansas that need to report income tax.

03

Tax professionals helping clients prepare AR tax returns.

04

Individuals seeking to understand their tax obligations in relation to AR tax laws.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get Arkansas state tax forms?

State Tax Forms In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock) Email: Individual.Income@rev.state.ar.us.

What is form AR1000RC5?

The AR1000RC5 form is used by families to receive a $500 tax credit for individuals with developmental disabilities. It is submitted with your state income taxes.

What is form AR1000NR?

2022 AR1000NR. ARKANSAS INDIVIDUAL. INCOME TAX RETURN. Nonresident and Part Year Resident.

What is the extension form for Arkansas withholding?

If you want to file specifically for a State of Arkansas Extension, you must file Arkansas form AR1055. This form must be postmarked on or before April 15.

What is an AR941A form?

File Form AR941A. File AR941, Employers Annual Report for Income Tax Withheld and pay any tax due for the previous calendar year.

What is AR941PT?

ar941pt. AR941PT Pass-Through Entity Withholding Report INSTRUCTIONS This form is used to report the tax withheld on nonresident members of a pass through entity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AR Tax Tables from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including AR Tax Tables, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send AR Tax Tables to be eSigned by others?

When your AR Tax Tables is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete AR Tax Tables online?

With pdfFiller, you may easily complete and sign AR Tax Tables online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is AR Tax Tables?

AR Tax Tables are official documents used for reporting tax information and determining tax liabilities in the state of Arkansas.

Who is required to file AR Tax Tables?

Individuals and businesses that have income subject to Arkansas state tax are required to file AR Tax Tables.

How to fill out AR Tax Tables?

To fill out AR Tax Tables, you need to provide your personal or business information, report your income and deductions, and follow the instructions provided for the tax year.

What is the purpose of AR Tax Tables?

The purpose of AR Tax Tables is to provide a standardized method for calculating state income tax liabilities and ensuring compliance with Arkansas tax laws.

What information must be reported on AR Tax Tables?

The information reported on AR Tax Tables includes total income, deductions, exemptions, and any applicable tax credits.

Fill out your AR Tax Tables online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR Tax Tables is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.