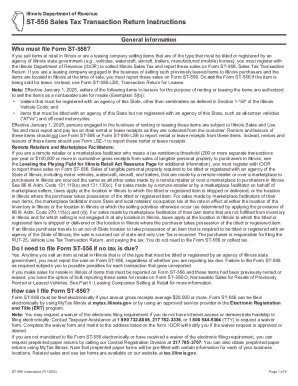

IL ST-556 (1) Instructions 2016 free printable template

Show details

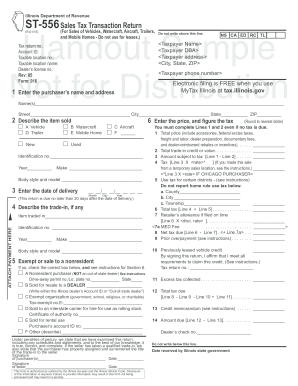

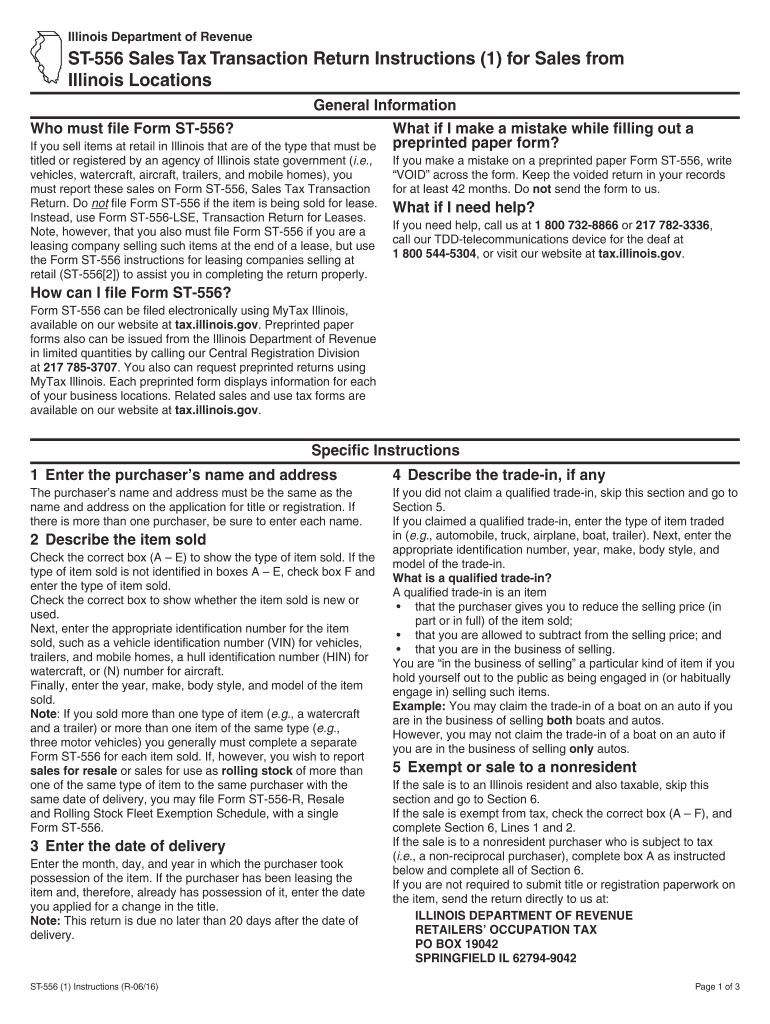

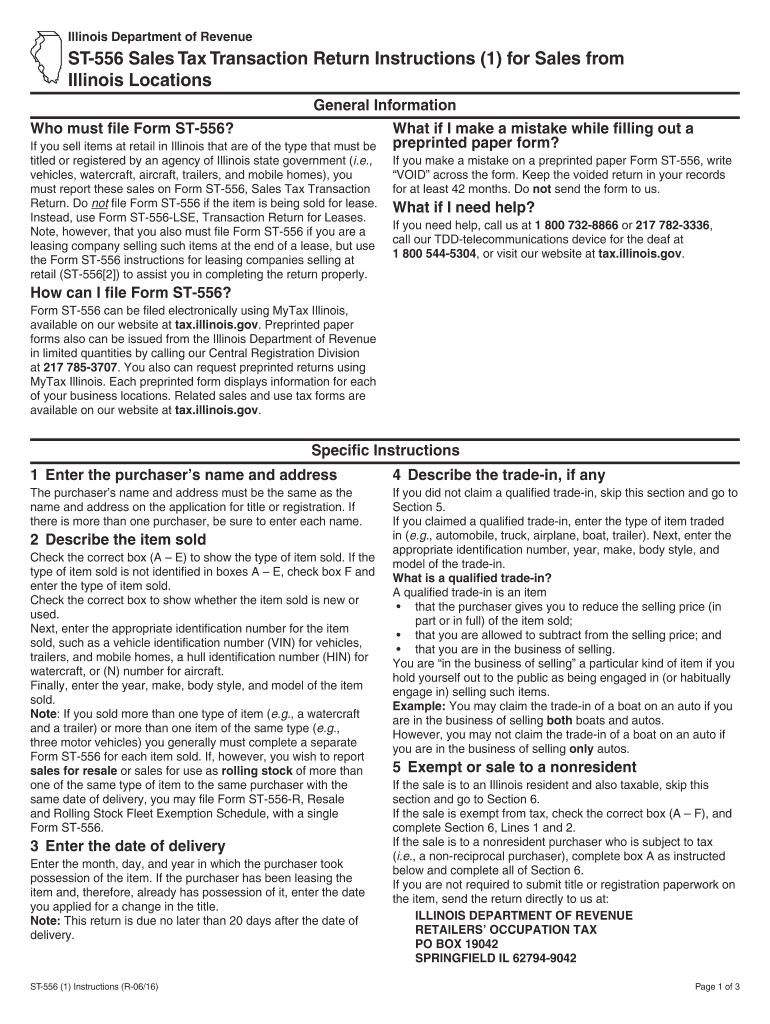

Requirements to claim credit for a previously leased item 1. Use tax was paid either to an Illinois retailer on Form ST-556 or directly to us on Form RUT-25 when the item was purchased. 2. On the tax return number line you have written the correct tax return number either from the Form ST-556 led by the Illinois retailer when you purchased the item and paid the tax or Form RUT-25 led when the item was purchased and the tax paid. Line 11 If you collected more tax than is due on this sale...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL ST-556 1 Instructions

Edit your IL ST-556 1 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL ST-556 1 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL ST-556 1 Instructions online

Follow the steps down below to use a professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IL ST-556 1 Instructions. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL ST-556 (1) Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL ST-556 1 Instructions

How to fill out IL ST-556 (1) Instructions

01

Gather the necessary information, including the buyer's name, address, and tax identification number.

02

Fill out the seller's information with their name and address.

03

Indicate the type of property being transferred and the transaction details.

04

Specify the purchase price and any exemptions that may apply.

05

Confirm the date of the sale.

06

Sign and date the form at the bottom, ensuring all provided information is accurate.

Who needs IL ST-556 (1) Instructions?

01

Individuals or businesses involved in a real estate transaction in Illinois who are required to document the sale for tax reporting purposes.

Fill

form

: Try Risk Free

People Also Ask about

Are sales taxes collected from customers and remitted to the state by seller?

Sales taxes are considered “trust taxes” where the seller collects the tax from the customer and remits the collected tax to the appropriate taxing jurisdiction. There are different types of sales taxes imposed by the states. Some states are Seller Privilege Tax states while others are Consumer Tax states.

What is the sales tax remittance threshold in Illinois?

The tax remittance thresholds are: $100,000 or more in cumulative gross receipts from sales of tangible personal property to purchasers in Illinois; or. 200 or more separate transactions for the sale of tangible personal property to purchasers in Illinois.

What is Illinois Form ST 556 for?

If you sell items at retail in Illinois that are of the type that must be titled or registered by an agency of Illinois state government (e.g., vehicles, watercraft, aircraft, trailers, manufactured (mobile) homes), you must report these sales on Form ST‑556, Sales Tax Transaction Return.

How do I remit sales tax in Illinois?

