MO MO-PTC Chart 2013 free printable template

Show details

Print Form Reset Calculate DO NOT file this claim if you are going to file a Missouri income tax return! See the instructions. Do automatic calculations AMENDED CLAIM Don't do any calculations 2013

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2013 form mo-ptc property

Edit your 2013 form mo-ptc property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 form mo-ptc property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2013 form mo-ptc property online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2013 form mo-ptc property. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MO-PTC Chart Form Versions

Version

Form Popularity

Fillable & printabley

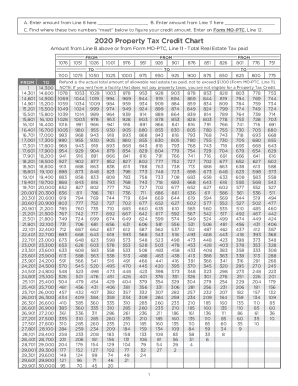

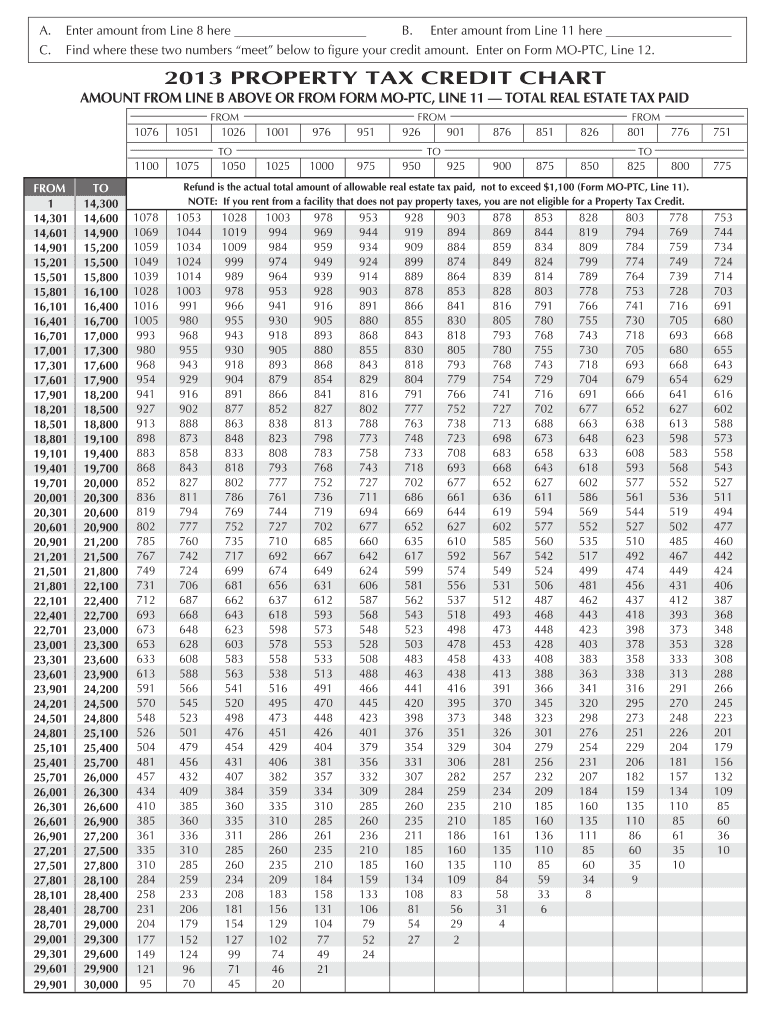

How to fill out 2013 form mo-ptc property

How to fill out MO MO-PTC Chart

01

Begin with the identification section: Enter the name of the taxpayer and the tax year.

02

Fill in the table of income: List all sources of income and the corresponding amounts.

03

Document adjustments: Include any adjustments to income, such as deductions or credits.

04

Calculate total income: Combine all sources and adjust for any deductions.

05

Complete the tax calculation section: Use the applicable rates to determine the tax owed based on the total income.

06

Finalize the chart: Review all entries for accuracy and completeness before submission.

Who needs MO MO-PTC Chart?

01

Taxpayers who earn income in Missouri and are subject to state taxes.

02

Individuals claiming certain credits or deductions applicable to their income.

03

Accountants or tax preparers assisting clients with their state tax filings.

04

Anyone seeking to track their taxable income and associated tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

What is the statute of limitations on tax debt in Missouri?

Statute of Limitations on Missouri Tax Liabilities The state has three years to assess additional tax. The clock starts on the later of the date you filed the return or its due date.

