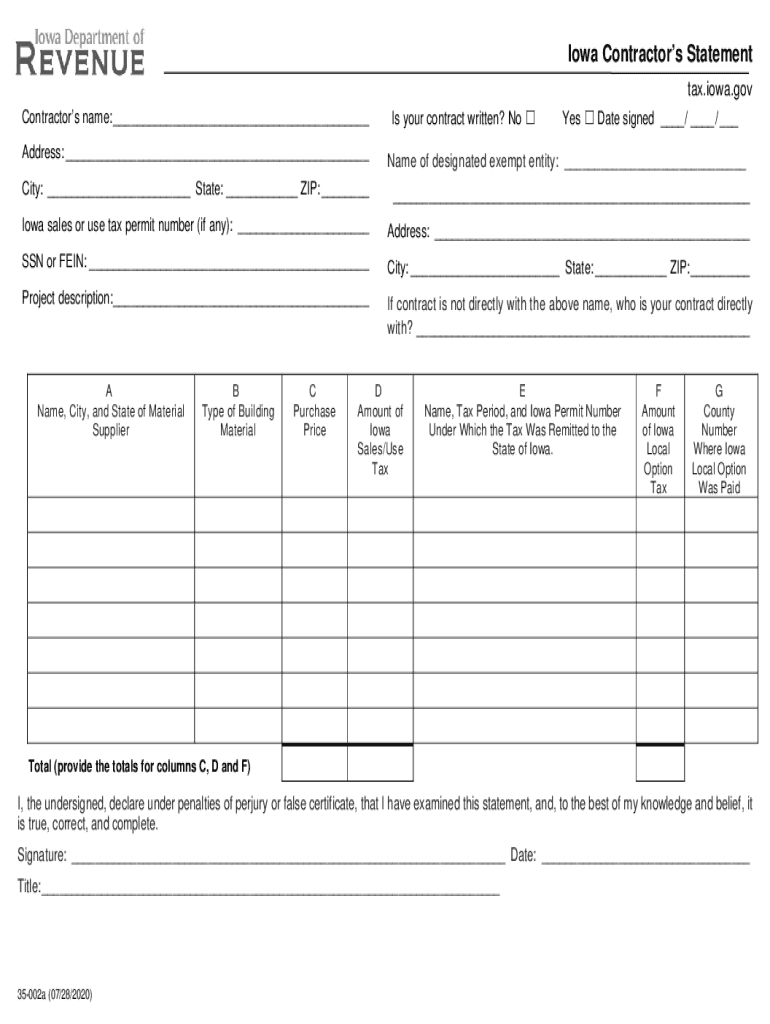

IA DoR 35-002 2020 free printable template

Get, Create, Make and Sign IA DoR 35-002

Editing IA DoR 35-002 online

Uncompromising security for your PDF editing and eSignature needs

IA DoR 35-002 Form Versions

How to fill out IA DoR 35-002

How to fill out IA DoR 35-002

Who needs IA DoR 35-002?

Instructions and Help about IA DoR 35-002

We've been waiting for an attached hotel for a long time it completely changes the package that Duane has to offer to fully maximize the ability to utilize the other two facilities the arena and the convention space we needed the hotel people walk in the door the hotel we wanted to say wow this is something and this is a great place for Des Moines, and we like coming to Des Moines it's the team, and it's the people that were involved every single person to a tee was committed to collaborating together and quite frankly a team that was not going to accept anything other than a huge success were able to do some unique things with prefabrication a lot of technology-based design up front where we coordinated models we had 10 to 12 different types of prefabrication on the job and really the start of all that happened to be the bathrooms which are unique and of themselves bringing in these prefabricated bathrooms I was a skeptic in fairness to whites, and again I'm back with trust I knew at the end of the day the outcome would have to be what we expected from a conventional build it saved a lot of time, and it was impressive I'd become a supporter of it while it was doubtful to begin with it turned out to work, and I assume till be used going forward first we already allowed us to see what that finished product looked like, and you know were so accustomed to looking at 2d drawings and 3d renderings of things but being able to see this and be able to move throughout the building in real time was very helpful for some of our trade partners that were coming on board at the time with that these designers and the collaboration that we did help expedite that process and helped create just-in-time delivery of materials decisions eliminated and potential questions and problems down the road, but I think the success happened when we had Hilton inside the hotel on the first of the year because they could really train and teach their employees work the kinks out prior to anybody else seeing it so that that's the powerful side of the prefabrication and the upfront game planning that took place here and everybody's excited about this and for you to bring it in on time or ahead of schedule is absolutely just wonderful for everybody all the surrounding way've been around a lot of big projects over the years in my past life I saw the reconstruction of i-235 it was the largest public works project in history the state of Iowa the hotel was absolutely the most challenging project I've ever been involved with, and I've been in this business over 35 years when you have a team who's motivated to work together they bring their expertise to the party and there's trust in each other it's hard to measure what can be accomplished this is a project that exemplifies that you know what a tremendous accomplishment not only for whites in the county but for the entire community this is an asset that fits in with the Convention Center and the arena that will have an impact for years...

