MO MO-PTC Chart 2024-2025 free printable template

Show details

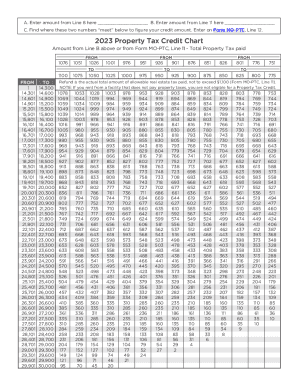

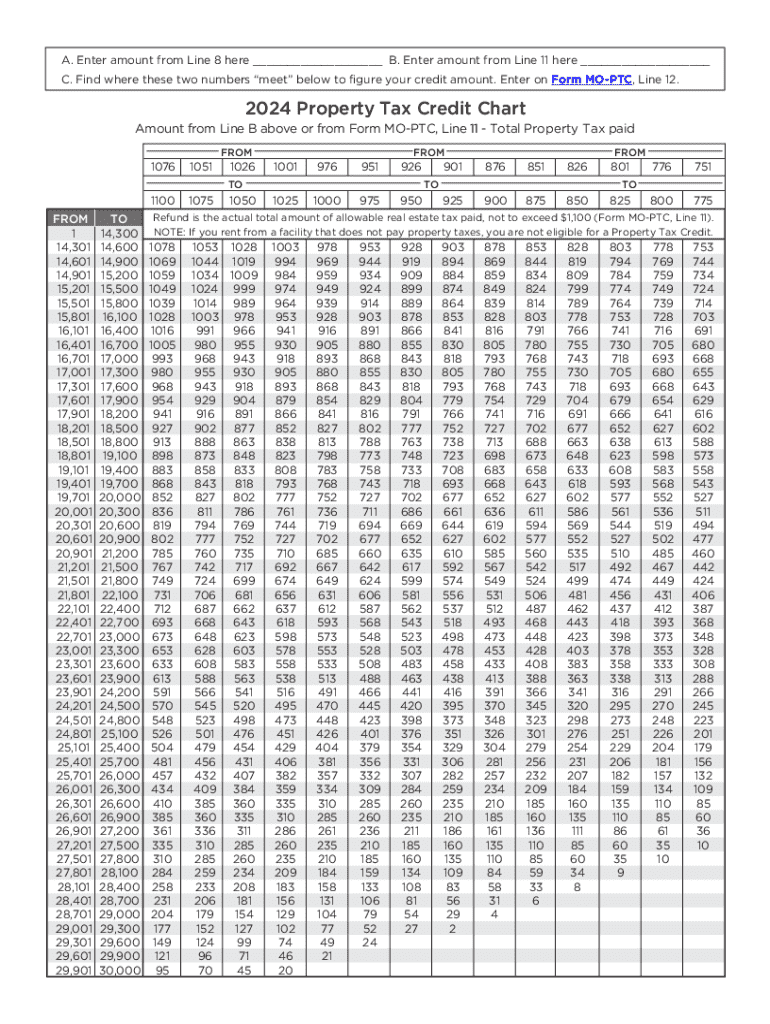

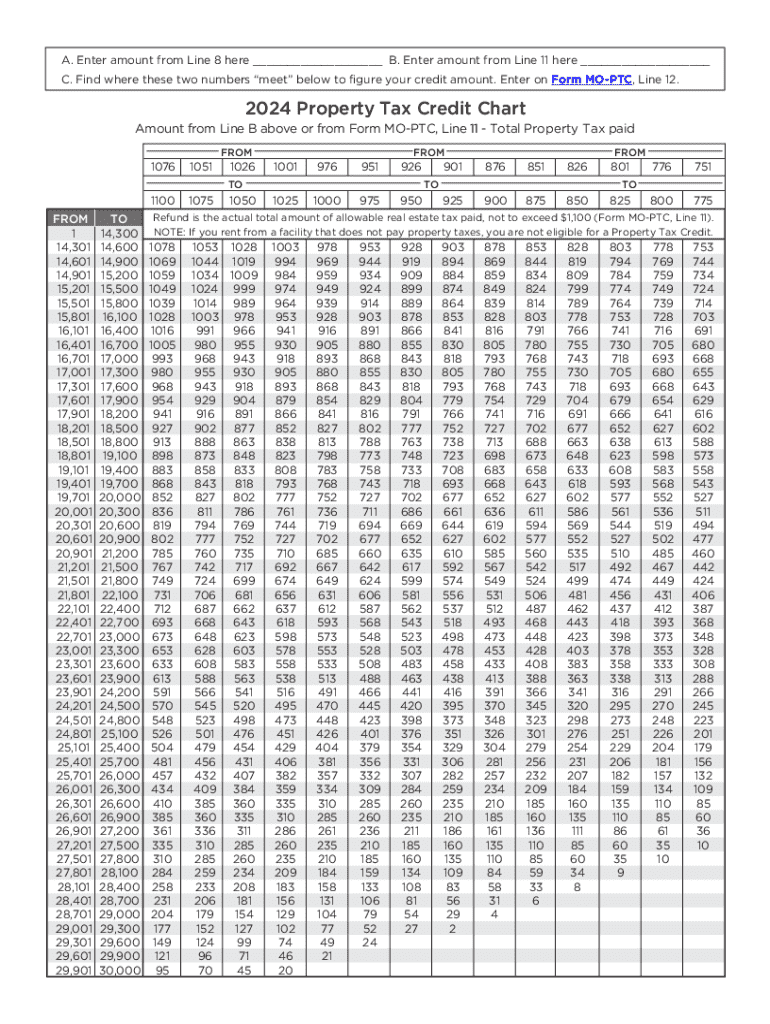

A. Enter amount from Line 8 here ___ B. Enter amount from Line 11 here ___ C. Find where these two numbers meet below to figure your credit amount. Enter on Form MOPTC, Line 12.2024 Property Tax Credit

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2024 ptc chart form

Edit your 2024 property tax credit chart form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missouri property tax credit chart 2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2024 missouri chart online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mo ptc 2024 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MO-PTC Chart Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mo ptc chart form

How to fill out MO MO-PTC Chart

01

Gather necessary personal and financial information.

02

Access the MO MO-PTC Chart form, either online or in print.

03

Fill in your details in the designated fields, including your name, address, and Social Security number.

04

Report your income accurately on the chart, ensuring to include all sources.

05

Calculate your tax credits or deductions as required.

06

Review the chart for accuracy and completeness before submission.

07

Submit the completed form to the appropriate state tax authority.

Who needs MO MO-PTC Chart?

01

Individuals filing taxes in Missouri.

02

Tax practitioners assisting clients with Missouri state tax filings.

03

Businesses operating in Missouri that need to report tax credits.

04

Individuals seeking to track their tax liability and credits accurately.

Video instructions and help with filling out and completing mo ptc chart 2024

Instructions and Help about missouri ptc chart

Fill

2024 mo ptc chart form

: Try Risk Free

People Also Ask about missouri property tax chart

What is a mo ptc form?

To claim real estate taxes for a prior year, you must file a claim for that year. Example: If you paid your 2021 real estate tax in calendar year 2022, you must file a 2021 Property Tax Credit Claim (Form MO-PTC).

Who is eligible for mo ptc?

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

Can I file Mo PTC online?

If you are eligible for a Property Tax Credit and required to file federal and Missouri (Form MO-1040) income tax forms, you are eligible to e-file.

How does the premium tax credit work for 2022?

