IA DoR 35-002 2016 free printable template

Show details

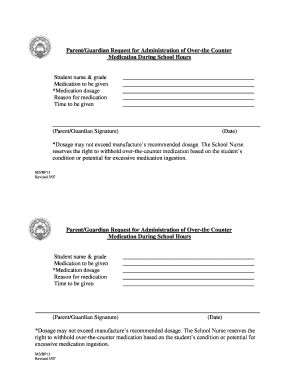

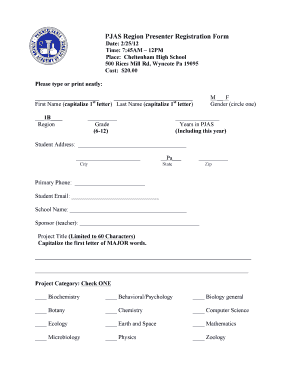

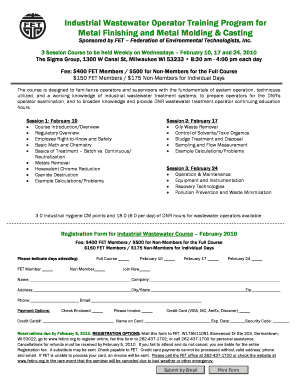

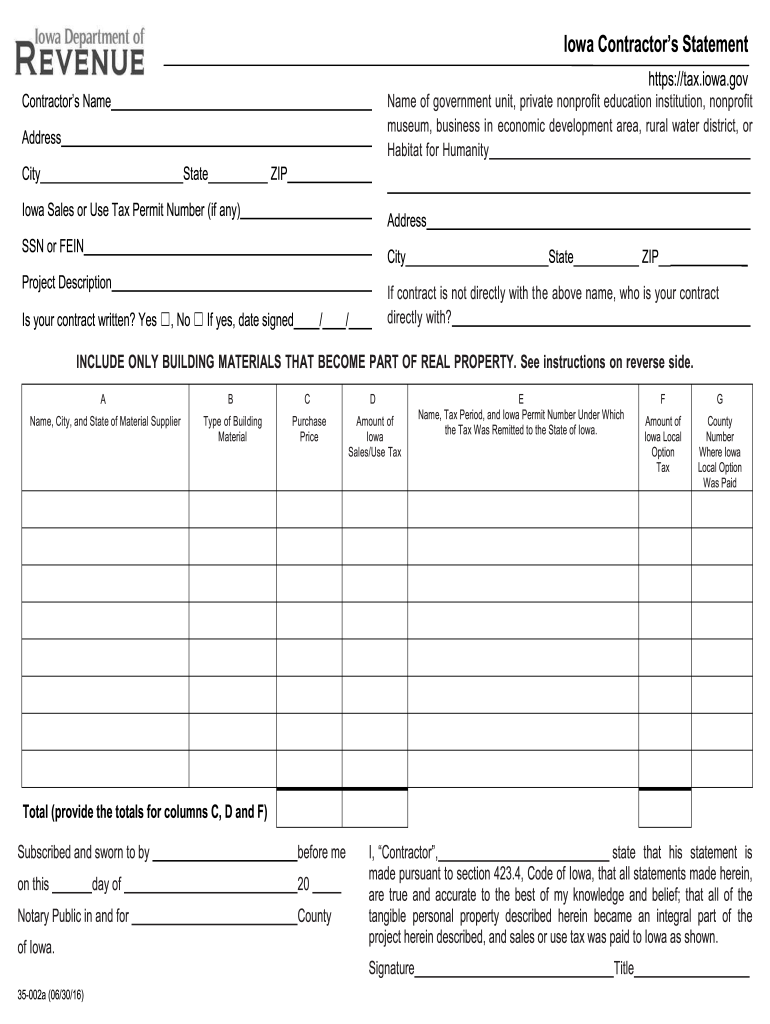

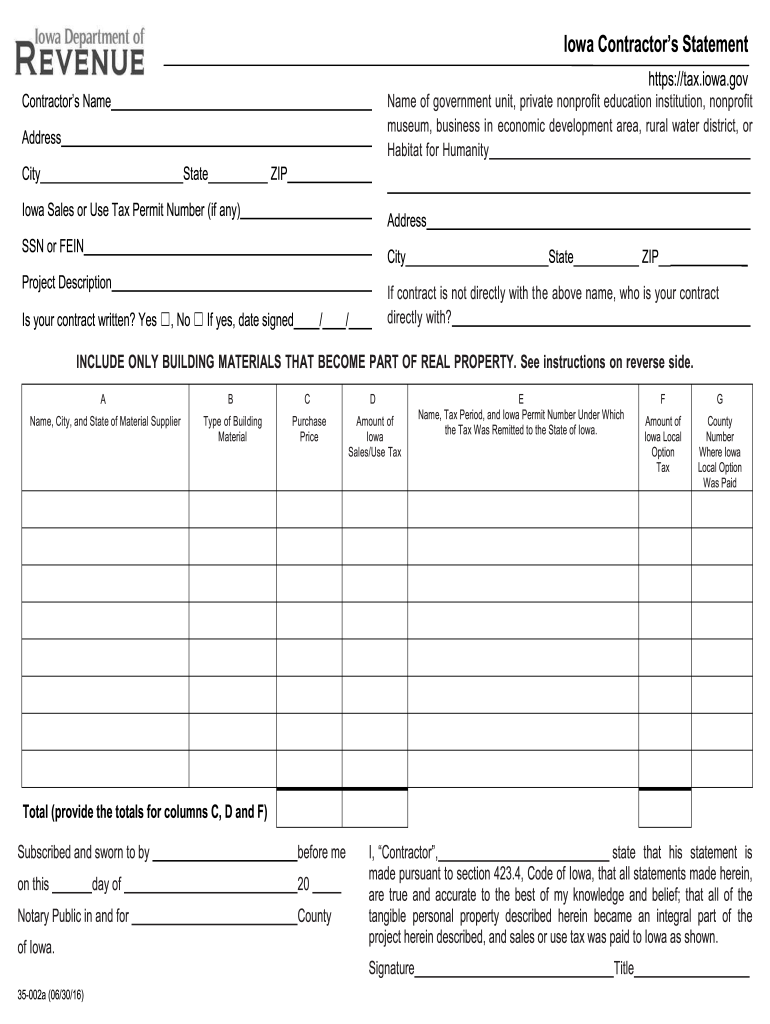

Iowa Contractor s Statement https://tax.iowa.gov Contractor s Name of government unit, private nonprofit education institution, nonprofit museum, business in economic development area, rural water

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fill in iowa contractors

Edit your fill in iowa contractors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fill in iowa contractors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fill in iowa contractors online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fill in iowa contractors. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA DoR 35-002 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fill in iowa contractors

How to fill out IA DoR 35-002

01

Obtain a copy of IA DoR 35-002 form.

02

Read the instructions thoroughly before starting to fill out the form.

03

Fill in the header section with your personal and contact information.

04

Provide the required details in the subsequent sections related to your application.

05

Ensure that all mandatory fields are completed accurately.

06

Review the form for any errors or omissions before submission.

07

Submit the completed IA DoR 35-002 form to the designated department.

Who needs IA DoR 35-002?

01

Individuals applying for a specific administrative request or benefit.

02

Organizations that require approval or acknowledgment from the relevant authority.

03

Any party that needs to report or document particular information as per regulatory requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is the labor sales tax in Iowa?

Iowa law imposes both a sales tax and a use tax. The rate for both is 6%, though an additional 1% applies to most sales subject to sales tax, as many jurisdictions impose a local option sales tax. There is no local option use tax.

Is new construction tax exempt in Iowa?

A contractor performs new construction. The contractor must pay tax on materials at the time they are purchased and does not collect any tax from the customer. A contractor performs a taxable service. The contractor must pay tax on the materials at the time they are purchased.

Do contractors charge sales tax on labor in Iowa?