You have three options for filing and paying your Illinois sales tax: File online – File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail – You can use Form ST-1 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

Is Illinois sales tax accrual or cash?

Payment of sales tax is on an accrual basis and not on a cash basis. Sales tax must be reported and paid with the return for the period in which the sale occurs.

What is ST 556 form for Illinois?

If you sell items at retail in Illinois that are of the type that must be titled or registered by an agency of Illinois state government (e.g., vehicles, watercraft, aircraft, trailers, manufactured (mobile) homes), you must report these sales on Form ST‑556, Sales Tax Transaction Return.

What is an st1 form Illinois?

What is an st1 form Illinois? You must file Form ST-1, Sales and Use Tax and E911 Surcharge. Return, if you are making retail sales of any of the following in Illinois: general merchandise, qualifying foods, drugs, and medical appliances, and/or prepaid wireless telecommunications service.

How do I file local sales tax in Illinois?

You have three options for filing and paying your Illinois sales tax: File online – File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail – You can use Form ST-1 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IL ST-556 1 Instructions without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including IL ST-556 1 Instructions. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute IL ST-556 1 Instructions online?

With pdfFiller, you may easily complete and sign IL ST-556 1 Instructions online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the IL ST-556 1 Instructions form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IL ST-556 1 Instructions and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IL ST-556 (1) Instructions?

IL ST-556 (1) Instructions is a form used in Illinois for reporting sales tax information and providing details on transactions subject to sales tax.

Who is required to file IL ST-556 (1) Instructions?

Any seller who makes sales of tangible personal property in Illinois and is liable for collecting sales tax is required to file IL ST-556 (1) Instructions.

How to fill out IL ST-556 (1) Instructions?

To fill out IL ST-556 (1) Instructions, gather transaction details, enter the seller's and buyer's information, specify the type of sale, calculate the total amount of sales tax due, and submit the completed form to the appropriate tax authority.

What is the purpose of IL ST-556 (1) Instructions?

The purpose of IL ST-556 (1) Instructions is to provide guidance on how to report and pay sales tax for transactions within the state of Illinois.

What information must be reported on IL ST-556 (1) Instructions?

The information that must be reported includes the seller's name and address, buyer's name and address, transaction details, total selling price, applicable tax rate, and the total sales tax collected.

Fill out your IL ST-556 1 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL ST-556 1 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.