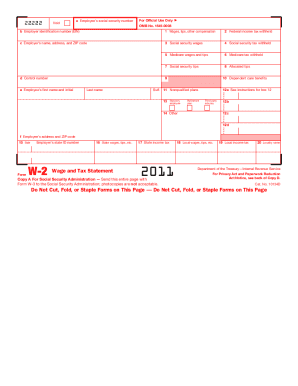

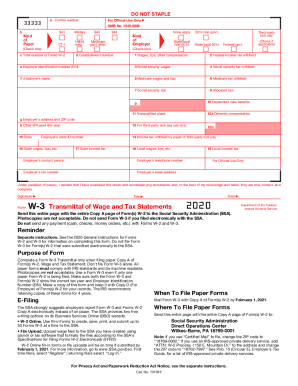

IRS W-3 2011 free printable template

Instructions and Help about IRS W-3

How to edit IRS W-3

How to fill out IRS W-3

About IRS W-3 2011 previous version

What is IRS W-3?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-3

What should I do if I need to correct an error after filing my IRS W-3?

If you discover an error after filing your IRS W-3, you can submit a corrected version. Ensure you mark the form as 'Corrected' and include the updated information. This helps maintain accurate records and comply with IRS regulations. Keep in mind that correcting errors promptly can prevent misunderstandings with the IRS.

How can I check the status of my IRS W-3 submission?

To check the status of your IRS W-3 submission, you can use the IRS e-file tools available on their website. If you filed electronically and receive a confirmation, it usually indicates your submission was received. Common e-file rejection codes may help you identify any issues needing resolution.

What record retention requirements should I follow for my IRS W-3 documentation?

It is essential to retain a copy of the IRS W-3 and related documentation for at least four years from the due date of the form or the date you filed it, whichever is later. This retention allows you to provide documentation in case of an audit or IRS inquiry. Implementing data security measures for these records is also advisable.

Are there specific considerations for filing an IRS W-3 for a nonresident payee?

When filing an IRS W-3 for a nonresident payee, ensure you are using the correct withholding rates and forms applicable under tax treaties. You may also need to submit additional documentation to avoid double taxation. Understanding the specific requirements can help streamline the process and ensure compliance.

What should I do if I receive an IRS notice related to my W-3 submission?

If you receive an IRS notice regarding your W-3 submission, read it carefully to understand the issue raised. Respond promptly with any requested information and maintain documentation to support your case. Clarifying discrepancies can prevent further complications and ensure compliance with IRS requirements.

See what our users say