HI DoT N-342 2017 free printable template

Show details

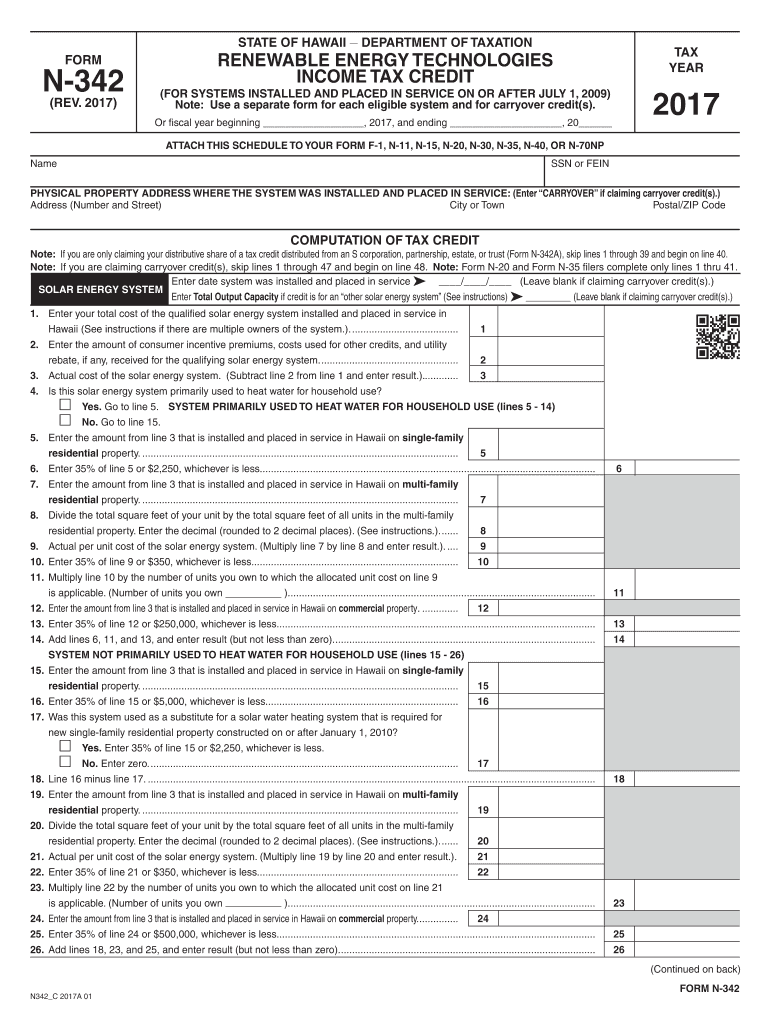

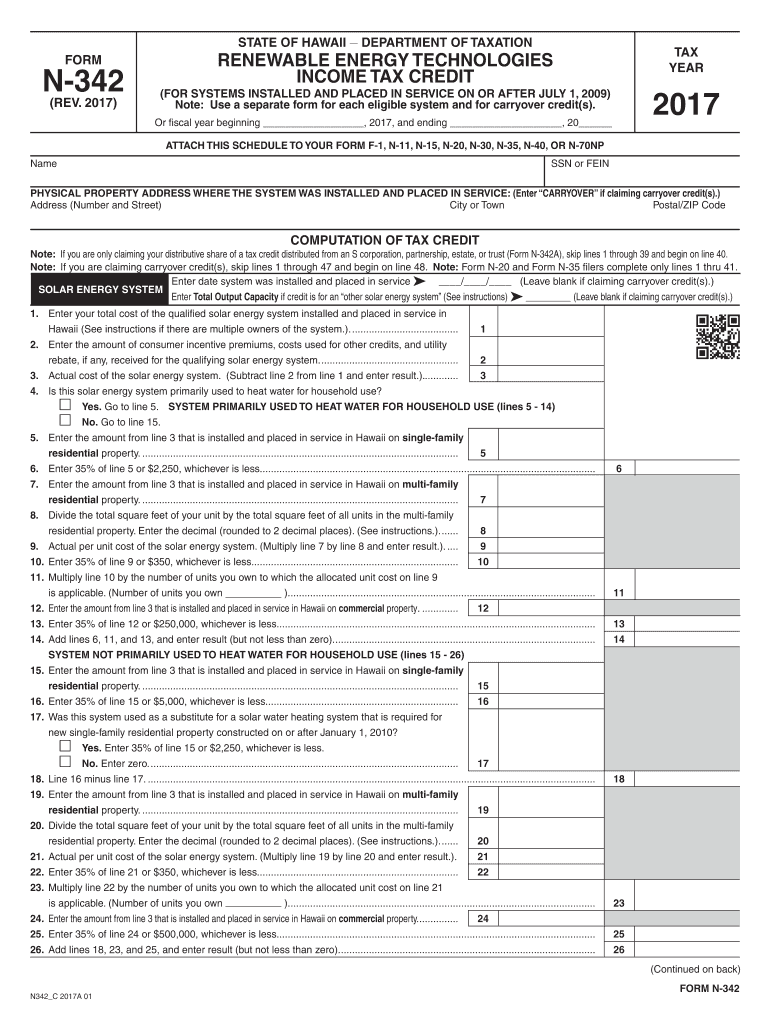

Continued on back FORM N-342 N342C 2017A 01 Form N-342 Page 2 WIND-POWERED ENERGY SYSTEM service in Hawaii See instructions if there are multiple owners of the system.. Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM N-342 REV. 2017 TAX YEAR RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT FOR SYSTEMS INSTALLED AND PLACED IN SERVICE ON OR AFTER JULY 1 2009 Note Use a separate form for each eligible system and for carryover credit s. Or fiscal year beginning 2017 and ending 20 ATTACH...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign state of hawaii form

Edit your state of hawaii form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of hawaii form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state of hawaii form online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit state of hawaii form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-342 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out state of hawaii form

How to fill out HI DoT N-342

01

Begin by downloading the HI DoT N-342 form from the official website.

