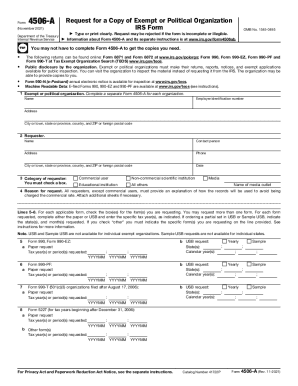

IRS 4506-A 2014 free printable template

Instructions and Help about IRS 4506-A

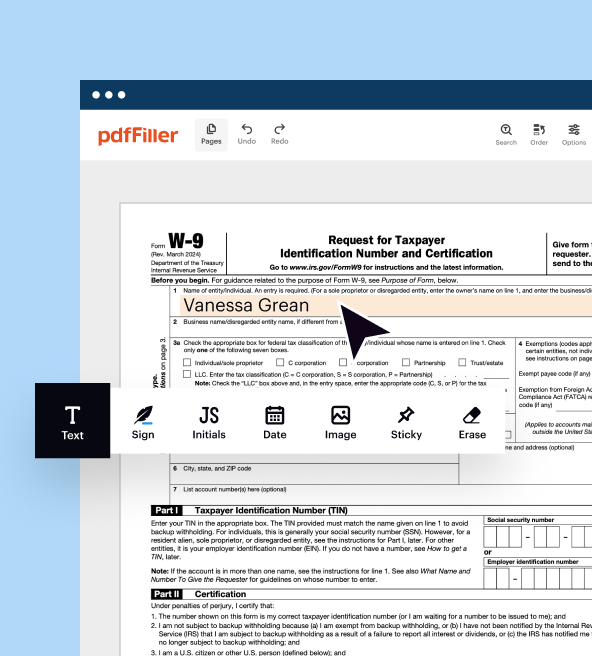

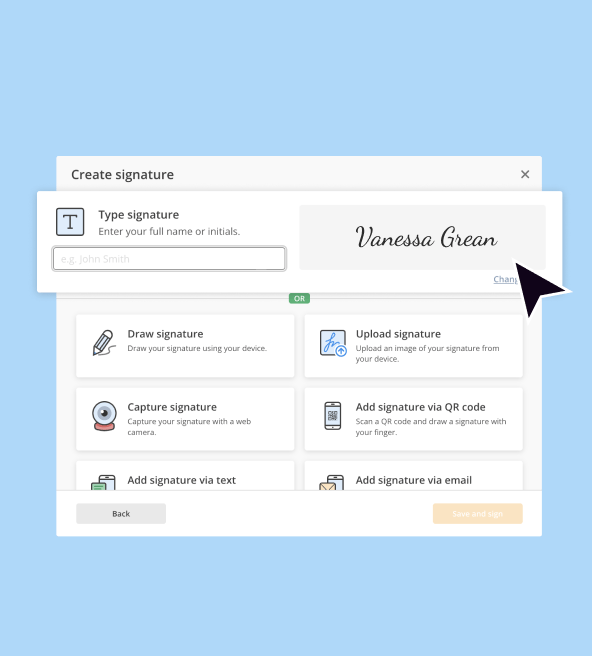

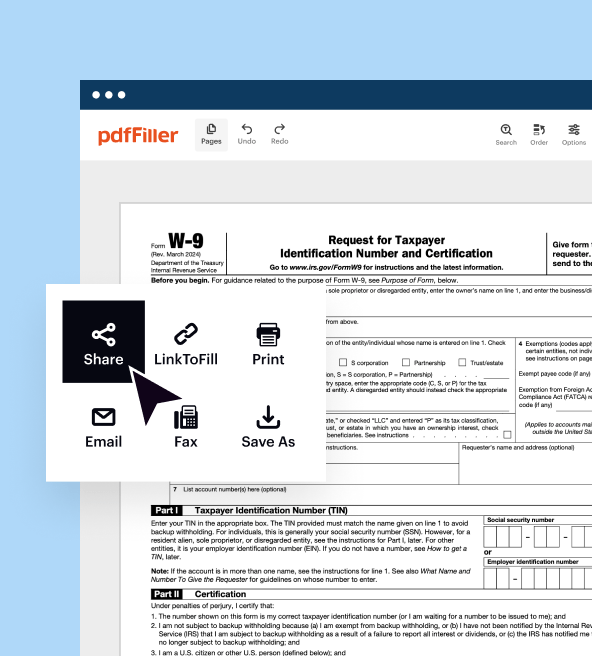

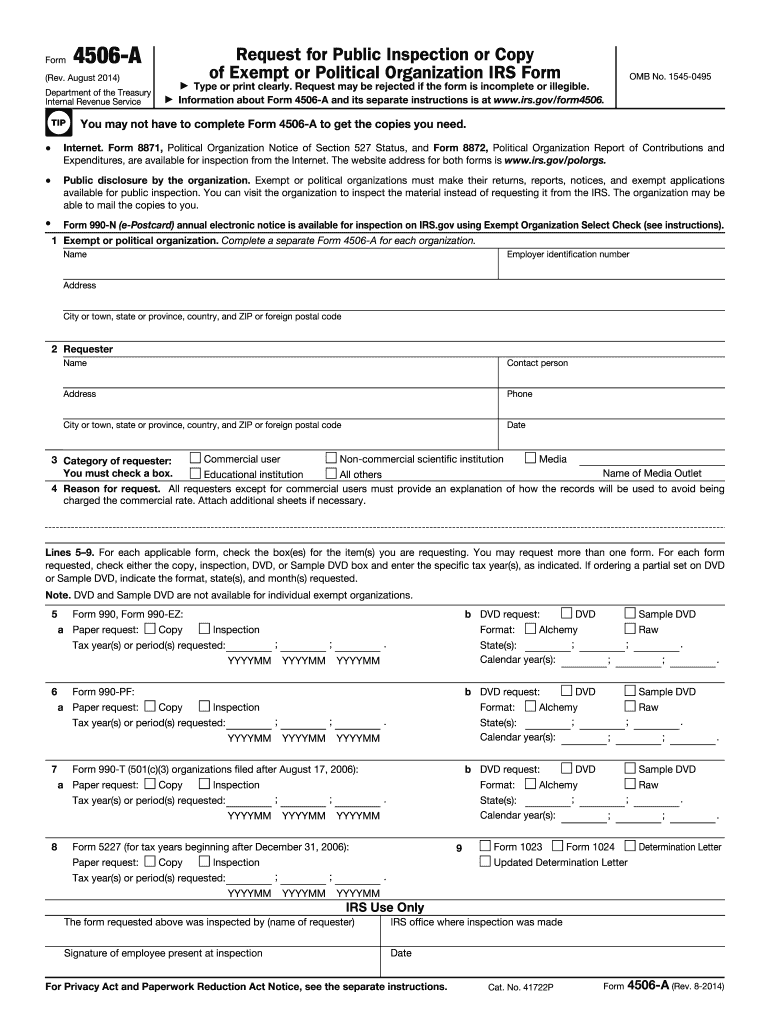

How to edit IRS 4506-A

How to fill out IRS 4506-A

About IRS 4506-A 2014 previous version

What is IRS 4506-A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 4506-A

What should I do if I made an error on my file forms misc problems?

If you've made an error on your file forms misc problems, you should submit an amended form as soon as possible. Clearly indicate the corrections made and ensure that you keep a copy of both the original and amended forms for your records. It's crucial to check the specific instructions for amendments related to your form type.

How can I verify if my file forms misc problems have been received by the IRS?

To verify receipt of your file forms misc problems, you can check your e-file status online if you filed electronically. For paper submissions, it can take several weeks; thus, contacting the IRS directly or using their phone line may yield faster information. Keeping track of submission dates can also help manage this process.

What are the common e-file rejection codes for file forms misc problems?

Common e-file rejection codes for file forms misc problems include mismatched TIN and name combinations, incorrect formatting, or missing required fields. If your submission is rejected, review the rejection notice carefully and correct the identified issues before resubmitting your form.

What should I consider about record retention related to file forms misc problems?

It's vital to maintain records related to your file forms misc problems for a specified period, typically three to six years, depending on various factors. These records should include copies of your submitted forms, supporting documentation, and any correspondence received from the IRS.