To be eligible for the premium tax credit, your household income must be at least 100 percent and, for years other than 2021 and 2022, no more than 400 percent of the federal poverty line for your family size, although there are two exceptions for individuals with household income below 100 percent of the applicable

What is the PTC for 2022?

Earlier this year, the Internal Revenue Service (IRS) published the inflation adjustment factor for 2022, which, after application of this rounding rule, resulted in a PTC rate of 2.6 cents per kWh (1.3 cents per kWh in the case of 50% PTC Technologies).

What is the highest income to qualify for Obamacare 2022?

Generally, if your household income is 100% to 400% of the federal poverty level, you will qualify for a premium subsidy. This means an eligible single person can earn from $13,590 to $54,360 in 2022 and qualify for the tax credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2024 mo chart without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your mo ptc chart 2024 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send mo ptc chart 2024 for eSignature?

Once your mo ptc chart 2024 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in mo ptc chart 2024?

With pdfFiller, the editing process is straightforward. Open your mo ptc chart 2024 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is MO MO-PTC Chart?

The MO MO-PTC Chart is a tax form used in Missouri for reporting certain income and tax credits related to personal property.

Who is required to file MO MO-PTC Chart?

Individuals and entities that own personal property in Missouri and meet specific criteria outlined by the Missouri Department of Revenue are required to file the MO MO-PTC Chart.

How to fill out MO MO-PTC Chart?

To fill out the MO MO-PTC Chart, one must provide personal and property information, calculate the applicable tax credits, and ensure all sections are completed accurately as per the guidelines provided by the Missouri Department of Revenue.

What is the purpose of MO MO-PTC Chart?

The purpose of the MO MO-PTC Chart is to facilitate the reporting of personal property income and to claim any associated tax credits to reduce tax liability for taxpayers in Missouri.

What information must be reported on MO MO-PTC Chart?

Information that must be reported on the MO MO-PTC Chart includes taxpayer identification, details of the property owned, any income generated from the property, and the specific credits being claimed against personal property taxes.

Fill out your mo ptc chart 2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mo Ptc Chart 2024 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.