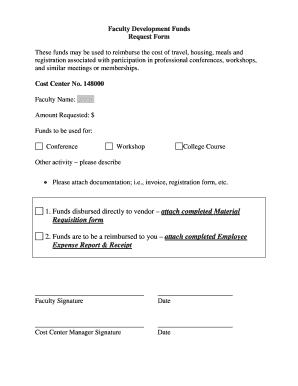

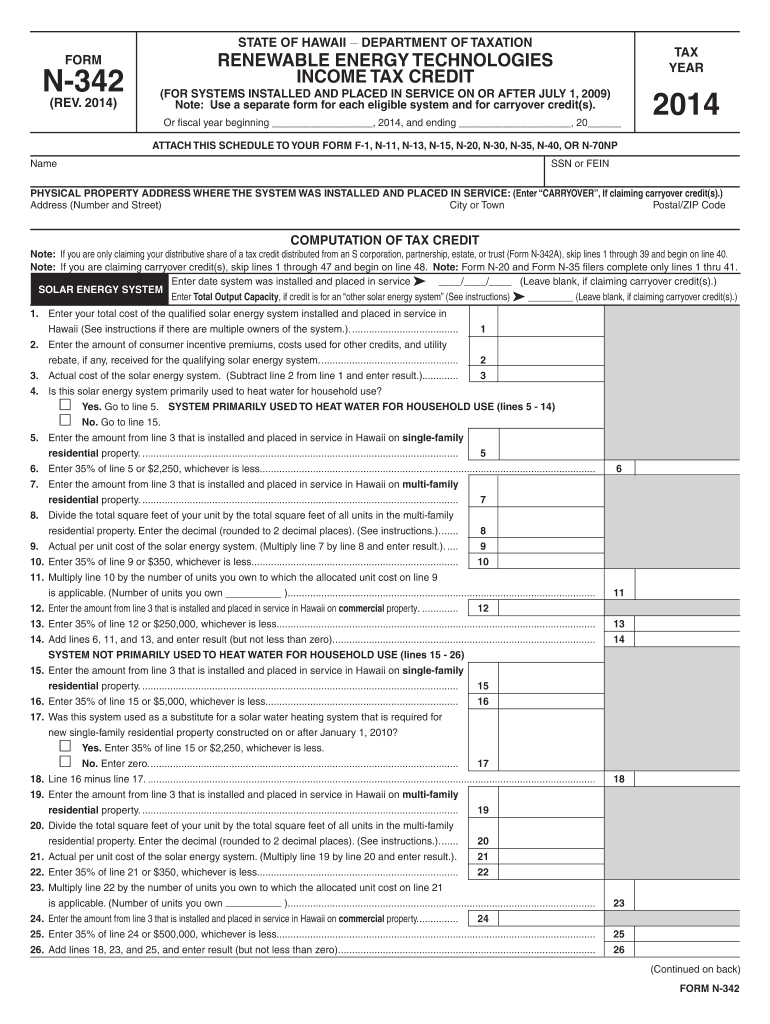

HI DoT N-342 2014 free printable template

Show details

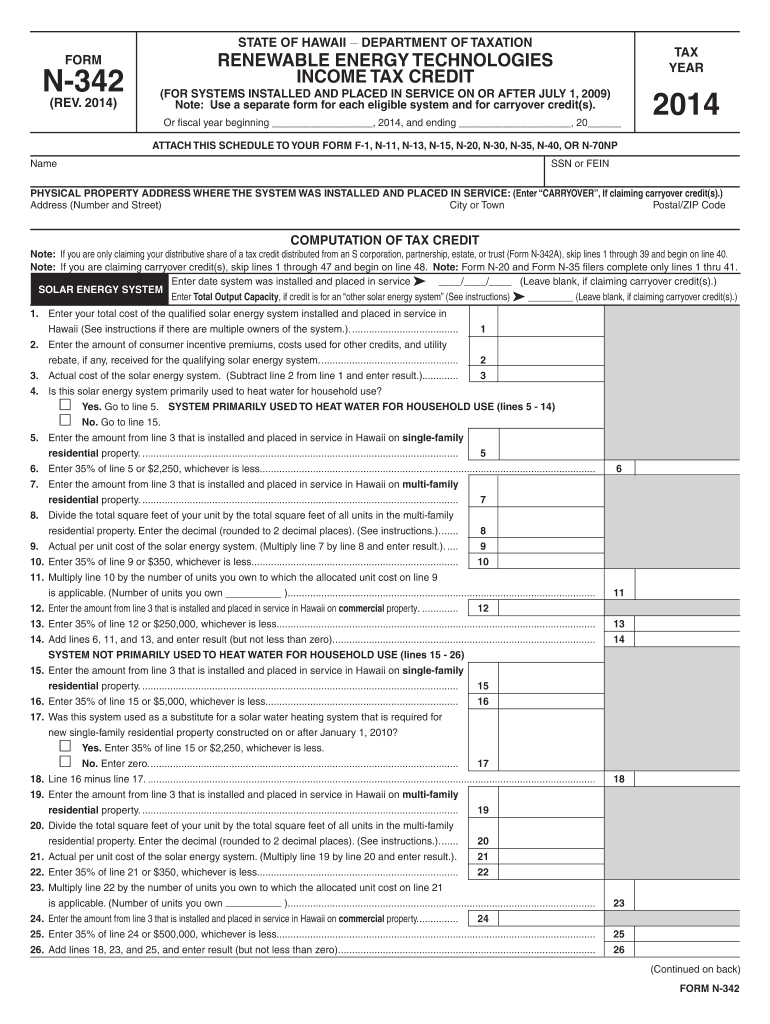

Continued on back FORM N-342 Form N-342 Page 2 WIND-POWERED ENERGY SYSTEM service in Hawaii See instructions if there are multiple owners of the system.. Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM N-342 REV. 2014 TAX YEAR RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT FOR SYSTEMS INSTALLED AND PLACED IN SERVICE ON OR AFTER JULY 1 2009 Note Use a separate form for each eligible system and for carryover credit s. Or fiscal year beginning 2014 and ending 20 ATTACH THIS SCHEDULE TO...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hawaii form n 342

Edit your hawaii form n 342 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hawaii form n 342 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hawaii form n 342 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hawaii form n 342. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-342 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out hawaii form n 342

How to fill out HI DoT N-342

01

Obtain the HI DoT N-342 form from the appropriate department or website.

02

Fill in your personal information in the designated sections, such as name, address, and contact information.

03

Provide details regarding the purpose of the application or request.

04

Include any supporting documents or evidence as required by the form.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the bottom in the specified field.

07

Submit the form according to the instructions, either by mail or electronically.

Who needs HI DoT N-342?

01

Individuals or businesses that need to request specific transport-related information or services.

02

Residents of Hawaii applying for permits or services related to transportation regulated by the Department of Transportation.

03

Any entity needing to report or address transportation-related issues in the state.

Fill

form

: Try Risk Free

People Also Ask about

What is the Hawaii form G 49?

What is Form G-49? Form G-49 is a summary of your activity for the entire year. This return must be filed in addition to Periodic General Excise/Use Tax Return (Form G-45). Form G-49 is used by the taxpayer to reconcile their account for the entire year.

What is the non resident tax form for state of Hawaii?

