AR Tax Tables 2021 free printable template

Show details

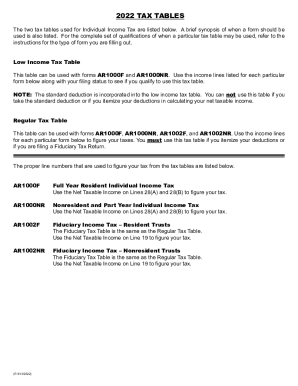

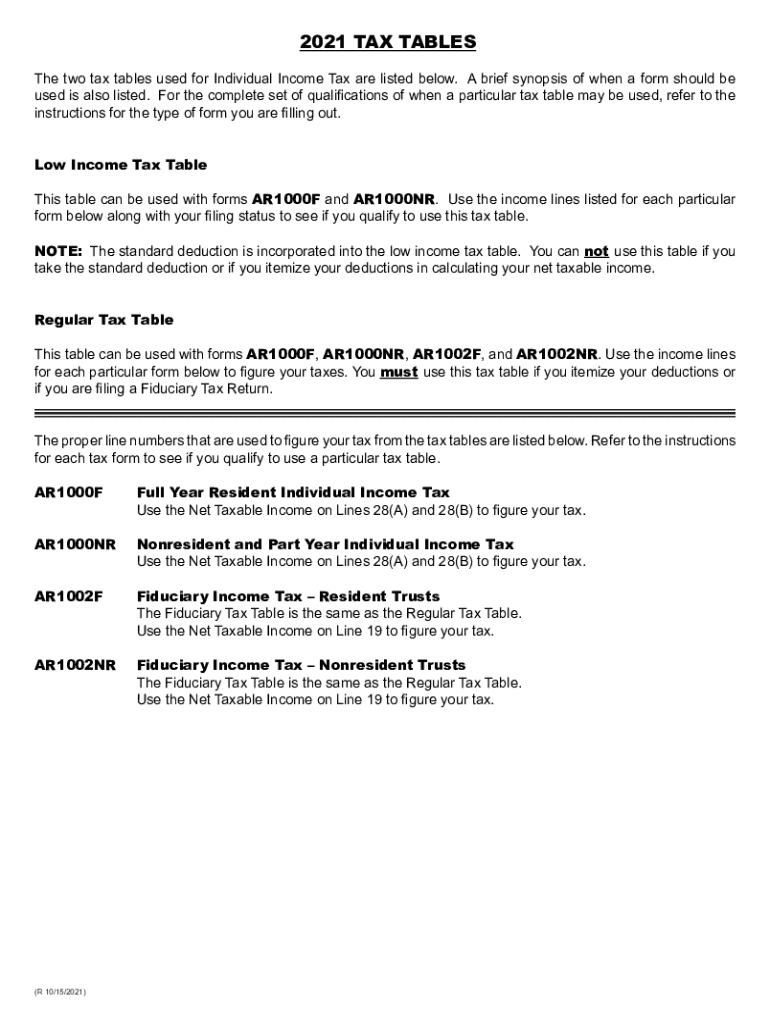

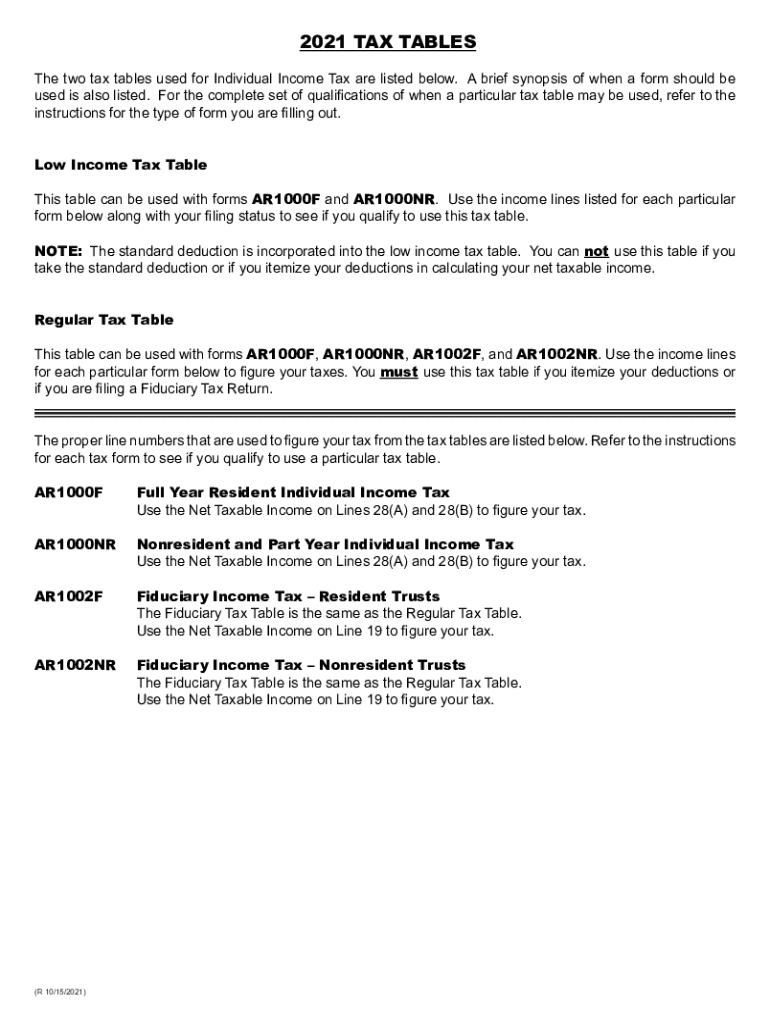

2021 TAX TABLES The two tax tables used for Individual Income Tax are listed below. A brief synopsis of when a form should be used is also listed. For the complete set of qualifications of when a

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR Tax Tables

Edit your AR Tax Tables form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR Tax Tables form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR Tax Tables online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AR Tax Tables. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR Tax Tables Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR Tax Tables

How to fill out AR Tax Tables

01

Obtain the current AR Tax Tables from the official state tax website or your tax professional.

02

Gather all necessary financial documents, including income statements and deduction records.

03

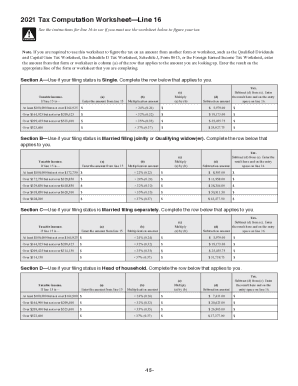

Locate the tax year for which you are filling out the tables.

04

Identify the correct tax brackets that apply based on your filing status (single, married, etc.).

05

Calculate your total taxable income by adding all sources of income and subtracting deductions.

06

Refer to the AR Tax Tables to find the corresponding tax amount for your taxable income.

07

Ensure that all calculations are accurate and clearly documented.

08

Complete any additional forms required along with the AR Tax Tables.

Who needs AR Tax Tables?

01

Individuals filing personal income tax returns in Arkansas.

02

Businesses operating in Arkansas that need to report and pay state income tax.

03

Tax professionals assisting clients with tax preparation in Arkansas.

04

Anyone needing to understand their tax liabilities for a specific tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I register for an Arkansas withholding account?

To register online, use the Arkansas Taxpayer Access Point (ATAP). If you register online you should receive your account number immediately. To register on paper, use Form AR-1R, Combined Business Tax Registration Form. Blank forms are available from the DFR website.

Does Arkansas have a state income tax form?

Arkansas State Income Tax Forms for the current Tax Year can be e-Filed in conjunction with a IRS Income Tax Return. Details on how to only prepare and print an Arkansas Tax Return. Prior back taxes forms can no longer be e-Filed.