People Also Ask about

What is the labor sales tax in Iowa?

Is new construction tax exempt in Iowa?

Do contractors charge sales tax on labor in Iowa?

Is a contractors license required in Iowa?

Does Iowa require sales tax on labor?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IA DoR 35-002 online?

Can I edit IA DoR 35-002 on an iOS device?

Can I edit IA DoR 35-002 on an Android device?

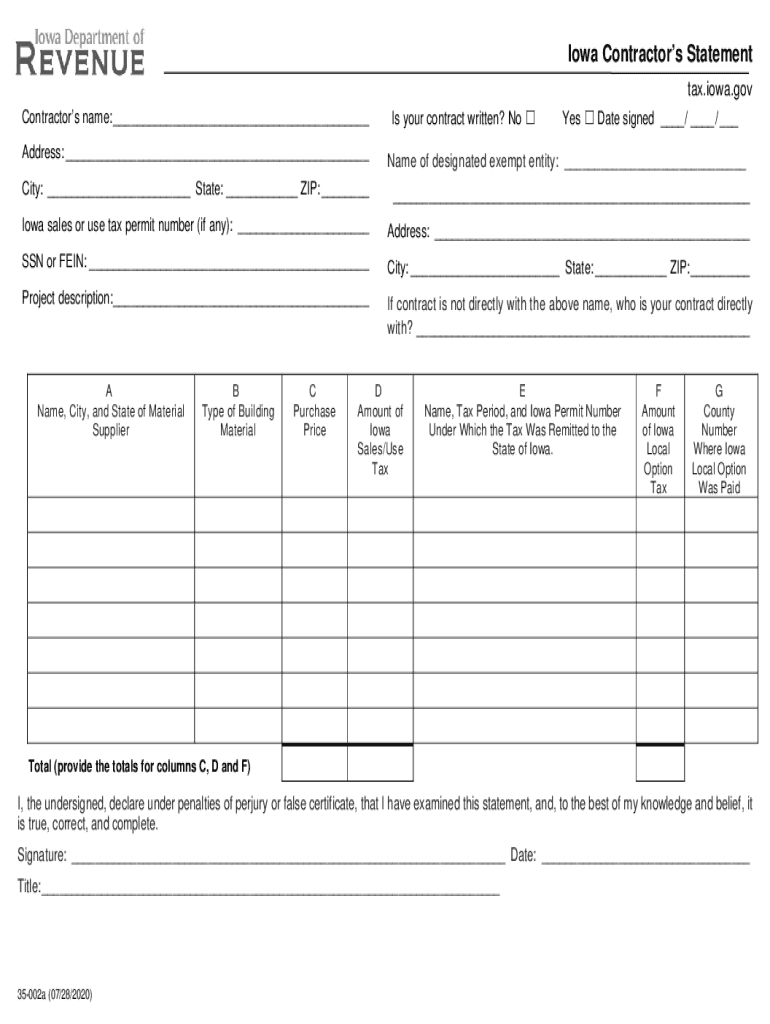

What is IA DoR 35-002?

Who is required to file IA DoR 35-002?

How to fill out IA DoR 35-002?

What is the purpose of IA DoR 35-002?

What information must be reported on IA DoR 35-002?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.