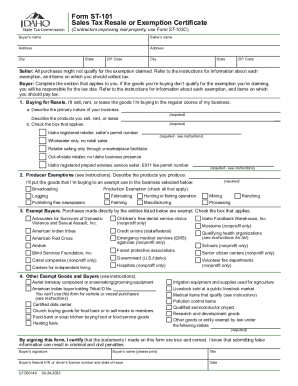

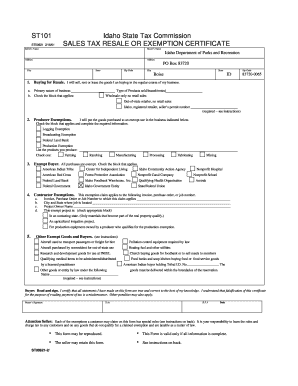

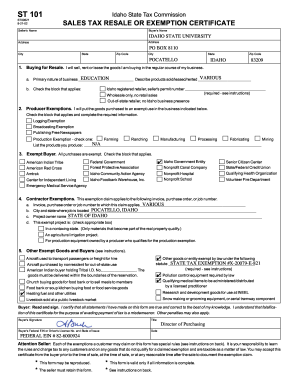

ID ST-101 2014 free printable template

Get, Create, Make and Sign ID ST-101

How to edit ID ST-101 online

Uncompromising security for your PDF editing and eSignature needs

ID ST-101 Form Versions

How to fill out ID ST-101

How to fill out ID ST-101

Who needs ID ST-101?

Instructions and Help about ID ST-101

Hello hey what's up I need your help can you come here I can't I'm buying clothes all right well hurry up and come over here well I can't find them what do you mean you can't find them I can't find them there's only soup what do you mean there's only soup it means there's only soup well then get out of there soup aisle all right you do have to shout at me there's more soup what do you mean there's more soup there's just more soup going to the next aisle there's still soup where are you right now that's soup what do you mean you're at soup I mean I'm at so what store are you in I'm at the soup store why are you buying clothes at the soup store you

People Also Ask about

What is the sales tax in ID?

What is the power of attorney tax form for Idaho?

What is a form 40 Idaho?

How do I get a Virginia sales tax ID number?

Why did I get a state of Idaho Stars deposit 2023?

What is the form 51 in Idaho?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ID ST-101 to be eSigned by others?

How can I get ID ST-101?

Can I create an electronic signature for the ID ST-101 in Chrome?

What is ID ST-101?

Who is required to file ID ST-101?

How to fill out ID ST-101?

What is the purpose of ID ST-101?

What information must be reported on ID ST-101?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.