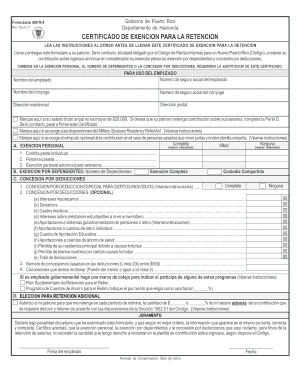

PR 499 R-4 2016-2025 plantilla gratuita para imprimir

Obtener, crear y firmar certificado exencion form

Cómo revisar certificado de exención para la retención en la web

Seguridad sin concesiones para tus necesidades de edición de PDF y firma electrónica

PR 499 R-4 Versiones del formulario

Cómo rellenar 499 r 4 form

Cómo completar PR 499 R-4

¿Quién necesita PR 499 R-4?

Instrucciones en vídeo y ayuda para rellenar y completar formulario 499 r 4

Instrucciones y Ayuda sobre adobe

Had snail Carter from first step accounting, and today we're going to do a quick tutorial on how to complete your w-4 form this form is for all my gob holders it lets your payroll department know how many exemptions you're claiming to adjust the taxes withheld from your gross pay basically it lets them calculate how much in taxes that's going to be withheld from your paycheck each week you want to get this number correct so that when you file your taxes next year you won't owe you can get the correct pay each pay period to get the form you can go directly to IRS govt and search for Form w-4 typically it's on the home page because it is a commonly used form once you have the form it only takes a few minutes to complete it, and we're going to go through each line by line hopefully I make it easy for you and you can just print it off and take it directly to your HR department ok line one ask for your name and mailing address you should use the dress you're going to use when you file your tax returns since this will be the address on your form w-2 at the end of the year, and you want those two addresses to match line to ask for your social security number if you don't know about Hart please go check your Social Security card line three is a checkbox where you indicate if you're single married or married but want to be taxed at the single rate single filers do include people who file as head of household as well the only time you should be checking that married box but want to be had the taxes withheld and a higher the higher single rate is if you plan on filing married filing separately line four you check this box if the last name on your form and your Social Security card don't match if they don't match you need to request a new card and the number to do so is listed on the form line five is where all the magic happens if you scroll midway up the form you will see that there is a personal allowances' worksheet, and we're going to go through each one of these line by line as well but here is where you come up with the number of how many exemptions you will want withheld so line a PRE going to put one here if no one else can claim you as a dependent if you live at home with your parents are in college and under the age of 24 you're probably going to put a zero here because your parents will probably claim you on their taxes B you're going to enter one if you're single and only have one job or if you're married and only have one job and your spouse doesn't work or wages from a second job end or from your spouse's job will be $1,500 or less so the final number and B should either be 0 or what C you're going to enter one for your spouse I only recommend doing this if your spouse is not currently working again the final number here should be zero or one D you're going to enter the number of dependents you're claiming on your tax return this includes children stepchildren parents nieces or nephews do not include anyone you will not be filing on your tax...

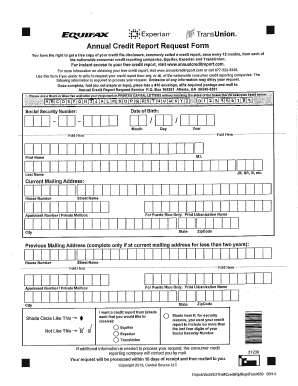

La gente también pregunta acerca de formulario 499 r 4 pdf

What is the withholding tax in Puerto Rico for non residents?

What is the Puerto Rico employer withholding tax?

What is a withholding exemption certificate?

What does withholding exemption certificate mean?

What is withholding form Type 499 R 4?

Should I claim exemption from withholding?

Para las preguntas frecuentes de pdfFiller

A continuación se muestra una lista de las preguntas más comunes de los clientes. Si no puede encontrar una respuesta a su pregunta, no dude en comunicarse con nosotros.

¿Cómo puedo? hacer ediciones en 499 r 4 hacienda sin tener dejar Inoxidable?

Puedo indicador el certificado de exencion en formato electrónico en Inoxidable?

¿Cómo puedo? completa 499 r4 mediante un sistema operativo Android dispositivo?

¿Qué es PR 499 R-4?

¿Quién debe presentar PR 499 R-4?

¿Cómo completar PR 499 R-4?

¿Cuál es el propósito de PR 499 R-4?

¿Qué información se debe reportar en PR 499 R-4?

pdfFiller es una solución integral para administrar, crear y editar documentos y formularios en la nube. Ahorre tiempo y molestias preparando sus formularios de impuestos en línea.