MO MO-PTC Chart 2014 free printable template

Show details

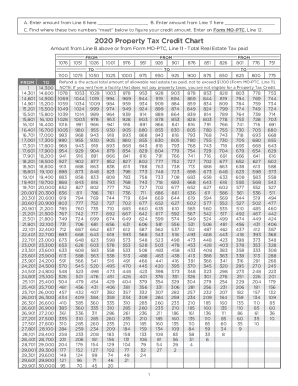

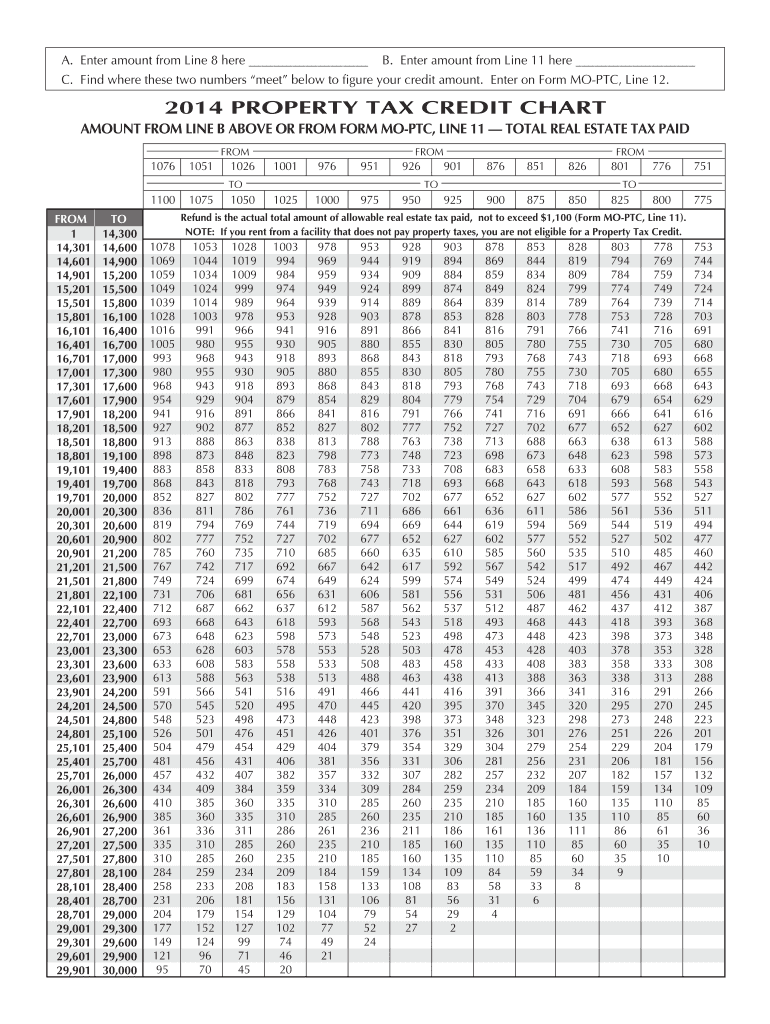

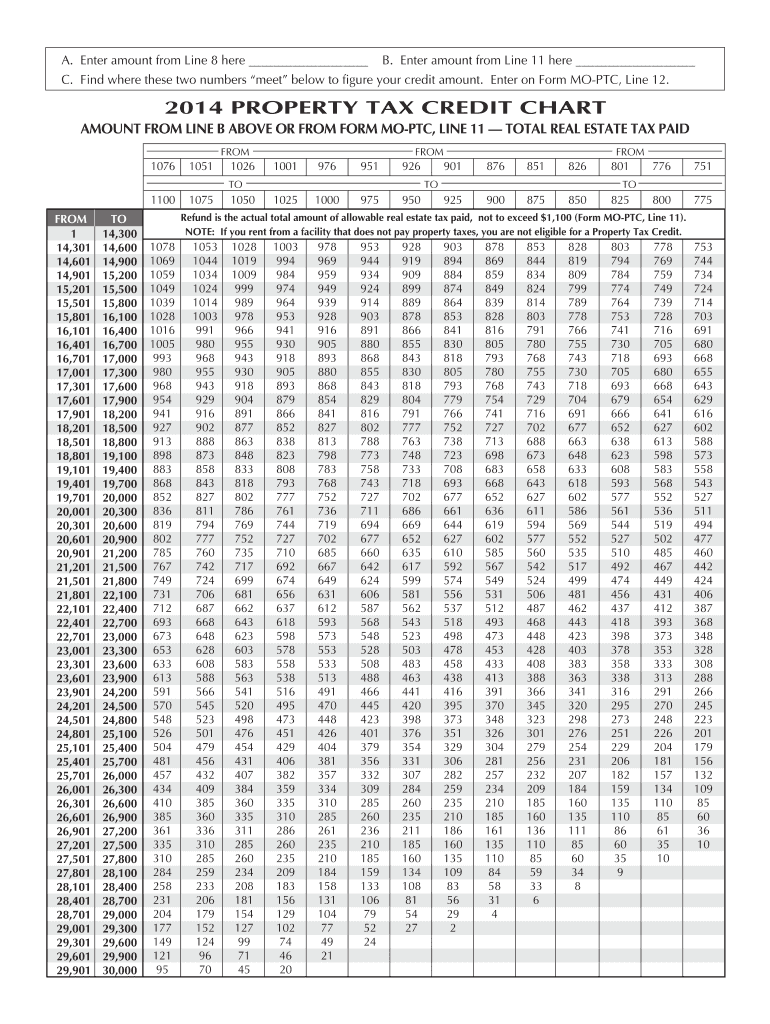

Enter on Form MO-PTC Line 12. 2014 PROPERTY TAX CREDIT CHART AMOUNT FROM LINE B ABOVE OR FROM FORM MO-PTC LINE 11 TOTAL REAL ESTATE TAX PAID FROM 976 951 926 901 876 851 826 801 776 751 TO 1000 975 950 925 900 875 850 825 800 775 Refund is the actual total amount of allowable real estate tax paid not to exceed 1 100 Form MO-PTC Line 11. A. Enter amount from Line 8 here B. Enter amount from Line 11 here C. Find where these two numbers meet below to figure your credit amount. NOTE If you rent...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO MO-PTC Chart

Edit your MO MO-PTC Chart form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO MO-PTC Chart form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO MO-PTC Chart online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MO MO-PTC Chart. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MO-PTC Chart Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO MO-PTC Chart

How to fill out MO MO-PTC Chart

01

Gather necessary personal information including name, address, and social security number.

02

Identify the income sources that need to be reported on the MO MO-PTC Chart.

03

Collect documentation for any potential tax credits or deductions.

04

Fill in the chart with the relevant information under the appropriate categories.

05

Double-check all entries for accuracy and completeness.

06

Submit the completed MO MO-PTC Chart through the designated method (online, mail, etc.).

Who needs MO MO-PTC Chart?

01

Individuals filing their taxes in Missouri who are seeking to claim a tax credit.

02

Tax professionals preparing tax returns for clients in Missouri.

03

Businesses that need to report information for tax credits on behalf of employees.

Instructions and Help about MO MO-PTC Chart

Fill

form

: Try Risk Free

People Also Ask about

What is a mo ptc form?

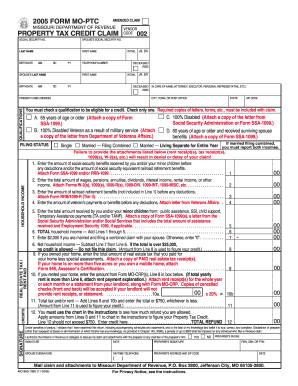

To claim real estate taxes for a prior year, you must file a claim for that year. Example: If you paid your 2021 real estate tax in calendar year 2022, you must file a 2021 Property Tax Credit Claim (Form MO-PTC).

Who is eligible for mo ptc?

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

Can I file Mo PTC online?

If you are eligible for a Property Tax Credit and required to file federal and Missouri (Form MO-1040) income tax forms, you are eligible to e-file.

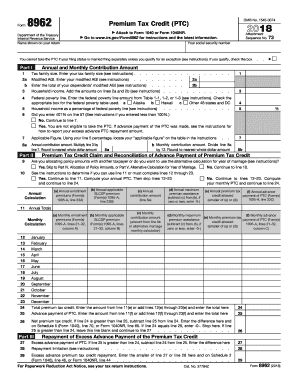

How does the premium tax credit work for 2022?

