Get the free Corporation Income/Franchise Tax Payment Voucher - dor mo

Show details

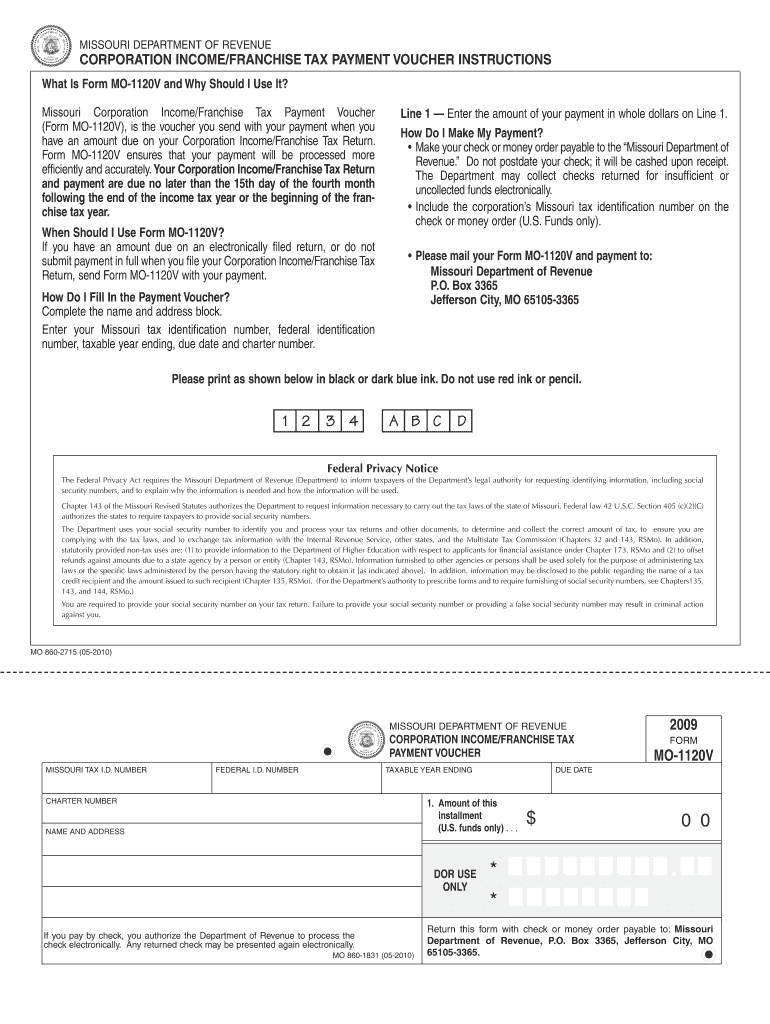

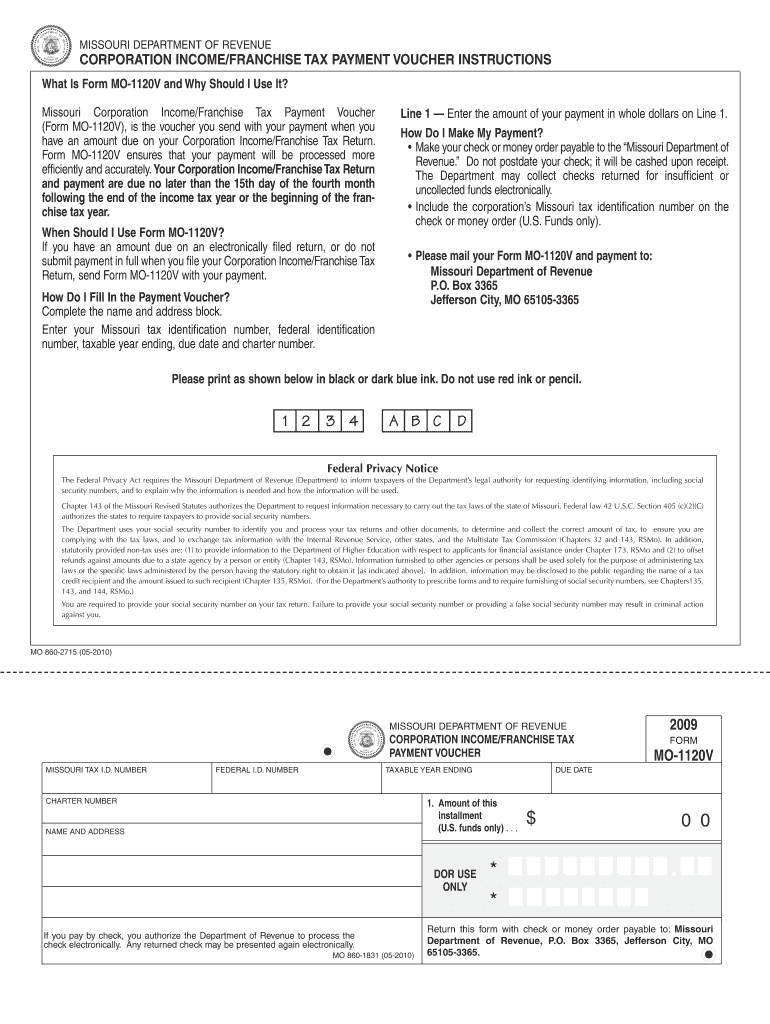

This document provides instructions for the Missouri Corporation Income/Franchise Tax Payment Voucher required for tax payments due on an income or franchise tax return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporation incomefranchise tax payment

Edit your corporation incomefranchise tax payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporation incomefranchise tax payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporation incomefranchise tax payment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit corporation incomefranchise tax payment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporation incomefranchise tax payment

How to fill out Corporation Income/Franchise Tax Payment Voucher

01

Obtain the Corporation Income/Franchise Tax Payment Voucher form from the appropriate tax authority's website or office.

02

Fill in your corporation's name, address, and tax identification number in the designated fields.

03

Indicate the tax period for which you are making the payment.

04

Calculate the total amount of tax due and write it in the 'Amount Due' section.

05

Specify any credits or prepayments that may apply to reduce the total amount.

06

Sign and date the voucher to certify that the information is accurate.

07

Include any required attachments, such as copies of previous filings or additional documentation.

08

Mail the completed voucher along with your payment to the address provided on the form.

Who needs Corporation Income/Franchise Tax Payment Voucher?

01

Corporations that are subject to income or franchise tax obligations in their respective states or territories.

Fill

form

: Try Risk Free

People Also Ask about

Is there a payment voucher for form 1120?

Corporations don't generate Form 1120-ES for estimated tax vouchers. Per the IRS Form 1120-W instructions, regarding the electronic deposit requirement: "Corporations must use electronic funds transfer to make all federal tax deposits (such as deposits of employment, excise, and corporate income tax).

How do you pay taxes on S Corp?

How are S corporations taxed? To the IRS, S corporations (S corps) are considered “pass-through entities”, which means any deductions, losses, income, credits, and profits pass through directly to shareholders, who report their share of the business's performance on their own personal tax returns.

What is an income tax payment voucher?

