ID ST-101 2011 free printable template

Show details

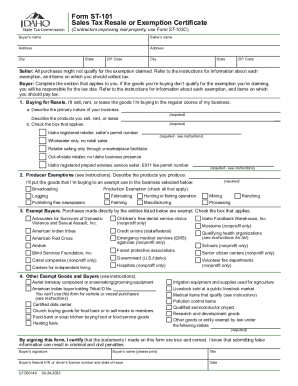

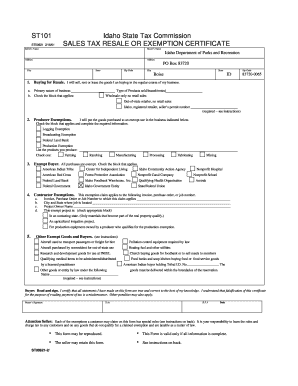

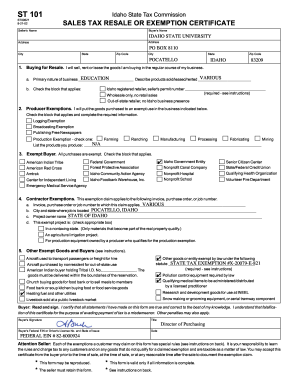

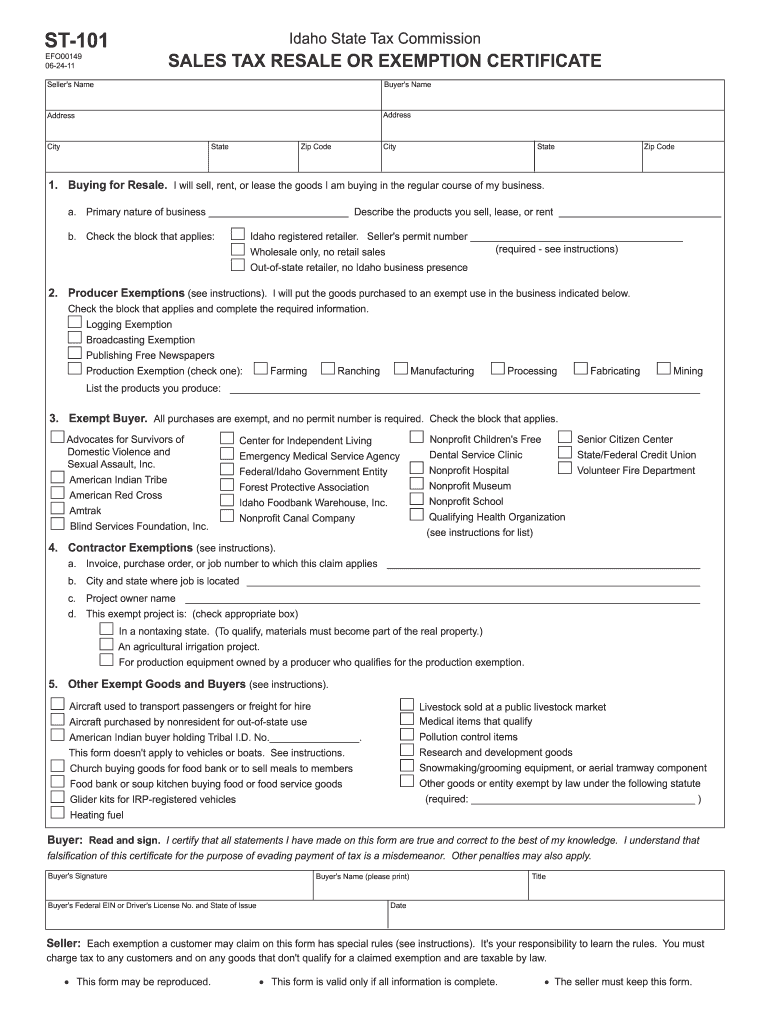

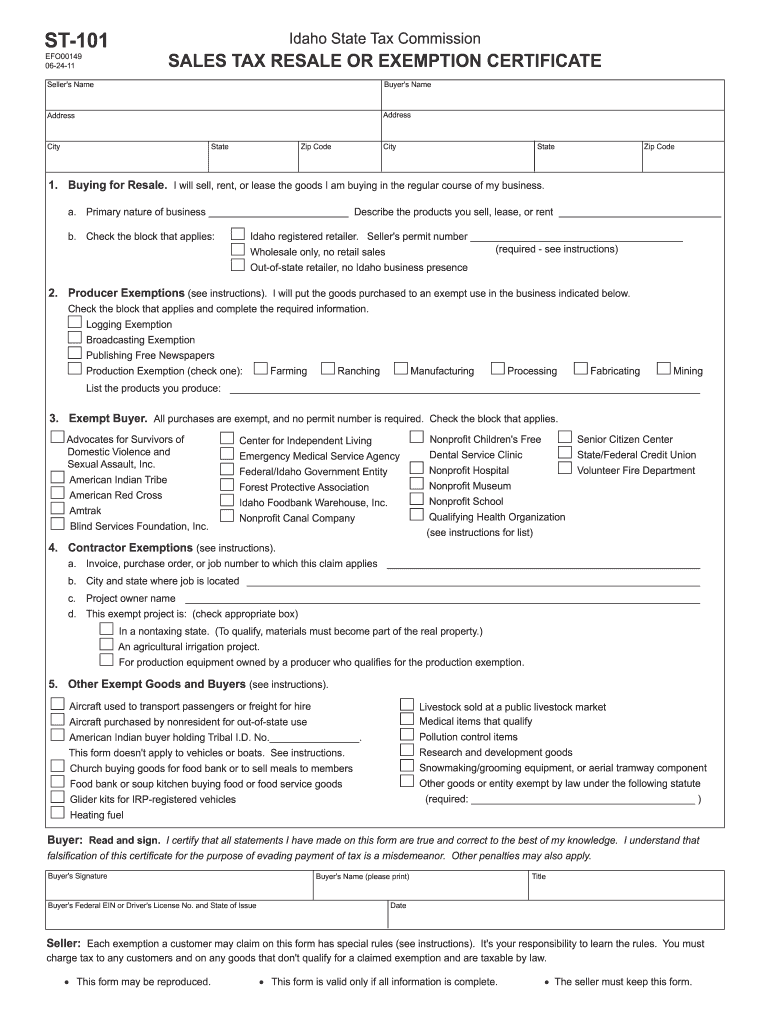

ST-101 EFO00149 06-24-11 Idaho State Tax Commission SALES TAX RESALE OR EXEMPTION CERTIFICATE Seller's Name Buyer's Name Address City State Zip Code City State Zip Code 1. Buying for Resale. I will

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign st-101 - idaho state

Edit your st-101 - idaho state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-101 - idaho state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st-101 - idaho state online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit st-101 - idaho state. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID ST-101 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out st-101 - idaho state

How to fill out ID ST-101

01

Begin by obtaining the ID ST-101 form from the relevant tax authority website or office.

02

Read the instructions carefully before filling out the form.

03

Enter your name, address, and contact information in the designated fields.

04

Provide your taxpayer identification number or Social Security number as required.

05

Fill out the sections pertaining to your income, deductions, and any applicable credits.

06

Double-check all entries for accuracy and ensure no fields are left blank unless specified.

07

Sign and date the form at the bottom.

08

Submit the completed form by mail or electronically as instructed.

Who needs ID ST-101?

01

Individuals or businesses that are required to report their income and pay taxes in a particular jurisdiction.

02

Anyone claiming specific deductions or credits that necessitate the use of ID ST-101.

03

Taxpayers seeking to amend previous tax returns that require updated information.

Fill

form

: Try Risk Free

People Also Ask about

What for is Idaho form 850?

Sales and Use Tax Forms Form IDForm NameRevision Date850-USelf-Assessed Use Tax Return and Instructions03-14-2019850Sales and Use Tax Return Instructions 202211-28-20221152Travel and Convention Return Instructions 202211-28-20221152Travel and Convention Return - Page 208-20-202121 more rows • Mar 21, 2023

What is the power of attorney form for Idaho taxes?

An Idaho tax power of attorney, or “Form bL375E,” is a designation that allows someone else to be able to handle a citizen's tax filing with the Idaho State Tax Commission. The taxpayer can use the fields to define the exact tax matters for which the agent will be approved to represent them.