To be eligible for the premium tax credit, your household income must be at least 100 percent and, for years other than 2021 and 2022, no more than 400 percent of the federal poverty line for your family size, although there are two exceptions for individuals with household income below 100 percent of the applicable

What is the PTC for 2022?

Earlier this year, the Internal Revenue Service (IRS) published the inflation adjustment factor for 2022, which, after application of this rounding rule, resulted in a PTC rate of 2.6 cents per kWh (1.3 cents per kWh in the case of 50% PTC Technologies).

What is the highest income to qualify for Obamacare 2022?

Generally, if your household income is 100% to 400% of the federal poverty level, you will qualify for a premium subsidy. This means an eligible single person can earn from $13,590 to $54,360 in 2022 and qualify for the tax credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MO MO-PTC Chart?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific MO MO-PTC Chart and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in MO MO-PTC Chart without leaving Chrome?

MO MO-PTC Chart can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out MO MO-PTC Chart on an Android device?

Use the pdfFiller Android app to finish your MO MO-PTC Chart and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is MO MO-PTC Chart?

The MO MO-PTC Chart is a form used in the state of Missouri to report certain tax information for businesses, specifically for the calculation of the Missouri Part-Time Credit.

Who is required to file MO MO-PTC Chart?

Businesses and individuals who qualify for the Missouri Part-Time Credit and are required to report their part-time employment information must file the MO MO-PTC Chart.

How to fill out MO MO-PTC Chart?

To fill out the MO MO-PTC Chart, taxpayers need to provide accurate details such as their name, tax identification number, income details, and the number of part-time employees. It is essential to follow the instructions provided with the form for proper completion.

What is the purpose of MO MO-PTC Chart?

The purpose of the MO MO-PTC Chart is to facilitate the reporting of part-time employee information to ensure that tax credits are accurately calculated and applied, promoting compliance with Missouri tax laws.

What information must be reported on MO MO-PTC Chart?

The information that must be reported on the MO MO-PTC Chart includes the business's name and address, tax identification number, the total number of part-time employees, and the income generated from part-time employment.

Fill out your MO MO-PTC Chart online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO MO-PTC Chart is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.