HI DoT N-342 2013 free printable template

Show details

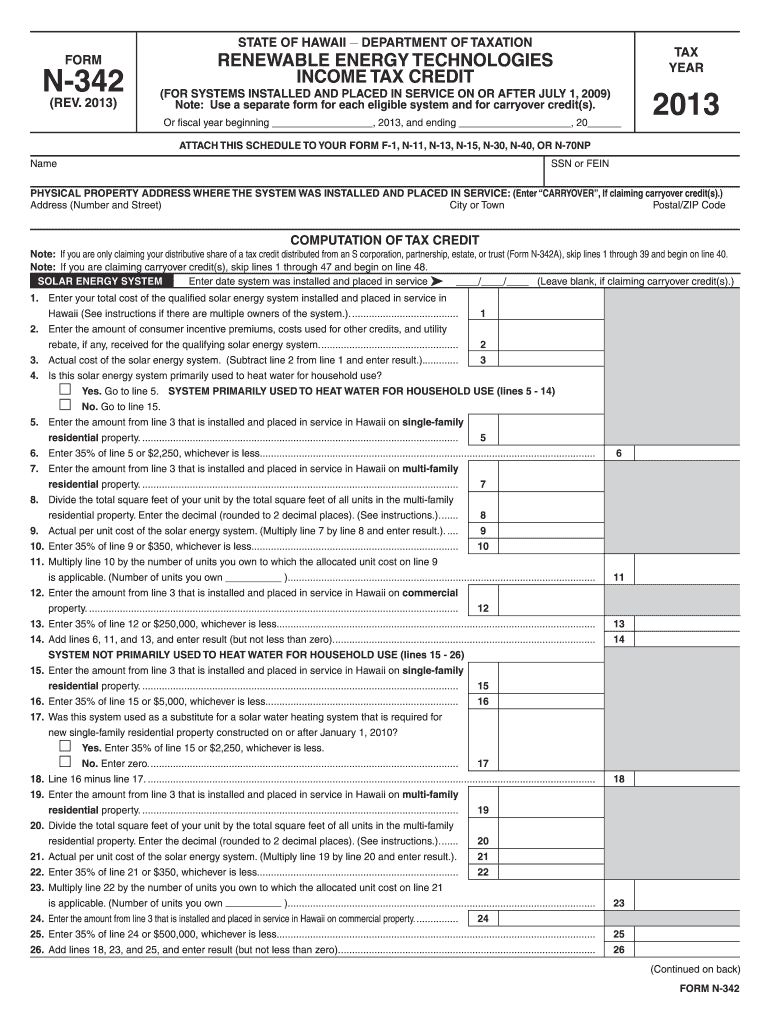

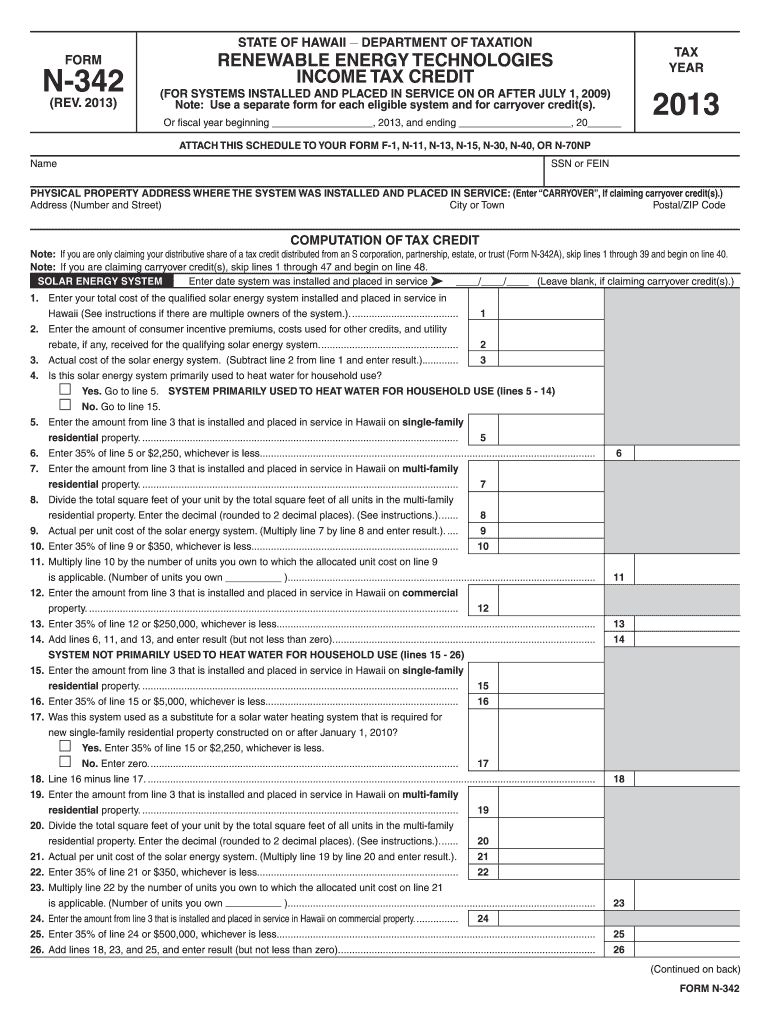

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM N-342 (REV. 2013) TAX YEAR RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT (FOR SYSTEMS INSTALLED AND PLACED IN SERVICE ON OR AFTER JULY 1, 2009)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form n 342 2013

Edit your form n 342 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form n 342 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form n 342 2013 online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form n 342 2013. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-342 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form n 342 2013

How to fill out HI DoT N-342

01

Obtain the HI DoT N-342 form from the official website or local office.

02

Carefully read the instructions provided on the form.

03

Fill in your personal information in the designated fields such as name, address, and contact details.

04

Provide any necessary identification numbers, including your driver's license number or Social Security number, if required.

05

Complete any sections relating to the specific purpose of the application or request.

06

Review all the information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form either online, by mail, or in person, depending on the submission guidelines.

Who needs HI DoT N-342?

01

Individuals or businesses seeking to register a vehicle, obtain a license, or complete other vehicular-related processes in Hawaii.

02

People who need to update or change their vehicle information with the Department of Transportation.

Fill

form

: Try Risk Free

People Also Ask about

How does Hawaii State solar tax credit work?

If you're looking to go solar, you may be wondering about the Hawaii Solar Tax Credit. This credit is available to residents of Hawaii and can be used to offset taxes that you owe on your solar power system. The credit is 26% of the cost of your system, which covers both the equipment and installation costs.

What is the renewable energy technology tax credit in Hawaii?

Residential Renewable Energy Tax Credit A taxpayer may claim a credit of 30% of qualified expenditures for a system that serves a dwelling unit located in the United States that is owned and used as a residence by the taxpayer.

Is Hawaii solar tax credit refundable or nonrefundable?

Is Hawaii Solar Tax Credit Refundable Or Nonrefundable? The good news is that the Hawaii solar tax credit is actually both refundable and nonrefundable! That means if you exceed the amount of your total eligible costs for your solar installation, then you can receive some or all of the remaining balance as a refund.

