Get the free Traditional or Roth IRA Account Options/FundsLink, Apr 2016

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional or roth ira

Edit your traditional or roth ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional or roth ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit traditional or roth ira online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit traditional or roth ira. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

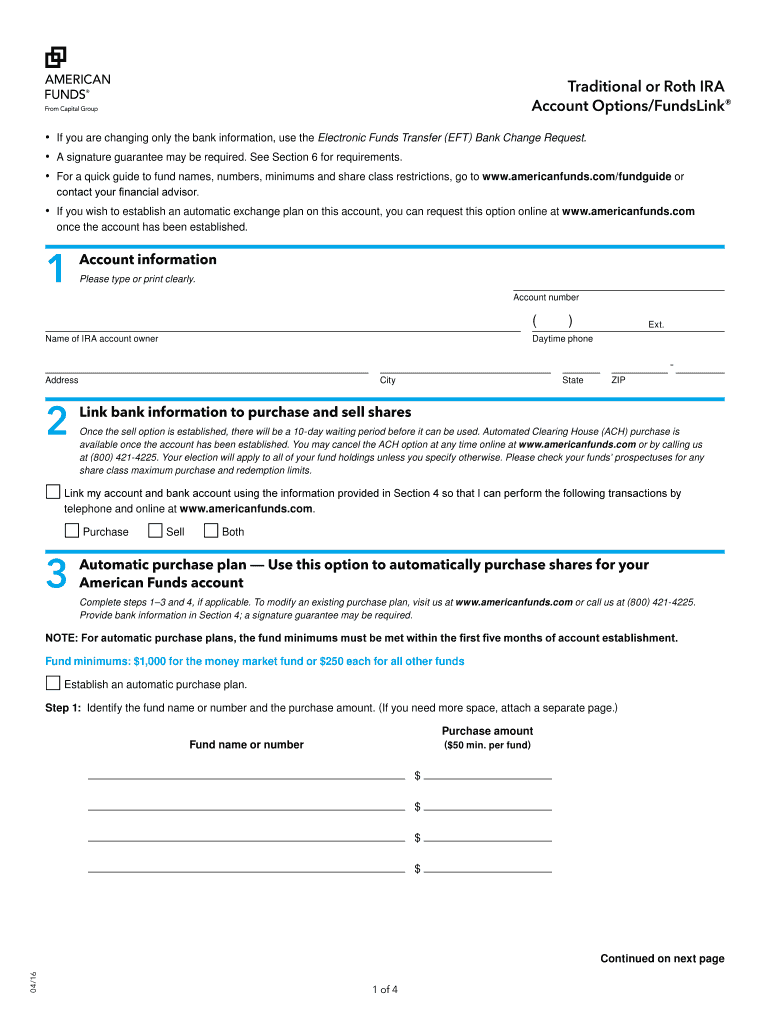

How to fill out traditional or roth ira

How to fill out traditional or Roth IRA:

01

Determine your eligibility: Before starting to fill out a traditional or Roth IRA, it is important to determine if you qualify for either type of account. Traditional IRAs have no income limits, but there may be restrictions on deductible contributions based on your income and whether you or your spouse have access to an employer-sponsored retirement plan. Roth IRAs have income limits, so make sure you meet the eligibility requirements for this type of account.

02

Choose the type of IRA: Once you have determined your eligibility, decide whether a traditional or Roth IRA is more suitable for your financial goals and circumstances. Take into account factors such as your current income tax bracket, future tax expectations, and desired retirement age. Traditional IRAs offer potential tax deductions on contributions but are subject to taxes upon withdrawal, while Roth IRAs provide tax-free withdrawals in retirement but do not offer immediate tax benefits.

03

Open an account: To fill out a traditional or Roth IRA, you will need to open an account with a financial institution such as a bank, brokerage, or mutual fund. Research different providers and compare their fees, investment options, and customer support. Once you have chosen a provider, follow their specific instructions for opening an IRA account.

04

Fund your account: After opening the IRA, you will need to fund it with contributions. Determine how much you can afford to contribute and consider maximizing your contributions to take advantage of tax advantages and potential long-term growth. Consult with a financial advisor if you need guidance on how much to contribute.

05

Select your investments: Traditional and Roth IRAs offer a range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Choose investments that align with your risk tolerance, time horizon, and investment objectives. Consider diversifying your portfolio to spread out risk. Consult a financial advisor if you are uncertain about which investments to choose.

06

Monitor and manage your account: Regularly review and adjust your IRA investments to ensure they align with your changing financial goals and tolerance for risk. Keep track of contributions, withdrawals, and any potential tax implications. If necessary, seek guidance from a financial professional to optimize your IRA portfolio.

Who needs traditional or Roth IRA:

01

Individuals planning for retirement: Traditional and Roth IRAs are beneficial for individuals who want to save for retirement, regardless of their employment status. Both accounts offer the potential for tax advantages and long-term growth, allowing individuals to secure their financial future.

02

Those looking for tax advantages: Traditional IRAs provide the opportunity for tax-deductible contributions, potentially reducing your current taxable income. Roth IRAs, on the other hand, offer tax-free withdrawals in retirement, providing tax advantages when you need it the most.

03

People with different income levels: Traditional IRAs have no income limits, making them accessible to individuals at any income level. Roth IRAs, however, have income limits, which may exclude high-earning individuals, unless they employ certain strategies such as a Backdoor Roth IRA conversion.

04

Those seeking flexibility: Roth IRAs allow for flexible withdrawals of contributions penalty-free before retirement age, which can be advantageous for individuals who anticipate needing access to their funds earlier. Traditional IRAs, on the other hand, have stricter withdrawal rules and may impose penalties for early withdrawals.

05

Individuals with no access to employer-sponsored retirement plans: Traditional and Roth IRAs are particularly valuable for individuals who do not have access to employer-sponsored retirement plans, such as 401(k)s or pensions. Opening and contributing to an IRA can help bridge the gap in retirement savings and provide additional security for the future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send traditional or roth ira for eSignature?

When your traditional or roth ira is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in traditional or roth ira without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing traditional or roth ira and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my traditional or roth ira in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your traditional or roth ira and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your traditional or roth ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional Or Roth Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.