What form do I use for payroll tax withholding in Idaho?

Complete Form ID W-4 so your employer can withhold the correct amount of state income tax from your paycheck. Sign the form and give it to your employer. Use the information on the back to calculate your Idaho allowances and any additional amount you need withheld from each paycheck.

What is Idaho form 910 for?

Form 910. Monthly filers: You must file Form 910 monthly if you're in one of these situations: You withhold less than $25,000 a month and more than $750 a quarter. You have only one monthly pay period.

Why would I get a letter from the Idaho State Tax Commission?

We might send you letters to verify your identity or to ask for more information.

Can you make payments on Idaho state taxes?

Individual and businesses that owe income tax: You can request a payment plan online, with or without a TAP account. Without a TAP account, you'll need any letter we've sent you in the past two years. When you request a payment plan online, you'll need to set up automatic payments from your bank account.

Why did I get a State of Idaho Stars deposit 2023?

Idaho taxpayers are set to receive a payment of up to $600 in the first quarter of 2023. The Gem State is giving the rebate to anyone who was a state resident for the full year of 2020 and 2021 and has filed their taxes for the same tax years.

What is the Idaho State Tax Commission penalty?

When penalty is due. ing to Idaho Code section 63-3046, penalty is due if a taxpayer: Files a return but the tax due isn't paid (0.5%/month to a maximum of 25%) Doesn't file a tax return on time (5%/month to a maximum of 25%)

What does the Idaho State Tax Commission do?

The Tax Commission informs taxpayers about their obligations so everyone can pay their fair share of taxes, and it must enforce Idaho's laws to ensure the fairness of the tax system with those who don't voluntarily comply.

How do I apply for tax exemption in Idaho?

You must complete an application for a Homestead Exemption. You can get an application by emailing us or calling our office at (208) 287-7200.

What are non taxable sales in Idaho?

In Idaho, purchases of tangible personal property for purposes of resale are not subject to tax. However, all sales are presumed taxable, and the seller has the burden of proving that a sale is not taxable (unless the seller has a resale certificate on file from you, the purchaser).

Who is required to file Idaho state tax return?

You must file individual income tax returns with Idaho if you're any of the following: An Idaho resident. A part-year Idaho resident with income from Idaho sources or income earned while an Idaho resident. A nonresident of Idaho with income from Idaho sources.

How do I pay my Idaho state income tax?

Payment options Pay securely online from your bank account (free) using Quick Pay. Pay by another method like debit card or credit card (fee). Pay from your bank account (free) or using a credit card (fee) through TAP, if you have a TAP account. Pay by check through the mail or in person.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit st-101 - idaho state from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like st-101 - idaho state, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I fill out st-101 - idaho state on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your st-101 - idaho state. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit st-101 - idaho state on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute st-101 - idaho state from anywhere with an internet connection. Take use of the app's mobile capabilities.

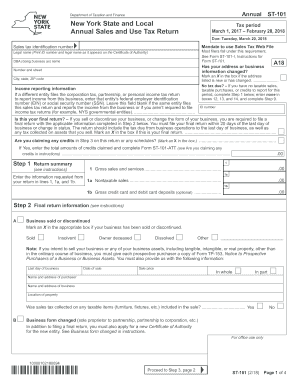

What is ID ST-101?

ID ST-101 is a form used in New York State for the purpose of reporting sales tax information for sales of tangible personal property and certain services.

Who is required to file ID ST-101?

Businesses or individuals who make taxable sales of goods and services in New York State are required to file ID ST-101.

How to fill out ID ST-101?

To fill out ID ST-101, enter your business or individual name, address, the type of sales made, and total sales tax collected during the reporting period, along with any deductions or exemptions.

What is the purpose of ID ST-101?

The purpose of ID ST-101 is to report and pay the amount of sales tax collected by sellers to the state government.

What information must be reported on ID ST-101?

The information that must be reported on ID ST-101 includes the seller's name and address, total sales made, sales tax collected, and any applicable deductions or exemptions.

Fill out your st-101 - idaho state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-101 - Idaho State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.