Where to get Arkansas State Income Tax forms?

State Tax Forms In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock) Email: Individual.Income@rev.state.ar.us.

What is an AR941A form?

Annual filers must file form AR941A (Employer's Annual Withholding Report) and send remittance on or before January 31 following the close of the reporting year. A zero payment voucher is required for any annual filer where no taxes were withheld.

What is the AR1000F form?

AR1000F, Page 1 (R 7/21/2022) 2022 AR1000F. ARKANSAS INDIVIDUAL. INCOME TAX RETURN. Full Year Resident.

How much taxes are held out of a paycheck in Arkansas?

For federal income taxes and FICA taxes, employers withhold these from each of your paychecks. That money goes to the IRS, who then puts it toward your annual income taxes, Medicare and Social Security.Income Tax Brackets. All FilersArkansas Taxable IncomeRate$0 - $4,3002.00%$4,300 - $8,5004.00%$8,500+5.50%

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AR Tax Tables from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including AR Tax Tables, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit AR Tax Tables straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing AR Tax Tables, you need to install and log in to the app.

How do I edit AR Tax Tables on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as AR Tax Tables. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is AR Tax Tables?

AR Tax Tables refer to the tables used in Arkansas for calculating income tax withholding for employees based on their wages and filing status.

Who is required to file AR Tax Tables?

Employers in Arkansas who withhold income tax from employee wages are required to utilize and file AR Tax Tables.

How to fill out AR Tax Tables?

To fill out AR Tax Tables, employers must first determine the employee's filing status and wages, then refer to the appropriate tax table to calculate the withholding amount needed for each pay period.

What is the purpose of AR Tax Tables?

The purpose of AR Tax Tables is to provide a systematic method for employers to determine the correct amount of state income tax to withhold from employees' paychecks.

What information must be reported on AR Tax Tables?

AR Tax Tables should report the employee's gross pay, filing status, and the calculated withholding amount based on the applicable tax rates.

Fill out your AR Tax Tables online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR Tax Tables is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.