Key Takeaways. Form 1040-V is a payment voucher used to pay a balance owed to the IRS for various tax forms. Personal information, including the SSN, owed amount, name, and address, needs to be included on the form, and it should not be stapled to a payment check or money order.

Is the $800 LLC fee deductible for California?

Every year after that, the tax payments are due on the 15th of the fourth month of your tax year — April 15 for most businesses. Plus, California's LLC annual fee is tax deductible for federal taxes. You can deduct the $800 Franchise Tax – and any additional annual fee you pay.

How do I pay $800 minimum franchise tax for an S Corp?

The California Minimum Franchise Tax of $800 will be automatically calculated for applicable corporate and S corp returns on CA Form 100, page 2, line 23 or CA Form 100S, page 2, line 21. The amount due for the current return can be paid via the PMT screen or with voucher CA 3586-V.

What is the minimum $800 tax to the California franchise tax board?

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

How should I pay myself as an S Corp owner?

The 60/40 rule is a simple approach that helps S corporation owners determine a reasonable salary for themselves. Using this formula, they divide their business income into two parts, with 60% designated as salary and 40% paid as shareholder distributions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Corporation Income/Franchise Tax Payment Voucher?

The Corporation Income/Franchise Tax Payment Voucher is a form used by corporations to remit payment for their income or franchise taxes owed to the state.

Who is required to file Corporation Income/Franchise Tax Payment Voucher?

Corporations, including C corporations and certain other business entities, that are subject to income or franchise taxes in the state are required to file this voucher.

How to fill out Corporation Income/Franchise Tax Payment Voucher?

To fill out the voucher, corporations need to provide their legal name, address, taxpayer identification number, amount of tax due, and payment method, ensuring all required fields are completed accurately.

What is the purpose of Corporation Income/Franchise Tax Payment Voucher?

The purpose of the voucher is to facilitate the payment of franchise or income taxes, ensuring that the funds are allocated correctly to the state tax authority.

What information must be reported on Corporation Income/Franchise Tax Payment Voucher?

The voucher must report the corporation's name, address, taxpayer identification number, taxable income, amount of tax owed, and any payments made or credits applied.

Fill out your corporation incomefranchise tax payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporation Incomefranchise Tax Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.