02

Fill in your personal information including your name, address, and contact details.

03

Provide information related to your vehicle, such as make, model, and VIN (Vehicle Identification Number).

04

Indicate the purpose for which you are submitting the form (e.g., registration, transfer of ownership).

05

Sign and date the form to certify that the information provided is accurate.

06

Submit the completed form to the appropriate department along with any required fees and additional documents.

Who needs HI DoT N-342?

01

Individuals registering a vehicle in Hawaii.

02

Those transferring ownership of a vehicle.

03

Anyone needing to update their vehicle information with the Hawaii Department of Transportation.

Fill

form

: Try Risk Free

People Also Ask about

How does a tax credit work if I don't owe taxes?

Even with no taxes owed, taxpayers can still apply any refundable credits they qualify for and receive the amount of the credit or credits as a refund. For example, if you end up with no taxes due and you qualify for a $2,000 refundable tax credit, you will receive the entire $2,000 as a refund.

How does the solar tax credit work if I get a tax refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. 15 However, you can carry over any unused amount of tax credit to the next tax year.

Is Hawaii solar tax credit refundable or nonrefundable?

Hawaii also offers a “refundable credit” for PV system owners who do not have sufficient state tax liability; the refundable credit is 30% less than the normal tax credit, but state cuts a check directly to the system owner.

Is the renewable energy tax credit refundable?

The energy tax credit isn't a refundable credit that would result in you receiving money. The energy credit is a nonrefundable credit that can only reduce the tax you owe to $0. You won't receive a refund for any remaining credit amount.

Is solar tax credit refundable or nonrefundable?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. 15 However, you can carry over any unused amount of tax credit to the next tax year.

What is Hawaii tax credit for solar panels?

Hawaii Tax Incentives and Solar Rebates* Qualified homeowners with home solar could be eligible for a tax credit of up to 30% against the cost of the system. The 35% state solar tax credit is available for purchased home solar systems in Hawaii.

How do you get money back on taxes from solar panels?

To claim the credit, you must file IRS Form 5695 as part of your tax return. You'll calculate the credit on Part I of the form, and then enter the result on your 1040.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

How does solar tax credit work in Hawaii?

Hawaii's Photovoltaic Tax Credit Through the Renewable Energy Technologies Income Tax Credit (RETITC), residents of Hawaii can get a 35% state solar tax credit when purchasing their residential solar system. The maximum credit available through the RETITC is $5,000 per purchaser.

How do solar tax credits work in Hawaii?

Renewable Energy Technologies Income Tax Credit (RETITC) Buy a new rooftop panel system in Hawaii and get a 35% credit of its total cost against your personal income taxes owed in that year. The maximum state tax credit in a taxable year can't exceed $5,000 for each home solar installation.

Where can I get Hawaii state tax forms?

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators (FTA) Secure Exchange System (SES) website. The SES website is a secure way to provide files to those that reproduce our forms.

How much tax credit do you get for solar panels?

Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30% for the installation of which was between 2022-2032.

How do I get Hawaii tax forms?

To request a form by mail or fax, you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1-800-222-3229.

Why can't I claim my solar tax credit?

You can't claim the residential solar credit for installing solar power at rental properties you own. But you can claim it if you also live in the house for part of the year and use it as a rental when you're away.

How does the solar tax credit work if I don't owe taxes?

You may be asking yourself, “How does the solar tax credit work if I don't owe taxes?” Anyone who does not owe federal income taxes will not be able to benefit from the solar tax credit in the current year.

How much is the Hawaii solar tax credit?

Renewable Energy Technologies Income Tax Credit (RETITC): This credit gives Hawaii residents an income tax break of 35% on residential solar installations (maximum $5,000).

Can I get solar tax credit if I don't owe taxes?

Unfortunately, not everyone will be able to take full advantage of this lucrative financial incentive. To benefit from the solar ITC, you must owe federal income taxes. If you don't — if you break even or end up qualifying for a refund check — you won't be eligible … at least not this year.

Is Hawaii solar credit refundable?

Hawaii also offers a “refundable credit” for PV system owners who do not have sufficient state tax liability; the refundable credit is 30% less than the normal tax credit, but state cuts a check directly to the system owner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send state of hawaii form to be eSigned by others?

state of hawaii form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit state of hawaii form in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing state of hawaii form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I fill out state of hawaii form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your state of hawaii form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is HI DoT N-342?

HI DoT N-342 is a form used by the Department of Transportation in Hawaii for reporting certain transportation-related activities and data.

Who is required to file HI DoT N-342?

Individuals or organizations involved in transportation activities in Hawaii that fall under the reporting guidelines set by the Department of Transportation are required to file HI DoT N-342.

How to fill out HI DoT N-342?

To fill out HI DoT N-342, obtain the form from the Hawaii Department of Transportation, provide accurate information as requested in the form fields, and submit it according to the provided instructions.

What is the purpose of HI DoT N-342?

The purpose of HI DoT N-342 is to collect data on transportation activities to help inform planning, safety measures, and regulatory compliance within the state.

What information must be reported on HI DoT N-342?

HI DoT N-342 requires reporting of information such as the type of transportation activity, dates of the activity, locations involved, and any relevant statistics or data as specified in the form.

Fill out your state of hawaii form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Of Hawaii Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.