IA DoR 35-002 2011 free printable template

Show details

Upon completion of the contract this form must be presented to that sponsor so they may file for a tax refund in accordance with section 423. 4 Iowa Code as amended. Contractor Forward this statement to the sponsor governmental unit private nonprofit educational institution nonprofit museum business in economic development area rural water district or Habitat for Humanity. Do NOT send it to the Iowa Department of Revenue. Sponsor This statement must be attached to the Construction Contract...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign iowa contractors statement 2011

Edit your iowa contractors statement 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iowa contractors statement 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit iowa contractors statement 2011 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit iowa contractors statement 2011. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA DoR 35-002 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out iowa contractors statement 2011

How to fill out IA DoR 35-002

01

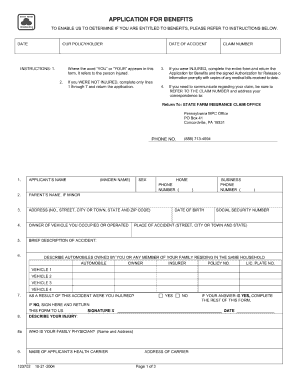

Obtain the IA DoR 35-002 form from the appropriate regulatory or official website.

02

Read the instructions carefully provided with the form to understand the requirements.

03

Fill in your personal information at the top of the form, including your name, address, and contact details.

04

Provide all necessary identification numbers, such as Social Security Number or relevant identification.

05

Complete the section regarding the purpose of the form, detailing why you are submitting it.

06

Fill out any required fields based on the specific data being requested by the form.

07

Review the information for accuracy and completeness before submission.

08

Sign and date the form where indicated.

09

Submit the form via the designated method (online, mail, etc.) as instructed.

Who needs IA DoR 35-002?

01

Individuals or entities that are required to comply with regulatory requirements related to the information being collected in IA DoR 35-002.

02

Organizations or businesses that operate in sectors or industries defined by the governing body associated with IA DoR 35-002.

03

Legal representatives acting on behalf of individuals or companies in matters requiring the completion of the form.

Fill

form

: Try Risk Free

People Also Ask about

What is the labor sales tax in Iowa?

Iowa law imposes both a sales tax and a use tax. The rate for both is 6%, though an additional 1% applies to most sales subject to sales tax, as many jurisdictions impose a local option sales tax. There is no local option use tax.

Is new construction tax exempt in Iowa?

A contractor performs new construction. The contractor must pay tax on materials at the time they are purchased and does not collect any tax from the customer. A contractor performs a taxable service. The contractor must pay tax on the materials at the time they are purchased.

Do contractors charge sales tax on labor in Iowa?

Construction. When services are performed on or connected with new construction, reconstruction, alteration, expansion, or remodeling of a building or structure, they are exempt from sales and use tax. Repair services remain taxable. For more information, see our Iowa Contractors Guide.

Is a contractors license required in Iowa?

A: Each contractor or business that performs “construction” work and earns at least $2,000 a year in Iowa must be registered. An individual or business that makes less than $2,000 a year in “construction” work, or who works only on their own property, is not required to register.

Does Iowa require sales tax on labor?

Are services subject to sales tax in Iowa? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Iowa, services are generally not taxable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit iowa contractors statement 2011 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including iowa contractors statement 2011, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find iowa contractors statement 2011?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the iowa contractors statement 2011 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit iowa contractors statement 2011 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share iowa contractors statement 2011 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is IA DoR 35-002?

IA DoR 35-002 is a specific form used for reporting certain tax-related information to the Iowa Department of Revenue.

Who is required to file IA DoR 35-002?

Individuals or businesses that meet certain criteria, such as specific income thresholds or types of transactions in Iowa, are required to file IA DoR 35-002.

How to fill out IA DoR 35-002?

IA DoR 35-002 should be filled out by providing all requested information accurately, including personal identification and financial details, and submitted by the designated deadline.

What is the purpose of IA DoR 35-002?

The purpose of IA DoR 35-002 is to collect information regarding tax obligations for proper assessment of state taxes and compliance.

What information must be reported on IA DoR 35-002?

The form requires reporting personal identification information, income details, deductions, and any other relevant financial information as specified by the Iowa Department of Revenue.

Fill out your iowa contractors statement 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iowa Contractors Statement 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.