IL ST-556 (1) Instructions 2020 free printable template

Show details

Requirements to claim credit for a previously leased item 1. Use tax was paid either to an Illinois retailer on Form ST-556 or directly to us on Form RUT-25 when the item was purchased. 2. On the tax return number line you have written the correct tax return number either from the Form ST-556 led by the Illinois retailer when you purchased the item and paid the tax or Form RUT-25 led when the item was purchased and the tax paid. Line 11 If you collected more tax than is due on this sale...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL ST-556 1 Instructions

Edit your IL ST-556 1 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL ST-556 1 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL ST-556 1 Instructions online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IL ST-556 1 Instructions. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL ST-556 (1) Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL ST-556 1 Instructions

How to fill out IL ST-556 (1) Instructions

01

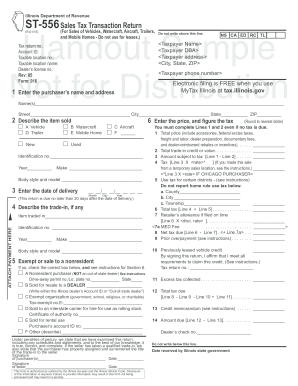

Gather necessary information such as vehicle details, buyer and seller information, and purchase price.

02

Obtain the IL ST-556 (1) form from the Illinois Department of Revenue website or local office.

03

Fill out the seller's name, address, and ID number in the appropriate fields.

04

Enter the buyer's name, address, and ID number in the specified sections.

05

Provide details of the vehicle including the make, model, year, and Vehicle Identification Number (VIN).

06

Indicate the purchase price and any applicable trade-in values.

07

If necessary, include any exemptions that apply and the reason for these exemptions.

08

Sign and date the form at the bottom.

09

Submit the completed form to the appropriate tax authority along with any required fees.

Who needs IL ST-556 (1) Instructions?

01

Individuals purchasing a vehicle in Illinois.

02

Sellers of vehicles who need to report the sale.

03

Those applying for a title transfer in the state of Illinois.

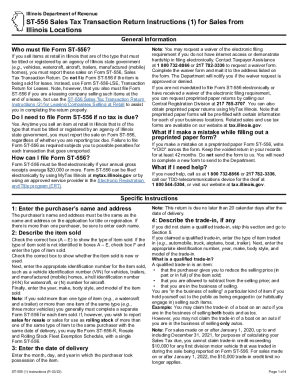

Instructions and Help about IL ST-556 1 Instructions

Fill

form

: Try Risk Free

People Also Ask about

Are sales taxes collected from customers and remitted to the state by seller?

Sales taxes are considered “trust taxes” where the seller collects the tax from the customer and remits the collected tax to the appropriate taxing jurisdiction. There are different types of sales taxes imposed by the states. Some states are Seller Privilege Tax states while others are Consumer Tax states.

What is the sales tax remittance threshold in Illinois?

The tax remittance thresholds are: $100,000 or more in cumulative gross receipts from sales of tangible personal property to purchasers in Illinois; or. 200 or more separate transactions for the sale of tangible personal property to purchasers in Illinois.

What is Illinois Form ST 556 for?

If you sell items at retail in Illinois that are of the type that must be titled or registered by an agency of Illinois state government (e.g., vehicles, watercraft, aircraft, trailers, manufactured (mobile) homes), you must report these sales on Form ST‑556, Sales Tax Transaction Return.

How do I remit sales tax in Illinois?

You have three options for filing and paying your Illinois sales tax: File online – File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail – You can use Form ST-1 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

Is Illinois sales tax accrual or cash?

Payment of sales tax is on an accrual basis and not on a cash basis. Sales tax must be reported and paid with the return for the period in which the sale occurs.

What is ST 556 form for Illinois?

If you sell items at retail in Illinois that are of the type that must be titled or registered by an agency of Illinois state government (e.g., vehicles, watercraft, aircraft, trailers, manufactured (mobile) homes), you must report these sales on Form ST‑556, Sales Tax Transaction Return.

What is an st1 form Illinois?

What is an st1 form Illinois? You must file Form ST-1, Sales and Use Tax and E911 Surcharge. Return, if you are making retail sales of any of the following in Illinois: general merchandise, qualifying foods, drugs, and medical appliances, and/or prepaid wireless telecommunications service.

How do I file local sales tax in Illinois?

You have three options for filing and paying your Illinois sales tax: File online – File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail – You can use Form ST-1 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IL ST-556 1 Instructions on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit IL ST-556 1 Instructions.

How do I edit IL ST-556 1 Instructions on an Android device?

With the pdfFiller Android app, you can edit, sign, and share IL ST-556 1 Instructions on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I complete IL ST-556 1 Instructions on an Android device?

Use the pdfFiller app for Android to finish your IL ST-556 1 Instructions. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is IL ST-556 (1) Instructions?

IL ST-556 (1) Instructions are guidelines provided by the State of Illinois for the proper completion of the IL ST-556 form, which is used for the State of Illinois Sales Tax transaction.

Who is required to file IL ST-556 (1) Instructions?

Any individual or business engaged in selling tangible personal property at retail in Illinois is required to file the IL ST-556 form when collecting sales tax.

How to fill out IL ST-556 (1) Instructions?

To fill out the IL ST-556 (1) Instructions, one must provide accurate information regarding the seller, the purchaser, the items sold, sales tax collected, and any exemptions applied. Ensure that all sections of the form are completed as per the guidelines.

What is the purpose of IL ST-556 (1) Instructions?

The purpose of IL ST-556 (1) Instructions is to provide clarity on how to accurately report sales transactions and calculate sales tax owed to the state of Illinois.

What information must be reported on IL ST-556 (1) Instructions?

The information that must be reported on IL ST-556 (1) includes the names and addresses of the seller and purchaser, the date of the transaction, the description of the items sold, the total purchase price, the sales tax amount, and any applicable exemptions.

Fill out your IL ST-556 1 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL ST-556 1 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.