How to determine which form to file. Hawaiʻi nonresidents or part-year residents should file state Form N-15. A completed copy of the federal return must be attached to the Form N-15. Full-year Hawaiʻi residents filing a federal return should file state Form N-11.

How does Hawaii solar tax credit work?

Buyers can also qualify for a 30% federal tax credit through the end of 2023, and then that percentage is set to decrease to 22% in 2023 until expiring at the end of that year unless the federal government makes changes to the program.

What is the renewable energy technology tax credit in Hawaii?

Residential Renewable Energy Tax Credit A taxpayer may claim a credit of 30% of qualified expenditures for a system that serves a dwelling unit located in the United States that is owned and used as a residence by the taxpayer.

What is Hawaii tax form N 15?

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

What form do I use for Hawaii estimated taxes?

1040ES. Estimated Tax for Individuals. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, or alimony).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my hawaii form n 342 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your hawaii form n 342 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make edits in hawaii form n 342 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your hawaii form n 342, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out hawaii form n 342 using my mobile device?

Use the pdfFiller mobile app to fill out and sign hawaii form n 342 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is HI DoT N-342?

HI DoT N-342 is a form used in Hawaii to report the tax on the sale of tobacco products.

Who is required to file HI DoT N-342?

Any retailer or distributor who sells tobacco products in Hawaii is required to file HI DoT N-342.

How to fill out HI DoT N-342?

To fill out HI DoT N-342, you need to provide information such as the total sales of tobacco products, the tax rate, and the total tax due, following the instructions provided on the form.

What is the purpose of HI DoT N-342?

The purpose of HI DoT N-342 is to ensure that taxes on the sales of tobacco products are accurately reported and collected by the state.

What information must be reported on HI DoT N-342?

The information that must be reported on HI DoT N-342 includes the seller's details, total quantity of tobacco sold, sales price, applicable tax rates, and total tax owed.

Fill out your hawaii form n 342 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hawaii Form N 342 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.