What is Hawaii tax form n15?

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

What type of tax return do non residents file?

Nonresident aliens who are required to file an income tax return must use Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

What is the tax form for non residents in Hawaii?

Hawaiʻi nonresidents or part-year residents should file state Form N-15. A completed copy of the federal return must be attached to the Form N-15. Full-year Hawaiʻi residents filing a federal return should file state Form N-11.

How does Hawaii solar tax credit work?

Buyers can also qualify for a 30% federal tax credit through the end of 2023, and then that percentage is set to decrease to 22% in 2023 until expiring at the end of that year unless the federal government makes changes to the program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form n 342 2013 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your form n 342 2013.

How can I fill out form n 342 2013 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your form n 342 2013. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete form n 342 2013 on an Android device?

Use the pdfFiller mobile app and complete your form n 342 2013 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is HI DoT N-342?

HI DoT N-342 is a form used for reporting specific health-related information as required by the Hawaii Department of Transportation.

Who is required to file HI DoT N-342?

Individuals or organizations involved in activities that relate to health and safety compliance under Hawaii regulations are required to file HI DoT N-342.

How to fill out HI DoT N-342?

To fill out HI DoT N-342, you need to provide relevant personal and organizational information, complete all required sections with accurate data, and ensure all entries meet the stipulated guidelines.

What is the purpose of HI DoT N-342?

The purpose of HI DoT N-342 is to collect vital health and safety information to ensure compliance with state regulations and to monitor health-related activities.

What information must be reported on HI DoT N-342?

The information that must be reported on HI DoT N-342 includes details about the reporting entity, the nature of the health-related activities, and any incidents or compliance issues relevant to public health.

Fill out your form n 342 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form N 342 2013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.