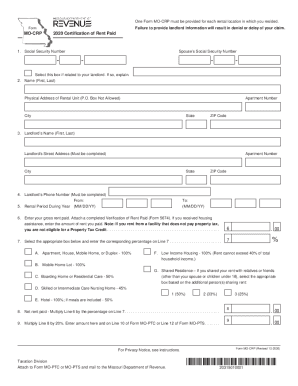

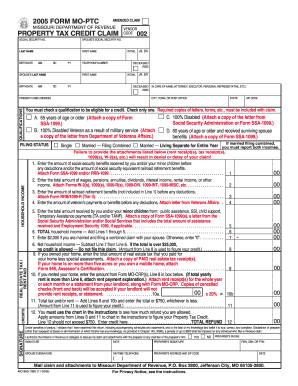

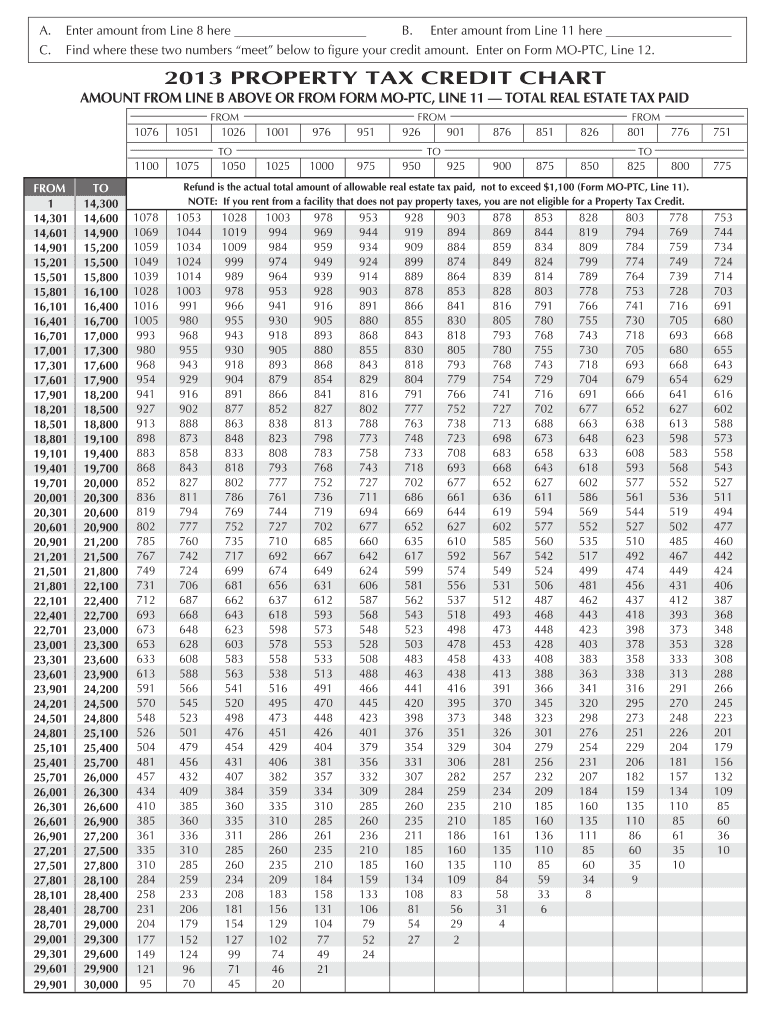

How do I claim property tax credits in Missouri?

How do I file for the credit? If you are required to file a Missouri Individual Income Tax Return, you must use Form MO-1040 with a Property Tax Schedule (MO-PTS) attached. If you are not required to file a Missouri Individual Income Tax Return, then you may file the Missouri Property Tax Credit Claim (MO-PTC).

What is the difference between Mo PTC and Mo PTS?

If you are required to file a Missouri Individual Income Tax Return, you must use Form MO-1040 or Form MO-1040P with Property Tax Schedule (MO-PTS) attached. If you are not required to file a Missouri Individual Income Tax Return, then you may file the Missouri Property Tax Credit Claim (MO-PTC).

How far back can I file a Mo PTC?

$29,200 if rented or owned less than full year; $34,000 if owned & occupied full year. The MO-PTC is generally filed with the income tax return, but may be filed at any time during the year for up to three years back. Example: In 2022 you may file for 2019, 2020 & 2021.

What is the Missouri PTC refund?

The Missouri Property Tax Credit Claim gives back a portion of the rent or real estate tax paid for that year by persons 65 and older, or persons 18-64 that receive SSI, SSD, or Veterans Disability. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

What is a mo ptc form?

To claim real estate taxes for a prior year, you must file a claim for that year. Example: If you paid your 2021 real estate tax in calendar year 2022, you must file a 2021 Property Tax Credit Claim (Form MO-PTC).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2013 form mo-ptc property without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your 2013 form mo-ptc property into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete 2013 form mo-ptc property online?

Easy online 2013 form mo-ptc property completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit 2013 form mo-ptc property online?

The editing procedure is simple with pdfFiller. Open your 2013 form mo-ptc property in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is MO MO-PTC Chart?

The MO MO-PTC Chart is a reporting form used in Missouri to document and report certain tax information, specifically related to the calculation of the Personal Tax Credit.

Who is required to file MO MO-PTC Chart?

Individuals claiming the Missouri Personal Tax Credit must file the MO MO-PTC Chart as part of their tax return.

How to fill out MO MO-PTC Chart?

To fill out the MO MO-PTC Chart, gather relevant tax information, complete all required sections by providing accurate figures for income and expenses, and ensure that all necessary documentation is attached.

What is the purpose of MO MO-PTC Chart?

The purpose of the MO MO-PTC Chart is to facilitate the accurate calculation and claiming of the Personal Tax Credit, ensuring compliance with Missouri tax laws.

What information must be reported on MO MO-PTC Chart?

The MO MO-PTC Chart requires reporting of personal information, income details, tax credit calculations, and any qualifying deductions.

Fill out your 2013 form mo-ptc property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Form Mo-Ptc Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.