IL ST-556 (1) Instructions 2019 free printable template

Show details

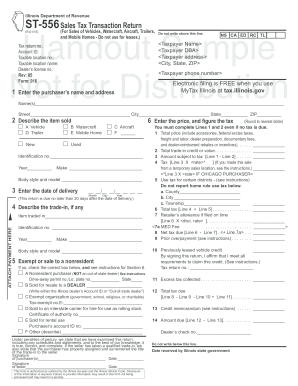

Illinois Department of RevenueST556 Sales Tax Transaction Return Instructions (1) for Sales from

Illinois Locations

Who must file Form ST556? General Information

How can I file Form ST556? If you

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL ST-556 1 Instructions

Edit your IL ST-556 1 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL ST-556 1 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL ST-556 1 Instructions online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL ST-556 1 Instructions. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL ST-556 (1) Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL ST-556 1 Instructions

How to fill out IL ST-556 (1) Instructions

01

Obtain the IL ST-556 (1) form from the Illinois Department of Revenue website.

02

Fill out the taxpayer information section, including name, address, and ID number.

03

Provide details of the vehicle being purchased, including make, model, year, and VIN.

04

Indicate the purchase price and the trade-in allowance if applicable.

05

Calculate the amount of sales tax due based on the purchase price.

06

Sign and date the form to certify that the information is accurate.

07

Submit the completed form to the Illinois Department of Revenue or to your local tax authority.

Who needs IL ST-556 (1) Instructions?

01

Individuals purchasing a vehicle in Illinois.

02

Dealerships selling vehicles to customers.

03

Anyone who requires a tax exemption on vehicle sales.

Instructions and Help about IL ST-556 1 Instructions

Fill

form

: Try Risk Free

People Also Ask about

Are sales taxes collected from customers and remitted to the state by seller?

Sales taxes are considered “trust taxes” where the seller collects the tax from the customer and remits the collected tax to the appropriate taxing jurisdiction. There are different types of sales taxes imposed by the states. Some states are Seller Privilege Tax states while others are Consumer Tax states.

What is the sales tax remittance threshold in Illinois?

The tax remittance thresholds are: $100,000 or more in cumulative gross receipts from sales of tangible personal property to purchasers in Illinois; or. 200 or more separate transactions for the sale of tangible personal property to purchasers in Illinois.

What is Illinois Form ST 556 for?

If you sell items at retail in Illinois that are of the type that must be titled or registered by an agency of Illinois state government (e.g., vehicles, watercraft, aircraft, trailers, manufactured (mobile) homes), you must report these sales on Form ST‑556, Sales Tax Transaction Return.

How do I remit sales tax in Illinois?

You have three options for filing and paying your Illinois sales tax: File online – File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail – You can use Form ST-1 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

Is Illinois sales tax accrual or cash?

Payment of sales tax is on an accrual basis and not on a cash basis. Sales tax must be reported and paid with the return for the period in which the sale occurs.

What is ST 556 form for Illinois?

If you sell items at retail in Illinois that are of the type that must be titled or registered by an agency of Illinois state government (e.g., vehicles, watercraft, aircraft, trailers, manufactured (mobile) homes), you must report these sales on Form ST‑556, Sales Tax Transaction Return.

What is an st1 form Illinois?

What is an st1 form Illinois? You must file Form ST-1, Sales and Use Tax and E911 Surcharge. Return, if you are making retail sales of any of the following in Illinois: general merchandise, qualifying foods, drugs, and medical appliances, and/or prepaid wireless telecommunications service.

How do I file local sales tax in Illinois?

You have three options for filing and paying your Illinois sales tax: File online – File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail – You can use Form ST-1 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IL ST-556 1 Instructions directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your IL ST-556 1 Instructions and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute IL ST-556 1 Instructions online?

With pdfFiller, you may easily complete and sign IL ST-556 1 Instructions online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the IL ST-556 1 Instructions in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your IL ST-556 1 Instructions in seconds.

What is IL ST-556 (1) Instructions?

IL ST-556 (1) Instructions are guidelines provided by the State of Illinois for taxpayers regarding the preparation and filing of the Sales and Use Tax Transaction Return.

Who is required to file IL ST-556 (1) Instructions?

Any individual or business entity that sells tangible personal property at retail or engages in a service that requires the collection of sales tax in Illinois is required to file IL ST-556 (1) Instructions.

How to fill out IL ST-556 (1) Instructions?

To fill out IL ST-556 (1), taxpayers must provide complete and accurate information including their name, address, account number, details of the transaction, items sold, and the calculated tax due based on sales.

What is the purpose of IL ST-556 (1) Instructions?

The purpose of IL ST-556 (1) Instructions is to provide a standardized form for reporting sales and use tax collected and to ensure compliance with Illinois tax laws.

What information must be reported on IL ST-556 (1) Instructions?

The information that must be reported includes the seller's details, buyer's information, description of property or services sold, quantity, sale price, amount of tax collected, and any exemptions claimed.

Fill out your IL ST-556 1 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL ST-556 1 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.