Construction. When services are performed on or connected with new construction, reconstruction, alteration, expansion, or remodeling of a building or structure, they are exempt from sales and use tax. Repair services remain taxable. For more information, see our Iowa Contractors Guide.

Is a contractors license required in Iowa?

A: Each contractor or business that performs “construction” work and earns at least $2,000 a year in Iowa must be registered. An individual or business that makes less than $2,000 a year in “construction” work, or who works only on their own property, is not required to register.

Does Iowa require sales tax on labor?

Are services subject to sales tax in Iowa? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Iowa, services are generally not taxable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in fill in iowa contractors without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing fill in iowa contractors and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out the fill in iowa contractors form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign fill in iowa contractors and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit fill in iowa contractors on an Android device?

The pdfFiller app for Android allows you to edit PDF files like fill in iowa contractors. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is IA DoR 35-002?

IA DoR 35-002 is a form used for reporting specific tax information to the Iowa Department of Revenue.

Who is required to file IA DoR 35-002?

Individuals or businesses that meet certain income thresholds or other criteria set by the Iowa Department of Revenue are required to file IA DoR 35-002.

How to fill out IA DoR 35-002?

To fill out IA DoR 35-002, you need to provide personal and financial information as specified on the form, including income details, deductions, and other relevant data.

What is the purpose of IA DoR 35-002?

The purpose of IA DoR 35-002 is to ensure compliance with state tax laws by collecting necessary tax information from taxpayers in Iowa.

What information must be reported on IA DoR 35-002?

Information that must be reported on IA DoR 35-002 includes gross income, taxable deductions, credits, and any other data pertinent to the taxpayer's financial situation.

Fill out your fill in iowa contractors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fill In Iowa Contractors is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.