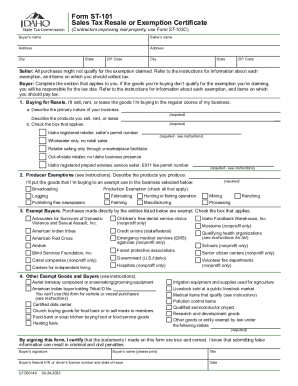

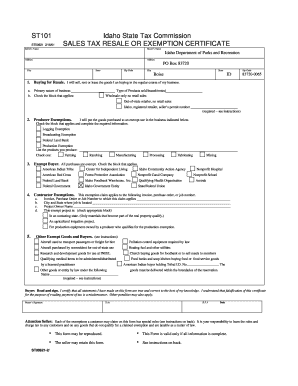

ID ST-101 2013 free printable template

Get, Create, Make and Sign ID ST-101

Editing ID ST-101 online

Uncompromising security for your PDF editing and eSignature needs

ID ST-101 Form Versions

How to fill out ID ST-101

How to fill out ID ST-101

Who needs ID ST-101?

Instructions and Help about ID ST-101

Here we are 2547 East blue taken Chadian this is the one-bedroom apartment brand-new apartments here granite countertops hardwood floors all new appliances stainless steel appliances these are Energy Star units very efficient you can see the dining area in kitchen here patio area they do come with washer and dryer here's the bathroom in the bedroom large bedroom with an attached walk-in closet also has a built-in desk area here and this is where the washer and dryer will be visited our website to apply Park Place ID com or call us at 208 377 3227

People Also Ask about

How do I get a resale certificate in Idaho?

What is reseller certificate?

Is there sales tax on resale in Idaho?

Does Idaho sales tax exemption expire?

How do I get a resale certificate?

Do resale certificates expire in Idaho?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in ID ST-101 without leaving Chrome?

How can I edit ID ST-101 on a smartphone?

Can I edit ID ST-101 on an iOS device?

What is ID ST-101?

Who is required to file ID ST-101?

How to fill out ID ST-101?

What is the purpose of ID ST-101?

What information must be reported on ID ST-101?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.