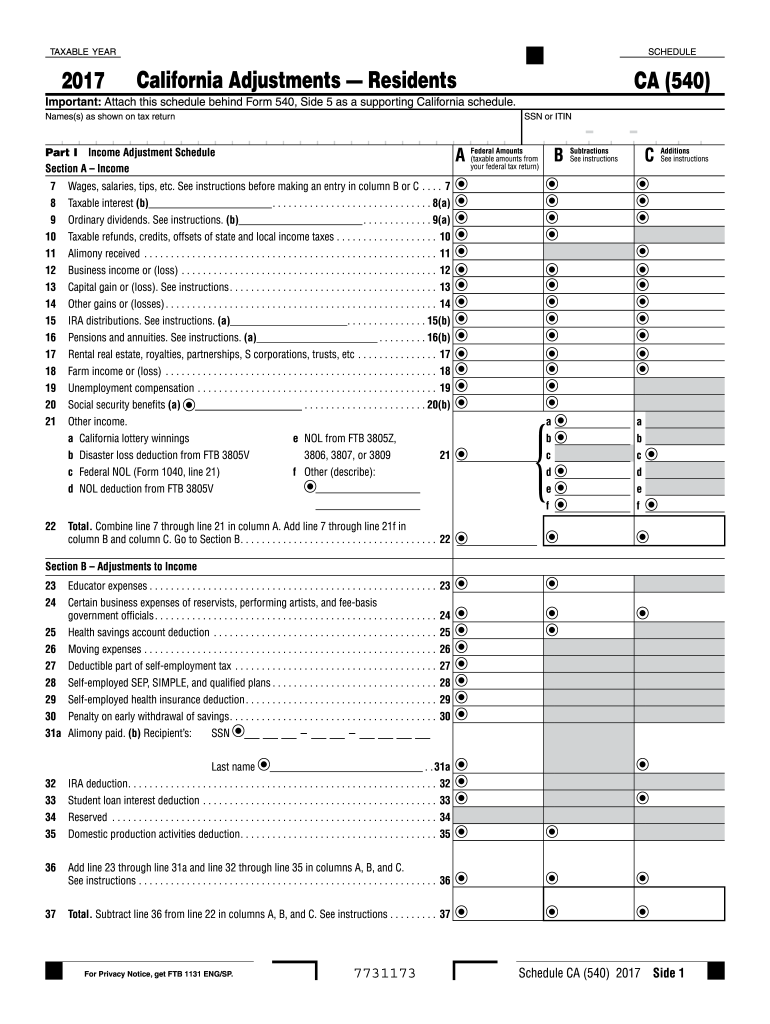

What is CA 540 Schedule?

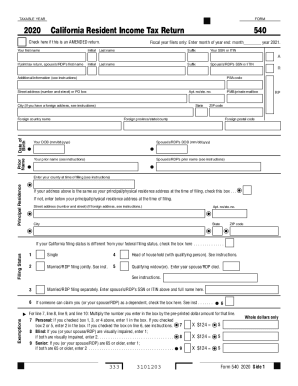

CA 540 Schedule is an attachment to Form 540 that is known as the California Resident Income Tax Return. All California taxpayers must file this form. An applicant may file a separate form for spouse or a joint one reporting general income. The schedule itself is devoted to the California Adjustments (Residents).

What is CA 540 Schedule for?

The schedule is designed to provide a more detailed report of the federal income. It is not complicated. There are only two pages of the schedule.

When is CA 540 Schedule Due?

The due date for CA 540 Schedule is the same as the one for Form CA 540. The form must be submitted by April 18, 2017. If a taxpayer fails to do that on time, it is possible to claim a time extension.

Is CA 540 Schedule Accompanied by Other Forms?

First the schedule cannot be filed without CA Form 540. Moreover, an applicant must firstly complete and file IRS Form 1040 before filling out both 540 Schedule and Form.

What Information do I Include in CA 540 Schedule?

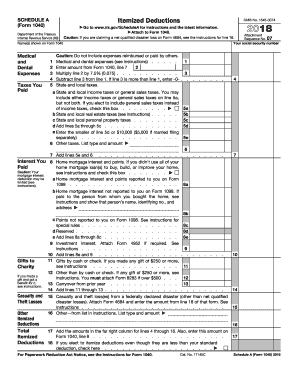

The schedule consists of two parts. Part 1 is called the Income Adjustment Schedule. It is required to indicate a taxable income, wages, tips, salaries, ordinary dividends, capital loss or gain, business loss or gain, IRA distributions, social security benefits, pensions, compensations, other income and a total amount. Part 2 is devoted to the adjustments to federal itemized deductions.

Where do I Send CA 540 Schedule after Completing?

Send the schedule and the form to the following address:

Franchise Tax Board

PO Box 942867

Sacramento CA 94267-0001